从PPP看汇率操纵与中国经济赶超的深层隐忧

Deep Concerns on China's Exchange Rate Manipulation and Economic Overtaking from the PPP Perspective

(四个附录)

钱 宏Archer Hong Qian

2025年12月17日于温哥华

首先,谢谢前《中国房地产年鉴》副主编战军先生荐读:“世界上反华人士和多数经济学家,一直预测人民币存在趋势性的贬值。而年末的几则消息,则认为人民币存在趋势性升值的合理性和必要性。”

这事究竟怎么看?请允许我从共生经济学(Symbionomics)维度,作一简单分析。

盛松成曾任中国央行调查统计司司长,是少数能接触几乎所有核心经济数据的官员之一。现在上海的中欧国际工商学院任教,他近期在金融会议上关于购买力平价(PPP,指为使不同国家的同类商品和服务价格一致,货币汇率应达到的水平)的讲话指出:从PPP视角看,汇率远低于当前1比7.1的水平,有人计算甚至可能在1比3.5附近。若人民币向这一水平升值,按美元计价,中国GDP总量将超越美国成为全球第一大经济体。

可以说,盛松成的观点有相当代表性,但很难被每年的“中央经济工作会议”采纳。

显然,中央决策者知道,中国人均GNP依然落在全球四十多个国家之后。而且,从中国当前经济明显衰退,投资、消费、出口三架马车力度看,投资和消费疲软到通缩,只有出口依然强劲。中国公布的数据显示,今年前11个月其全球贸易顺差已突破1.08万亿美元。而这种强劲,得益于什么?说到底,不就是得益于中国同类商品和服务价格不一致这个悬殊的价格差吗?而这个“悬殊的价格差”,除了中国生产力低人权优势和经济结构性失衡偏好,只能是得益于汇率人为控制——即汇率操纵!

所以,购买力平价,虽然可以看出一个国家(如中国)真实的GDP总量,也可以看出这个国家是否在国际贸易中存在汇率操纵。人民币走强(升值)将推高中国出口产品的价格,削弱其在海外市场的竞争力,同时,会让国内消费者更容易负担进口商品。当然,人民币升值中国出口商品涨价,也会推高美国及其他国家的消费者物价,使之难以负担中国商品。反之,让人民币对美元汇率保持长期贬值趋势,保持中国同类商品和服务价格与各国不一致“悬殊价格差”,有利于低价倾销,消化过剩产能,大幅度获得全球(尤其对发达国家)贸易顺差,让各国消费者“越来越依赖”中国的廉价商品和服务,以至于慢慢丧失部分乃至整体生产力!

但是,从国家政治文明与经济中长期发展来看,政府干预汇率操纵是把双刃剑,追求高幅度顺差的利弊得失不可以道里计。这就是共生经济学指出的全球化2.0“自由贸易幻象”中的“互害机制”,这种互害机制,又导致政治、经济、文化、社会生活、组织的“结构性失衡”。

如果说,美国要从中接受的教训,是“斯特芬-罗德里克难题”,这正是美国总统川普上位,放下“政治正确”,用“对等关税”(Reciprocal tariffs)改写二战以来全球化2.0“自由贸易规则”的原因。

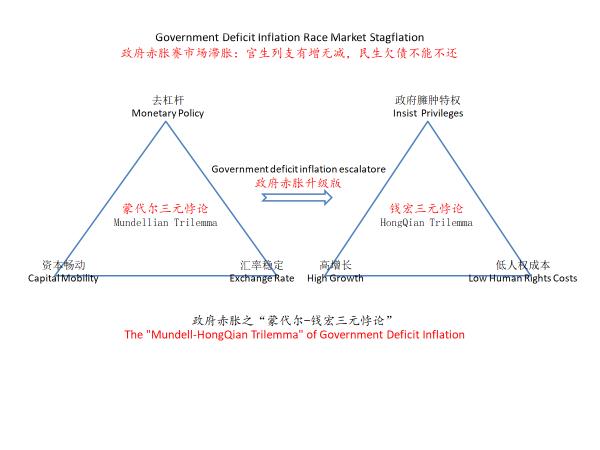

那么,中国要反省的问题是什么?我想大概应该是“蒙代尔-钱宏三元难题”。

正如有朋友看到的,“中国的举国体制、低人权成本优势、弯道超车战略、商品倾销战术等,在对付遵守规则的西方国家时,总体是成功有效的,甚至外交战狼化、经济关系武器化和异见人士刑徒人质化等处理政治、外交和内部关系时的三大工具,短期内还会有收获”(就不说自嗨的部分),但从长期看,这种“收获”对国家整体健康运行,改变“结构性失衡”(胡温2003年始提出),没什么实际意义!

