是不是该买点IBM

细心的读者或许还记得,从来不沾科技股的巴菲特,曾经大手笔的购买IBM的股票,而且他还一直持有这些股票。当然,在金融危机发生时,他乘人之危,购买的不是普通股。但是,在后来,他却加仓了普通股。在他看来,IBM已经远不再是一家科技公司。他看好的是IBM良好的现金流,和在科技服务业的霸主地位。

这些天,IBM临时倒霉,股价也跟着下跌。如果你现在进入的话,你未来的回报还会超越巴菲特:因为,他已经白忙活了两年了。

记住那句话:在好公司遇到临时困难时,就是最好的建仓时刻。那么,现在是不是就是建仓IBM的最佳时间呢?

你读读下面的分析,或许可以获得你个性化的答案。

有一点比较有谱:投资IBM让你遭受巨大损失的可能性相对比较小。同时,让你在短期内获得好几倍的快速巨大回报的机会也几乎没有。但是,如果你投资它,未来几年获得不错的低风险回报的可能性却很大。

祝你好运。

IBM: Upside To The Tune Of

$230 - UBS Analyst Has It Backwards

Nov

10 2013, 02:05

Overview

International

Business Machines (IBM) does not share the intense news

driven lifestyles that Apple (APPL) and Samsung (SSNLF) do, although it is an undervalued technology company

that offers significant upside for the investor. This discussion will detail

the fundamentally undervalued natured of IBM, and as such it offers an

attractive entry point for investors looking to profit as the market realizes

the growth in store for IBM to the tune of $230 per share.

IBM vs. Computer Services Sector

A quick-view of

company metrics can offer just that, a quick analysis. Although a comparison of

a company to the individual sector within the industry they do business in

offers a much more useful analysis. IBM is within the technology sector and the

computer services industry.

|

Metric:

|

IBM:

|

Computer Services:

|

|

P/E

|

12.49x

|

21.9x

|

|

P/B

|

9.83x

|

13.1x

|

|

P/ Sales

|

1.93x

|

2.2x

|

|

P/ Cash Flow

|

9.34x

|

14.5x

|

|

ROE

|

77.90%

|

26.01%

|

|

Total Debt/Equity

|

1.82x

|

0.6x

|

|

Dividend Yield

|

2.11%

|

1.13%

|

One area of concern

is IBM's near 3x the debt/equity ratio of IBM compared to the industry. Using

debt to finance growth is a concern that the growth is not material, although

as we can see below this divergence between the computer services industry's total

debt/ equity and that of IBM's is of no concern. This is due to IBM's growth

rates that are in turn well above the industry average.

|

IBM's Growth

|

Metric

|

|

Return on Assets

|

13.81%

|

|

Return on Equity

|

77.90%

|

|

Return On Invested Capital

|

20.86%

|

IBM's total

debt/equity is higher than the computer services industry, although IBM's

growth metrics are way above average. Surprisingly, IBM's return on equity is

2.995x higher than the industry average while their total debt to equity is

3.033x higher than the industry average. IBM's only metric of concern, total

debt to equity, is of no worry since their return on that equity has been on

par with the debt they have accumulated financing this growth. If IBM's return

on equity was well below the industry in comparison to their debt being above

the industry then that would be a cause of concern - although that is not the

case here.

$230 Target Using These Metrics:

IBM is undervalued

in comparison to the high growth industry that they compete within. My target

price of $230 would change the metrics of IBM to be more closely on par with

the computer services industry. If IBM was at $230 per share today, the

following metrics portrayed below would highlight IBM.

|

Metric:

|

IBM at $230 Per Share

|

Computer Services:

|

|

P/E

|

15.92x

|

21.9x

|

|

P/B

|

12.56x

|

13.1x

|

|

P/ Sales

|

2.47x

|

2.2x

|

|

P/ Cash Flow

|

11.93x

|

14.5x

|

Using a share price

of $230 when comparing the current amount of earnings, book value, sales and

cash flow of IBM created a valuation that is more closely correlated to the

computer services industry. Moreover, these values are generally still below

the computer services industry itself. That is due to the fact that IBM is an

extremely large company at $195 billion in market capitalization compared to an

industry that has a market capitalization of $3.6 billion. Investors will

likely not bid up IBM to the actual averages as money will flow into smaller

names that have promise for extreme gains and high growth, although IBM is

clearly the safer bet with their size.

