自我去年十月发文《放牛娃们想重温美好岁月》预测华尔街牛群将开启狂奔模式后,果然不出我所料,华尔街的牛群在AAPL的带领下一路狂奔向前,两个多月来已经狂奔了10%,连稍微休息一下(回调)都没有。

对于股市的牛群狂奔,在投资界有个描述它的专业术语—Melt-up,说的是在牛市末期牛群头也不回地一路向前越跑越快地直到坠入悬崖,直译为“熔冲”,也可叫“末路狂奔”。 关于Melt-up有一篇文章《The 2020 Melt-up And Aftermath》介绍给大家参考,已经附在本文后了。 玩Melt-up非常刺激,首先你要判断牛群已经进入“末路狂奔”状态,接着大胆做多,然后在牛群坠崖之前退出(清仓)并反手做空。这样玩出来的利润可以是平时做股票投资的好几倍。 我于2006年次级贷崩盘前玩过一次,收入颇丰,不过那时上班没时间精力投入在股市,也因是初次玩故只是小试牛刀,这次的Melt-up似乎有可能将是史诗级的,所以也准备玩大一点,同时和网友分享一点我玩Melt-up的体会。

1.首先要判断牛群已经进入“末路狂奔”状态。这一点很重要,如果判断错误,有可能你刚买入做多了,市场就遇到一个5%-10%的“回调”把你拍在半年到一年的最高点上。另外,如果你的判断太迟钝,当Melt-up已经是众人皆知,连开出租车的邻居都要买股票了,你再杀入时就会冒极高的风险。 那么当前的华尔街是否已经进入Melt-up状态了呢?我的观察判断是有80%的可能Yes。理由就是:市场自从S&P500 冲过了3000点后至今一直没有正常的“回调”。 事实上,我自从去年12月初就已经开始逐步做多华尔街股市了,至今已达60%的仓位(基于风险控制,我从来不玩满仓的)。接下来打算再用20%仓位做多黄金并辅以20%的现金在手以控制风险。

2.其次是做多Melt-up。我的建议是:首先做多股指期货,然后做多个股。做多(或做空)股指可以根据个人的风险承受能力选择eMini SP500 futures 或者Micro eMini SP500 futures,也可以选择众多的S&P500 ETF 或是加杠杆的ETF(比如Direxionn S&P500 Bull/Bear 3X),包括做多股票也可以用CFD加杠杆。不过要注意的是,某些个股可能已经涨幅巨大了(比如Tesla),而某些个股由于自身原因可能会被投资机构提前抛售。此时做多我一般会选前期涨幅不大的个股。

