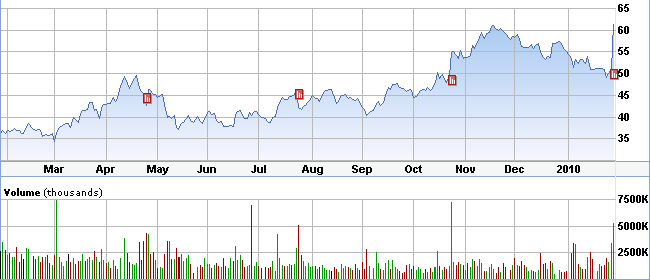

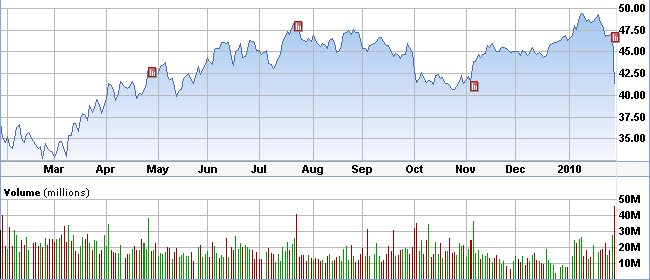

Netflix shares surge; Qualcomm drops after outlook 6:21 PM ET 1/27/10 LOS ANGELES (MarketWatch) -- Shares of Netflix Inc. leaped nearly 15% late Wednesday after the online DVD-rental company issued a strong forecast for its current quarter, but a lackluster yearly sales outlook from Qualcomm Inc. spurred a drop in the wireless technology developer's shares.

Netflix (NFLX) shares jumped 14% to $58.01 in heavy trading as the company said it expects first-quarter earnings to come in between 47 cents to 58 cents a share on revenue of $490 million to $496 million. Analysts polled by FactSet Research are looking for earnings of 45 cents a share on sales of $486.8 million.

The company's fourth-quarter profit rose 36% to $31 million, or 56 cents a share, thanks in part to lower costs related to acquiring subscribers. Excluding stock-based compensation, Netflix would have earned 59 cents a share. Revenue rose 24% to $444.5 million. Analysts expected earnings of 49 cents a share on revenue of $446 million. Read more about Netflix's report.

Shares of Qualcomm (QCOM) stumbled 9.9% to $42.55 and topped volume movers. The company said it expects revenue of $10.4 billion to $11 billion for fiscal-year 2010, falling short of the current estimate of $12.37 billion produced by a Thomson Reuters poll of analysts.

Earnings at Qualcomm jumped in its fiscal first quarter, to $841 million, or 50 cents a share, from $341 million, or 20 cents a share, in the same period last year. Earnings excluding items were 62 cents a share, above Wall Street's for earnings of 56 cents a share. Revenue at Qualcomm rose 6% to $2.67 billion. Analysts expected $2.7 billion. See more about Qualcomm's report.

Symantec Corp. (SYMC) issued a fourth-quarter forecast that came in line with Wall Street's expectations and swung to a profit for the third quarter, but investors still sent shares of the security software maker down 4% to $17.86.

Shares of LSI Corp. (LSI) were also in the red, down 5.8% at $5.65. The chip maker said it expects fiscal first-quarter earnings of 4 cents a share to 10 cents a share, with the lower end of the forecast below Wall Street's estimate of 6 cents a share.

But E-Trade Financial Corp. (ETFC) shares advanced, by 2.4% to $1.69 after the discount broker said it set aside $292 million to cover potential losses in the fourth quarter, less than $347 million set aside in the third quarter. Read more about E-Trade's results.

Ahead of the late session, U.S. stocks climbed higher in the wake of the Federal Reserve's decision to keep benchmark interest rates near zero. The S&P 500 Index $SPX rose 0.5%, the Dow Jones Industrial Average $INDU gained 42 points, or 0.4%, and the Nasdaq Composite (COMP) rose 0.8%. See more on U.S. stocks.

NFLX一年股价变化图

QCOM一年股价变化图 以三个月为限,现在是应该买NFLX还是QCOM? |