因而,继续从PPP看中国GDP总量是否“赶英超美”思维惯性,如果不能促使中国结束汇率操纵回归市场,不能改变严重失衡的政治经济文化社会组织结构,不能“让生产回归生活,让生活呈现生态,让生态激励生命”(2015),除了强化举国体制肥了一批又批与权力资本接近的个体和共同体(自己人),对中国社会成长,对中国成为一个正常的名副其实的现代国家(如共和国),也同样没有什么实际价值!

有道是祸福相依,中国GDP总量“赶英超美”,是好事吗?算是吧(毕竟其中饱含着几代中国人的血汗泪啊),但严重的问题是,将继续掩盖中国“走向共和”的紧迫性,拖累中国现代化进程融入世界现代文明——重点是温家宝在2012年最后一次中外记者招待会上说的“政治体制改革”,他强调没有政治体制改革的成功,经济体制改革不可能进行到底,已经取得的成果还有可能得而复失,“文革”这样的历史悲剧还有可能重新发生;用钱宏的话说,就是放下几十年来的意识形态营造的幻像,“重建人民共和国”(1986),也就是让人民共和国名副其实——最终大概率导致中国经济陷入倒退四十年的深渊(苦日子)!

其实,共生经济学思维视之,有中国参与的广义世界经济问题,说到底,是一个用什么的价值标准衡量各国政治、经济、社会、组织行为的问题。十七年前的2008年,我与时任国务院新闻办主任的赵启正先生的两次通信中,讨论过二战后形成的“投资-消费-出口”国民账户核算的“GDP锦标赛”该结束了,亟需创立一种以GDE价值参量的国民“生产-交换-生活”账户核算体系。如今,我越发觉得,这样的“GDE价值参量”,该成为国际社会的共识,并成为各国负责任的政府治理绩效的行动指南!

回到PPP视角,中国经济规模总量早已“赶英超美”,但若依赖汇率“低估”和现有模式,这一成就仅是表面繁荣,将放大结构性风险:出口依赖加剧内需疲软、债务积累、国际摩擦,最终可能陷入中等收入陷阱,经济倒退至改革开放初期水平。只有通过结束操纵、回归市场,并推进政治体制改革,方能避免互害循环,实现交互主体共生(Intersubjective Symbiosism)的全球化3.0范式转移(Paradigm Shift),中国和世界才能迈进再次伟大-健康的全新生活方式。

附录目录

附录一中国 GDP 总量“赶英超美”思维惯性将掩盖并拖累政治体制改革紧迫性,并引发经济倒退风险

Appendix I

The Inertial Mindset of China’s “Catching Up with the UK and Surpassing the U.S.” in GDP Size Will Obscure and Delay the Urgency of Political Institutional Reform, and May Trigger Risks of Economic Regression 中国 GDP “赶英超美”的现状与预测:表面繁荣的基石

I. The Current Status and Projections of China’s “Catching Up with the UK and Surpassing the U.S.” in GDP:

The Foundations of Apparent Prosperity “赶英超美”如何掩盖并拖累政治体制改革的紧迫性

II. How the “Catching Up and Surpassing” Narrative Obscures and Delays the Urgency of Political Institutional Reform 最终陷入经济深渊:倒退四十年的风险

III. The Ultimate Descent into an Economic Abyss:

The Risk of a Forty-Year Regression

结论

Conclusion

附录二“蒙代尔–钱宏三元难题”

Appendix II

The “Mundell–Archer Hong Trilemma” 经典蒙代尔–弗莱明三元悖论(Impossible Trinity)简要回顾

I. A Brief Review of the Classical Mundell–Fleming Trilemma (the “Impossible Trinity”) “蒙代尔–钱宏三元难题”:从“不可能”到“可能升级”的创新

II. The “Mundell–Archer Hong Trilemma”:

An Innovation from “Impossibility” to “Upgradeable Possibility” “蒙代尔–钱宏三元难题”的具体内涵解读

III. Interpreting the Substantive Meaning of the “Mundell–Archer Hong Trilemma” 全球化 3.0 可能性三角愿景

IV. The Triangular Vision of Possibility under Globalization 3.0 在共生经济学语境中的意义

V. Its Significance within the Framework of Symbionomics

附录三GDE 价值参量与 GDP 价值参量比较

Appendix III

A Comparison between the GDE Value Parameter and the GDP Value Parameter GDP 的加法思维:资本增值逻辑的局限