At a price of $230,

IBM's multiples would still give room for variations, and are generally below

averages that would account for the company's massive size in comparison to the

industry itself that contains smaller companies.

|

Metric

|

IBM at $230 Per Share

|

|

P/E

|

72.7% of industry

average

|

|

P/B

|

95.9% of industry

average

|

|

P/ Sales

|

112.3% of average

|

|

P/ Cash flow

|

82.3% of industry

average

|

At a price of $230

per share, IBM would still be considerably below the averages of the industry

on a P/E, P/B and P/Cash Flow basis. P/Sales is an area of concern as IBM would

be over the average, although no company is perfect. Comparing IBM's future to the

current industry average is useful since as time goes on IBM's advancement will

alter these industry averages, as IBM is a large component of the industry.

More On The Target:

The estimate used

above demonstrated UBS analyst Steve Milunovich's cut that included a price

slash to $186 from their previous target of $235.

"So, we see it

as dead money for, say, the next six months." (source)

I think this analyst

may have gotten the call completely backwards as back on April 10,

2013 the same UBS analyst raised his price target on UBS to $235. Although from

April 10, to today UBS did not hit the target or get close and shares have

fallen over 16% from the call at $212 to where they are now at $180. I think this analyst got it backwards

and on April 10 was the time to sell and now is the time to buy. That is why I would not put too much stock into this analyst

estimates.

Why Are Shares Cheap Now?

On October 17, 2013

UBS downgraded IBM from a buy to neutral following negative third-quarter

earnings results. IBM has actually appreciated

3.58% since October 17 though. The company reported revenue of $23.7 bullion or

a billion dollars off from $24.7 billion. The analyst stated that the company

reported EPS that was in line with estimates, although missed profit and

revenue numbers for two of the last three quarters which they saw as unusual.

Put simply, there

has to be a reason to pick up shares of a company cheaper than normal. These

events give the investor the ability to pick up shares on the cheap, for the

long term. Known as a contrarian investment viewpoint, investing in the bounce

back against the community can offer an investor significant gains. Although

IBM is no BlackBerry (BBRY), and this bounce back play offers

less risk due to the company's size and financial security. There is no doubt

that investors should question two out of three earnings and revenues misses as

it is unusual, although these are the opportunities that allow investors to buy

into oversold companies.

Did The Analyst Call Affect Institutions?

Moreover, the change

in UBS's outlook for IBM has majorly impacted institutional holdings of IBM, as

over the prior to the latest quarter the chance in net institutional purchases

is a negative 1.14%. Although the analyst call will likely be seen looking at

these numbers next quarter, institutions held strong into the end of the

quarter.

Earnings Numbers Had Some Glimmer:

IBM's recent

earnings numbers for the quarter ending September 30, 2013 had some positives over the quarter

ending June 30, 2013. Net income increased to $4.04 billion from $3.82 billion

and earnings per share increased to $3.68 per share from 3.33 per share in the

same quarter last year. Keep in mind that excluding one time charges, the

company crested estimates of $3.96 and earned $3.99 per share.

Moreover, IBM stated

that the absence of $408 million in charges related to job cuts that it logged

in the year ago period and lower expenses aided the company's recent earnings

numbers.

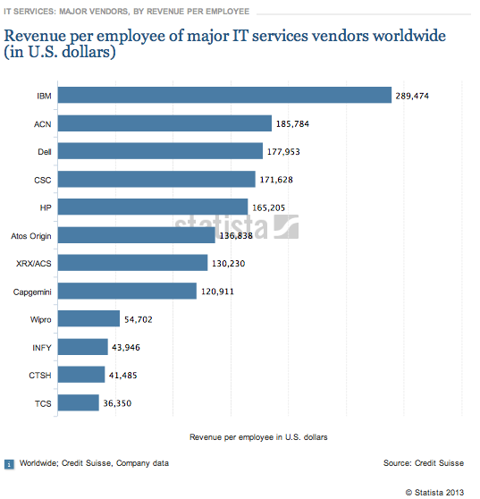

IBM and Servers:

A lot of people do

not hear too much about IBM in comparison to the news hungry companies such as

Apple and Samsung. Although in the background, IBM is not going anywhere

anytime soon. IBM has the highest revenue per employee of all major IT service

vendors. Their employees are not only efficient, they generate more revenue

than any company in the field. The two on the list that may pop a thought are

HP (HPQ) and Dell (DELL), although they have heavily lagged behind in revenue per

employee in comparison to IBM.