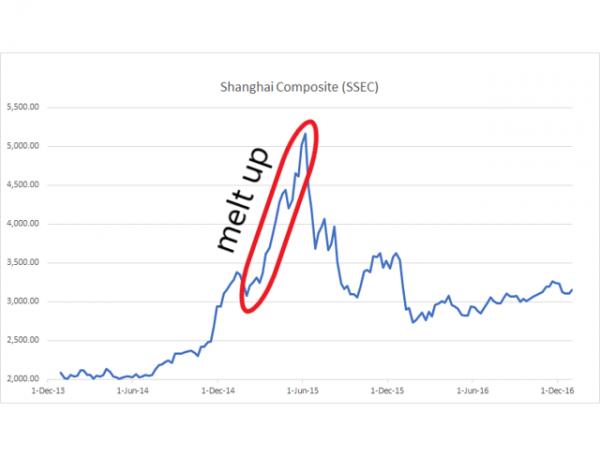

3.最后是在Melt-up的最高点清仓并反手做空市场。这一步也是最难的一步,因为没人知道Melt-up的最高点在哪里,每个市场参与者都在博弈,都既想在别人抛售前抢先获利又想最大化利润。参与博弈的可大概分为三方:一方为机构投资者的“多方”,一方为机构投资者的“空方”,一方为小投资者散户。当然Melt-up的前期三方基本都在做多,由于小投资者的力量是分散的形不成合力也左右不了市场,到了Melt-up的中后期就基本是机构投资者的多空双方主导市场了,而等到了Aftermath of the Melt-up即“大翻转”后三方则进入做空的熊市博弈。 我前面说“没人知道Melt-up的最高点在哪里”是指非主导市场的一方,作为小投资者,因为你的操作对市场的那个“大翻转”毫无影响,所以你只能被动地去感知市场到来的“大翻转”,并且做好“感知错了”的风险管理。你唯一可以庆幸的是你的风险管理比机构投资者容易得多,因为机构投资者的体量决定了他们很难在短时间内管理好已知的风险,所以机构投资者都是预知风险,做提前布局以及多种手段的风险管理。 我前面说“基本是机构投资者的多空双方主导市场”其实也不准确。作为机构投资者,他们包括了养老基金,保险基金等长期投资者,也包括了对冲基金,投行等中短期投资者,他们有各自不同的投资目标,策略,方法和期限,这决定了无论是多方还是空方,并不存在一个一致行动的同盟在操控市场。他们之所以加入多方或是加入空方,仅仅是当前的做多或是做空操作符合其各自的投资目标和策略。随着市场的变化,每个机构投资者都在随时随地调整其操作策略和多空方向。所以更准确的说法是:机构投资者的多空双方之间的博弈在主导着市场。所以机构投资者也是在感知市场的“大翻转“,只不过对他们来说,感知到的信息是其主动操作的反馈,如此他们能够比小投资者更早地感知到甚至去预判那个“大翻转”。 所以,回到本文的题目,如果还有人要问:你说华尔街的牛群狂奔是Melt-up,那么最高点在哪里? 我只能告诉你:在“大翻转”来临之前,即便是机构投资者也不确切知道最高点在哪里! 换句话说,Melt-up的高度和形态并非是一成不变有规律的,虽然附文中提到了比特币的Melt-up在一个月翻了一倍,2000年的互联网泡沫中Nasdaq市场的Melt-up在六个月翻了一倍,以及2015年上海股市的Melt-up在两个月翻了一倍,但在我看来都是有特定客观条件存在的极端特例,我不会就此设定当前华尔街Melt-up的最高点和走势形态,更不会如附文那样预期Nasdaq可能会涨到14000。 我在去年时发文谈“认知有限论”(见《读“戏说宇宙”有感兼谈认知有限伦》)中提到过,我从不假定市场的未来走势和目标,我习惯于每天去重新评估和认知市场,去感知接下来任何潜在的市场“Move”,并以此做操作决策的基础。