I. The Additive Logic of GDP:

The Limitations of Capital-Accumulation Thinking GDE 的乘法思维:资源能效逻辑的 innovation

II. The Multiplicative Logic of GDE:

Innovation through Resource-Energy Efficiency 加法 vs 乘法:对中国现实的镜鉴与出路

III. Addition vs. Multiplication:

A Mirror for China’s Reality and a Path Forward

附录四GDE 价值参量的计算公式示例

Appendix IV

Illustrative Examples of GDE Value Parameter Calculations GDE 计算框架的理论基础

I. The Theoretical Foundations of the GDE Calculation Framework GDE 的核心指标体系

II. The Core Indicator System of GDE GDE 的核心指标与六大资产负债表

III. Core GDE Indicators and the Six Major Balance Sheets GDE 指数应用的条件

IV. Conditions for the Application of the GDE Index GDE 指数应用的方法

V. Methods for Applying the GDE Index 计算公式示例

VI. Examples of Calculation Formulas GDE 指数公式的本质:不止是 GNP / GDP 关系

VII. The Essence of the GDE Index Formula:

More Than a GNP/GDP Relationship

附录一:中国GDP总量“赶英超美”思维惯性将掩盖并拖累政治体制改革紧迫性,并引发经济倒退风险

以下从经济数据、政治经济互动以及长期风险三个维度,论证中国GDP总量“赶英超美”(即超越英国并逼近或超越美国)将如何掩盖政治体制改革的紧迫性,同时拖累改革进程,最终可能导致经济倒退至四十年前(约1985年改革开放初期)的深渊水平。这一论证基于最新经济预测和分析,强调结构性问题而非短期波动。 1. 中国GDP“赶英超美”的现状与预测:表面繁荣的基石 按购买力平价(PPP)计算,中国GDP已于2014-2016年间超越美国,成为全球最大经济体,2025年预计达30万亿美元以上,占全球份额超25%。 按名义汇率,中国GDP约19万亿美元,预计到2045年超越美国(美国约30.6万亿美元),部分预测认为若维持4-5%增长率,可能提前至2030-2040年。 IMF上调2025年中国增长预期至5%,高于美国2%,得益于出口和制造业主导。 这已远超英国(约3万亿美元),实现“赶英”。 这种“超美”表面上强化了国家自信和合法性,但本质上是国家主导的投资-出口模式驱动,消费仅占GDP 50%(美国80%),依赖贸易顺差(2025年前11月超1万亿美元)。 高增长数据(如5%增长相当于1.5万亿美元增量,超美欧总和)往往被宣传为“中国模式”成功,掩盖了底层问题。 2. “赶英超美”如何掩盖并拖累政治体制改革的紧迫性 高GDP增长为政治体制提供了“绩效合法性”,让政府避免深层改革,如法治独立、言论自由或权力分立,转而优先“安全过增长”。 中国领导层将经济增长目标视为政治任务,地方官员通过追求高增长(如债务融资基础设施)获得晋升,这强化了顶层设计而非市场自发。 结果是,表面繁荣(如GDP赶超)模糊了改革的必要性:经济放缓时(如2024-2025消费和投资疲软),政府更倾向于刺激措施而非结构性变革,避免触及政治敏感区。 具体拖累体现在: 抑制市场化改革:国家控制汇率和资源分配(如补贴出口),维持增长但扭曲分配,导致城乡收入差距扩大(政治晋升机制加剧此问题)。 这让政治体制无需向更开放的方向转型,因为“增长神话”维系了社会稳定。 强化党控:五中全会强调“政治和经济改革”但重点在监管而非放权,优先党对经济的掌控。 官僚体系风险厌恶,效仿美国但更注重上级指令,阻碍创新和法治进步。 国际摩擦放大国内压力:贸易战(如特朗普关税)暴露依赖,但政府以“反卷入”应对而非内部改革,进一步拖延政治调整。