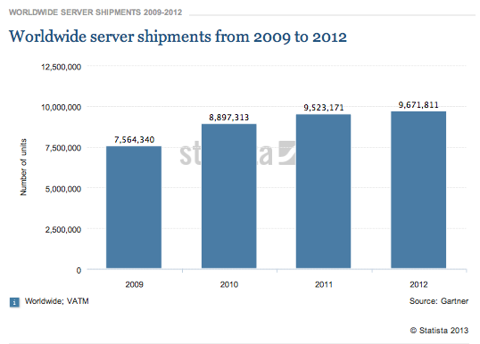

IBM is a major

player in the server business. The growth of server shipments is key in that it

allows IBM to not only compete with their competitors for sales as seen with

stagnant worldwide growth of a product, although it allows for increased sales

as the product demand has increased.

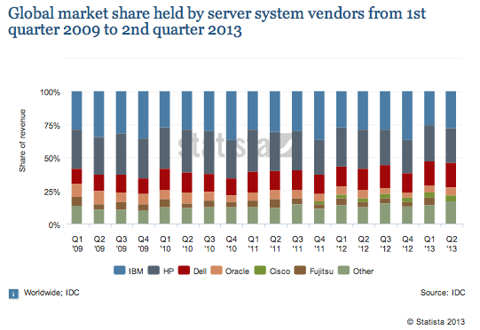

With the increase of

server shipments, IBM has held strong and increased their market share of the

server system market. IBM increased their marketshare to 27.90% in Q2 of 2013

from 25.70% in Q1 of 2013. Moreover IBM's market share does fluctuate between

25% and 36% so their is more than enough room for growth over the coming

quarters by this server powerhouse.

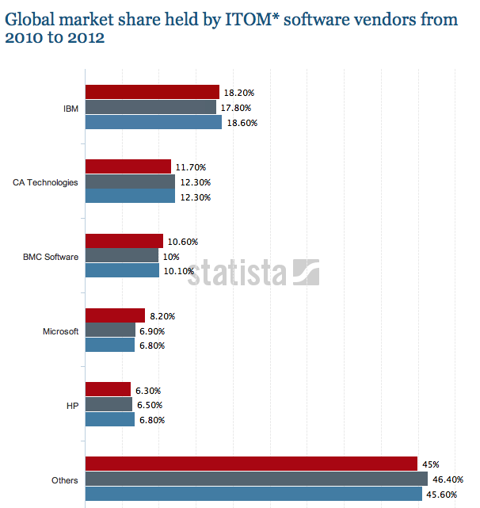

Moreover, IBM may be

large, although they are not maxed out with regard to their marketshare as seen

in the last graph although further detailed below. IBM's revenue derived from

IT operations management, ITOM for short, is at 18.20%. This means that there

is still room for significant growth in this area as well.

Moreover, these

market share statistics further demonstrate IBM's significant lead in employee

revenue, market share of server systems and market share of ITOM software. All

the while server shipments are growing worldwide annually, leading the investor

to note that the main target market for IBM's sales (servers) has not stagnated

and is growing worldwide to further feed growth.

Trading:

Another source of

IBM's decline in share price technically could be the death cross that occurred

in late July, 2013. This is a bearish signal that occurs then a stock's 50 day

moving average crosses below the 200 day moving average. We can assume that

this technical metric will last about 6-7 months for this large cap. This is

due to the fact that the last golden cross (opposite the death cross) occurred

back in late February of 2013 until the death cross in late July. It has been

around four months since the death cross, although the distance between the 50

and 200 day moving average is about equal to what it was at the middle of the

length in between the last golden and death cross. This is a good sign since if

the investor can get in between these crosses, it allows for more gains on a

technical basis. This is due to the fact that the trader does not only benefit

from the 50 DMA cross above the 200 DMA, although form the middle of the two

technical crosses to this golden cross event.

In plainer terms,

profit before the actual golden cross occurs buy buying when the maximum

distance between the 50 DMA and 200 DMA occurs to profit from the trek back as

well as after the golden cross occurs. These are all technicals and predictions

and I generally do not use too much technical analysis when investigating a

stock, although it can be a useful tool for the investor or trader to get the

best possible price.

Moreover, IBM

currently has an RSI or relative strength index rating of 48.47. This

demonstrates that not only is IBM not overbought, they are even below the

neutral range of 50 and bordering on oversold. A good technical indicator for

the investor.