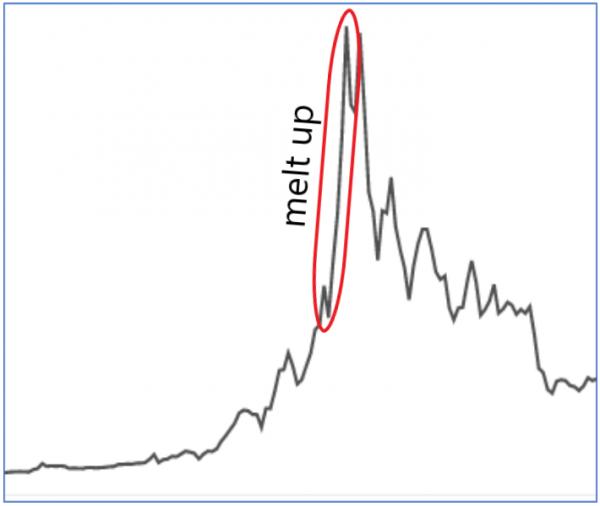

说到这里,如果你还是觉得自己无法把握这最后一步,那就不要玩Melt-up了,离场观望等待自己有把握的机会当是更好的选择。 最后,也许会有网友说我不够厚道:你自己已经买好了仓位后再来发此文忽悠大家买多Melt-up,那不是让大家给你抬轿吗?现在股市已经都进入Melt-up两个多月了,涨了这么多还能买入做多吗? 对此我想说以下几点: 1.我12月初开始买入时对Melt-up的认知并不是确定的,仅仅是一种牛市里的做多。我对Melt-up的确认和信心也是一天天在增长的,我至今相信华尔街已经有80%的可能走入了Melt-up也仅仅是我个人的评估,并不是投资界的共识。本文只是分享对Melt-up的一点个人体会,任何人都不应该以本文为依据做投资决策并应该对自己的任何投资决策负全责。 2.玩Melt-up的最大利润不是来自做多Melt-up,而是来自于对“大翻转”之后的市场做空。如果你坐过“云霄飞车”,你就知道最刺激的时刻是在过了最高点之后。所以,玩Melt-up首先你心脏要强壮,其次你完全可以不做多只做空,前提是你能够及时正确判断最高点。对于我来说,我只有参与进Melt-up(即做多)才能有助于我判断最高点和做空,完全是个人偏好。 3.玩Melt-up风险很大,强烈建议做好止损和对冲。止损的设置可以是1%--5%取决于你是何时做多/做空Melt-up的,甚至,如果你对自己的即时判断有足够信心也可以不设止损,这里就不展开细说了。对冲可以选择Options或黄金,我选择的是买入一定的黄金做对冲。 4.时时警惕黑天鹅的出现,要知道某些黑天鹅事件有可能会使走到一半的Melt-up就此结束并翻转。当突发事件发生时,如果你不确定其后果,可以及时减仓或清仓以规避风险。这属于风险管理,每个人应该有自己的风格和策略,这里也不展开细说了。 5.不要想当然地认为Melt-up的最高点都是一剑冲天的Spike形态,未必! Spike走势比较容易判断最高点,却不常出现。同时也不要想当然地用某个时间段来确定最高点,只要记住:Melt-up是市场参与各方博弈的结果,并没有一定之规可循。 声明:本文内容完全出自个人观点,不代表任何投资机构也非投资建议,本人也没有因写此文而收取任何利益,本人也与此文中提到的公司没有任何关系。

附文 The 2020 Melt-Up And Aftermath

Summary The market melt-up is in full swing. A melt-up with a subsequent crash similar to 2000 is now all but certain. History shows us that markets tend to melt up 100% or more before bursting in major bubbles. Timing melt-ups and their aftermath is extraordinarily difficult, but not impossible. We currently see behavioral finance in action. In the U.S., it was way back in 1999 when we last saw this irrational behavior in the markets. It is tricky to spot, being right in the middle of it, but the parameters are starting to line up beautifully for a March 2000 replay. Last year, I highlighted the risks of the emergent dot-com market sentiment. Although the risk factors were already brewing, at that time the environment wasn't quite ripe for a significant crash. Valuations last year were elevated, and the dot-com era parallels were starting to crystallize. However, some key signs were still missing that are starting to manifest: · Significant market euphoria à la late 1999. · Dismissal of bad news that, just months ago, would have caused large swings to the downside. · High amount of investor leverage, either via margin borrowing or investing through leveraged products. · Irrational sell-side analyst calls and talking head predictions.

These factors are steadily increasing. I will analyze these and others in more detail below. The origin of a market bubbleAs more market participants realize the quick rise of the markets, everyone seeks opportunity to benefit from the gain. Even those that are aware of the market melting up are attempting to profit. Leveraged buying further fuels the bubble. Plenty of investors know that this will end sooner or later and they have to exit rapidly. Most investors believe they can get the timing just right. Unfortunately, the math is stacked against them. Those that are oblivious to the situation are certainly left holding the bags. Bubble behaviorSo, what do we know about the general behavior of bubbles? Are there any patterns? It takes a certain amount of pressure for a bubble to burst. When looking at bubbles across the last decades in assets such as stocks, bitcoin and commodities, you will be hard-pressed to find a bubble that burst before melting up at least 40%. Some bubbles melted up 100% or more. The start of this melt-up is usually not immediately apparent at the time. Once it becomes evident, investors leverage up and expose themselves to tremendous downside risk.