若无改革,增长将持续掩盖腐败、低效和不平等的紧迫性,正如一些分析指出的,中国模式优先安全而非可持续性。 3. 最终陷入经济深渊:倒退四十年的风险 若GDP“赶超”继续依赖现有模式,而非政治改革驱动的转型,中国将面临中等收入陷阱(MIT)和停滞,类似于拉美国家或日本“失去的十年”,可能倒退至1985年水平(人均GDP约300美元,经济封闭)。 中等收入陷阱的证据:中国已接近MIT门槛(人均GDP 1.5-1.6万美元),增长放缓至5%以下,债务/GDP超325%,人口老龄化(工作人口下降)加剧。 不平等若持续,将陷入“不平等陷阱”转MIT,产能过剩和通缩(如2025年工厂产出放缓)导致长期停滞。 结构性深渊:房地产危机、出口依赖(若关税升级,供应链外移)将放大失业,消费疲软转为恶性循环。 2023-2025美国增长已超中国,凸显威权模式瓶颈。 若不改革(如浮动汇率、减少干预),可能重演“失去的三十年”,经济规模缩水,回归封闭状态。 倒退四十年的量化:1985年中国GDP约3000亿美元,人均低效农业主导。若陷阱实现,增长停滞5-10年,债务危机爆发(公私债双倍2010s),可能导致社会动荡,经济倒退至低增长、低创新的“石器时代”模式。

结论 中国GDP“赶英超美”虽是成就,但若继续掩盖政治改革(如从党控转向法治市场),将拖累转型,放大风险,最终陷入深渊。历史教训(如苏联停滞)表明,威权增长非可持续;需通过改革(如GDE体系)转向内需和创新,方能避免倒退。 这并非必然,但当前轨迹显示紧迫性。

附录二:“蒙代尔-钱宏三元难题”

在共生经济学(Symbionomics)框架下,将经典的蒙代尔-弗莱明三元悖论(Impossible Trinity:货币政策独立性、汇率稳定、资本自由流动不可兼得)进行了原创性改造和扩展,创造性地命名为“蒙代尔-钱宏三元难题”(Mundell-Qian Hong Trilemma),并将其应用于政府宏观政策困境的分析。 以下,基于共生经济学思想,以及经典蒙代尔-弗莱明模型的对比,进行系统深入解读。 1. 经典蒙代尔-弗莱明三元悖论(Impossible Trinity)简要回顾 这属于“不可能三角”(Impossible Triangle),强调政策选择的硬约束。 2. “蒙代尔-钱宏三元难题”:从“不可能”到“可能升级”的创新 将经典模型改造为: 左边三角(传统模式):蒙代尔三元悖论(Impossible Triangle) 右边三角(升级模式):钱宏三元悖论(Possibility Triangle?) 箭头指向:政府赤胀升级版(Government Deficit Inflation Advanced) 警句:政府赤胀市场滞胀:官生利支有增无减,民生欠债不能不还

这显然是对经典理论的批判性继承与发展: 3. “蒙代尔-钱宏三元难题”的具体内涵解读 新三元难题可能聚焦于政府主导模式下的三个相互冲突目标: 政府赤字扩张(持续财政刺激、举债投资、举国体制) 货币超发宽松(低利率、印钞对冲债务、通胀隐忧) 经济高速增长(GDP主义、赶英超美、出口导向)

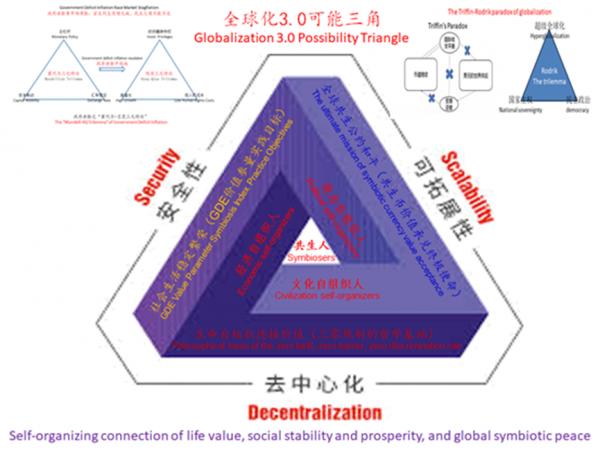

这三个目标短期可通过干预(如汇率低估、债务滚雪球)暂时兼得,但长期必然冲突: 这与汇率操纵的“互害机制”一脉相承:短期有效(顺差、增长),长期失衡(结构性通缩/滞胀、政治改革拖累)。 4. 全球化3.0可能性三角愿景 下面这张图,展现了全球化3.0可能性三角愿景

这正是对“蒙代尔-钱宏三元难题”的解决方案: 5. 在共生经济学语境中的意义 在汇率操纵与GDP赶超的讨论中,“蒙代尔-钱宏三元难题”深刻揭示: 中国当前模式(汇率低估+赤字投资+货币干预)短期实现了“增长+顺差+相对稳定”,但本质上是经典三元悖论的国内变体:牺牲长期可持续性,换取短期绩效合法性。 若不改革(结束操纵、推进政治体制改革、引入GDE),将陷入滞胀深渊,倒退四十年前。 出路:向全球化3.0可能性三角转型,让“人民共和国名副其实”,放下意识形态幻像,实现共生权主导的去中心化治理。