Recent News:

IBM has not been

without the move to the cloud, even at the government level. The company

recently recieved a government

operating approval to allow federal agencies the ability to use IBM's

infrastructure as a service to cloud platform. Moreover, it meets federal

network security standards. Although IBM was shot down recently over a CIA

contract that Amazon (AMZN) won, new details have shed

additional light on these developments. It was not as simple as a lower total

price, as Amazon's services were superior - so IBM has some catching up to do.

Although that could just be the opinion of the board, I'll leave a comparison

to the tech gurus involved with comparing the two company's services.

Moreover, IBM was

named a leader in providing customer relationship management services by Gartner, Magic Quadrant for CRM Service

Providers, Worldwide. IBM's Paul Papas had some words to say about this report,

the key being as IBM is a leader in CRM, that will further drive top-line

growth.

"Customer

experience has become the primary lens through which organizations are looking

to achieve competitive advantage and drive top-line growth," said Paul

Papas, global leader for Digital Front Office, IBM Global Business Services.

Although the setback

from Amazon is real, it will be interesting to see how well Amazon makes due on

their contract, as IBM is the clear leader in the space.

Indeed it was IBM who, in years gone

past, differentiated its cloud products as "trusted enterprise cloud", its way of keeping itselfdistinct from new players such as Amazon Web

Services who, while being new and exciting, don't have a decades-long legacy of

delivering solutions robustly, with backwards compatibility and with enterprise

levels of service. (Source, bold for emphasis)

Conclusion:

IBM is clearly not

the news hungry company that many large tech names in the industry such as

Apple and Samsung are, although I see that as a positive. Instead of watching

Samsung's net income crest Apple and the news debacle over the two companies, I

would rather take the secure and stable tech name that is undervalued.

Moreover, IBM is of course in the news, but not to the degree of its

competitors. A share price of $230 offers a gain of 27.78% while still not

being fundamentally overvalued in comparison to the industry itself. Moreover,

analyst opinions and technical metrics have driven the PPS down, creating this

buying opportunity for investors. The analysts did not want to wait around for

the bounce back as stated in their PR, a bounce back that I will be more than

happy to wait for without them.

"Normally we

would wait out mediocre results in preparation for the bounce back, but there

are too many questions at this time." (source)

Additional disclosure: Always do your own

research and contact a financial professional before executing any trades. This

article is informational and based in my own personal opinion.

股神巴菲特投资IBM两年收益为零

美股新闻腾讯财经[微博]无忌2013-10-22

向来不看好科技股的“股神”沃伦-巴菲特(Warren Buffett)在两年前开始大举建仓IBM。但是在发布了令人失望的第三季度财报之后,IBM股价在周一报收于172.86美元,仅仅是略高于巴菲特172.80美元的建仓成本价。这也就是说,自2011年第一季度开始建仓IBM股票以来,巴菲特至今依然颗粒无收。

IBM上周四发布了2013财年第三季度财报。财报显示,IBM第三季度净利润为40.41亿美元,比去年同期的38.24亿美元增长5.7%;营收为237.20亿美元,比去年同期的247.47亿美元下滑4.1%。IBM第三季度调整后每股收益超出华尔街分析师预期,但营收则不及预期,导致公司股价在随后一个交易日大跌6%,创出172.57美元的52周新低。

职业生涯从未投资过科技股的伯克希尔哈撒韦(Berkshire Hathaway)董事会主席兼首席执行官巴菲特,在2011年宣布开始建仓IBM股票。巴菲特当年投资IBM时曾列出了投资该公司的数个原因。第一是管理技巧;第二是该公司有能力实现五年目标。巴菲特2011年11月在接受CNBC电视台采访时曾表示,“我从来不相信像IBM这种规模的公司制定出的五年计划能够得到完美的执行。早在IBM制定出第一个五年计划时,我就开始留意这家公司,这一直持续至2010年年底。如今他们又制定出到2015年年底结束的线路图。这家公司做出了难以置信的工作。”

尽管第三季度的营收同比出现了下滑,但IBM在上周的电话会议中表示,该公司依然对2015年每股运营利润至少达到20美元充满信心。今年前三季度,IBM已通过派系和回购股票向股东返还了110亿美元,到2015年实现返还700亿美元的计划依旧不变。巴菲特2011年在接受CNBC采访时曾对IBM的股票回购政策给予肯定。他当时曾说,“如果这家公司通过回购只剩下6400万流通股,我将会非常开心。”(注:巴菲特当时已持有6400万股IBM流通股)

|