Bitcoin price 2016-2018 (Data source: Coinbase)

One of the most extreme examples in recent times was Bitcoin. In 2017, Bitcoin more than doubled within one month. It subsequently lost almost all of the gain once the bubble burst just as quickly as it had gained it. Nasdaq Composite (Source: Wikipedia) When the Nasdaq Composite peaked on March 10, 2000 at 5,048.62, it had almost doubled within six months. When the reckoning came, the drop was sharp. The Nasdaq lost over 30% within a month. It took around a year to descend down to where the melt-up started and then further down from there. The bubble in the Shanghai Composite (SSEC) in 2015 unfolded slightly differently. Although in retrospect it appears to follow a similar path, it would have been much harder to tell at the time how inflated this bubble actually was. The market was rising sharply, but the true melt-up really didn't start until March 2015. Within two months, the index doubled - although it already rose sharply before that.

The 2020 melt-upSo how high can we go? For those that think we are currently about to crash, let me illustrate that markets can rise tremendously. Below is a hypothetical scenario of the Nasdaq Composite, should it follow a typical bubble trajectory, in which the market doubles. In this scenario, the Nasdaq 100 could rise to over 14,000. I would argue this scenario is not that unlikely. We would know the answer in three months in the scenario below.

The AftermathThe examples above show that the drop after the bubble bursts is typically even quicker than the melt-up. The typical drop is at least 20% or more. Frequently, a dead cat bounce follows, until the bubble continues its decline down to a level well below the original melt-up. Timing the dropIf we could improve our timing of when this market peaks, we would have a tremendous opportunity to reduce our risk and potentially even profit. As I mentioned above, every investor thinks they are an above-average driver, but that math just doesn't work out. However, I have also shown that there are plenty of clear similarities in most bubbles throughout history. Apart from just price movement, many other factors can assist in improving the timing of when the bubble will burst. Market sentiment A significant amount of exuberance, to the level of euphoria, needs to be present for a bubble to inflate. And once we get that irrational level of exuberance, we're close to a popping bubble. This is a very subjective assessment. There are some clear indicators of market sentiment, such as reactions to bad news. Economic indicators that tended to get significant negative market reaction just a couple of months ago are now completely brushed aside. The recent Iran conflict barely made a dent in the market. These are all signs of a level of exuberance that overshadow all potential negativity. Leverage Starting in November 1999, margin debt skyrocketed. Investors leveraging up is a distinctive sign of risk-taking and attempts to benefit from rapid rises in prices. With the availability of leveraged products such as the ProShares UltraPro QQQ ETF (TQQQ), individual investors are able to be highly leveraged without the need for large margin debt. This may be the reason why we have not yet seen that large of an increase in margin debt. However, FINRA, which reports on margin debt, so far hasn't reported any data more recent than November 2019. I expect there to be a large jump in the margin debt in the December 2019 data to be released shortly. I suggest to keep a close eye on this. Valuations The Shiller P/E (CAPE) ratio is over 30, one of the highest values in history. However, it hasn't moved much for over a year. For comparison, the ratio was at an all-time high of 44 in December 1999. As the large S&P 500 components, Apple (AAPL) in particular, are further bid up, the Shiller P/E may rise to new heights well. This would truly be the writing on the wall. Volume and Volatility Trading volume and volatility are other indicators that show similarities across market bubbles but are not as clear-cut. Increases in trading volume are often associated with general euphoria. Similar to increases in leverage, more market participants want to be part of the action and trade higher volume. Volatility may be helpful to determine if the market turned or is just giving up some gains. Attempting to time the actual turn bears a tremendous amount of risk. Typically, a market turn creates a very significant spike in volatility within a couple of days with a drop in the market of several percent - a sort of collective reckoning that the bubble may have burst. Unless properly prepared, this can already destroy one's portfolio. An example where the market retreated without a major spike in volatility was the Iran crisis. The options market clearly wasn't concerned about a bursting bubble or we would have seen a much larger spike in the VIX. Personal assessmentIf there are no major geopolitical events, trade wars, earnings misses, and the like, I don't see any indication why this bubble wouldn't inflate similar to what we have seen in the past. That would mean a sharp rise into March at the same rate we are climbing right now. However, the higher the market rises, the more certain we can be that we will have a market decline not seen since the dot-com bubble. Highly leveraged investors lost vast sums of money within days. The market will most certainly return to a level we are currently at, so the most prudent move is to get out now.

|