这一理论创新,延续了蒙代尔的政策冲突分析精神,又以共生哲学赋予其“可能性”出路,极具原创性和现实指导价值。 附录三:GDE价值参量与GDP价值参量比较

有关“GDE价值参量”基本框架,于2010年6月8日钱宏接受上海社科院经济研究所特聘研究员演讲发表,后于2013、2019两次刊《经济要参》,详细介绍在即将出版的《共生经济学SYMBIONOMICS》一书。 1、GDP的加法思维:资本增值逻辑的局限 GDP(Gross Domestic Product,国内生产总值)源于20世纪30年代的凯恩斯主义需求管理工具,由西蒙·库兹涅茨等学者奠基,并经联合国SNA(System of National Accounts)标准化。它本质上是加法思维:汇总所有市场化产出(投资、消费、出口、政府支出),以货币价格作为度量。核心焦点是资本增值/减值——企业利润、资产升值、基础设施支出皆计为正贡献,即使伴随资源耗竭、环境破坏或不平等加剧(如房地产泡沫“推高”GDP,但实际是浪费)。 历史合理性:如您所述,GDP源于战争规划与福利国家需求。二战期间,它帮助盟国评估未利用产能;战后,成为政策权威的“解剖学”。但创始者库兹涅茨早于1934年警告:“一国福利几乎不能从GDP中推断。”它忽略非市场活动(如家庭劳动、社区服务)、生态成本(如污染修复反增GDP),并将“人民”简化为“消费者”,抽空精神体能与自组织力。 加法缺陷:线性叠加激励“GDP锦标赛”——地方政府与企业合谋追求数量增长,导致“投资、内需、出口”模式主导。短期显绩(如贸易顺差超1万亿美元)掩盖潜绩(如通缩、债务/GDP超300%)。在汇率操纵语境中,加法思维放大人为低估的优势:出口廉价倾销“加”出顺差,却忽略乘法级生态能耗与全球互害。

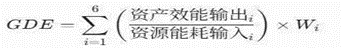

结果:表面“赶英超美”(按PPP,中国GDP已超美),实质陷入“蒙代尔-钱宏三元难题”——赤字扩张、货币宽松、高速增长短期兼得,长期冲突酿成滞胀深渊,拖累政治体制改革(如温家宝2012年强调的“政治体制改革”,以防“文革”悲剧重演)。 2、GDE的乘法思维:资源能效逻辑的创新 GDE(Gross Domestic Energy-conversion,国民能产转换总值)是您提出的替代体系,强调资源能效/能耗作为核心参量。它源于供给侧改革的“一降”——全方位提升单位效能、促降能耗——并嵌入“生产-交换-生活”账户框架,转向乘法思维:非线性协同,系统各环节效率互乘,总福祉呈几何增长;若任一环节破坏(如高能耗、低人权),整体乘积趋零。 理论框架:如文所述,GDE以能量转换(Energy Conversion)为计量单位,综合三个值:国内能产转换总值(GDE)、国民能产转换总值(GNE)、人类能产转换总值(GHE)。它整合绿色GDP、GEP(生态系统生产总值)、GNH(国民幸福总值),区别数量/质量、成本/回报、短期/长期、速度/效率。特点包括:自然纳入GDP遗漏领域(如生态服务、社区价值);有机整合多指标;生活导向——“让生产回归生活”,以幸福度、尊严感、生态平衡率为极致诉求。 乘法优势:不同于GDP的“加总”,GDE评估边际成本与效能平衡:高能效(如创新、管理、文化力)乘法放大价值;高能耗(如过度投资、倾销)惩罚整体。计算框架需多学科攻关(如经济学、物理学、生物学),形成六张资产负债表(自然、家庭、社区、社会、政府、企业),操作性通过能量转换平衡表实现。无“垃圾”或“负能量”——人类如自然般自行调节循环。 与生态文明的契合:GDE“E”打头,涵括“生态”“动态”“动力学”,体现“态”(业态、心态、生活态)的立体跃升。乘法思维解决三大极限(增长、对抗、操控)和三大陷阱(泛中等收入、泛产业化、城市化),从互害转向共生。

3、加法 vs 乘法:对中国现实的镜鉴与出路 在汇率操纵与GDP赶超语境中,加法思维放大短期“收获”:举国战略、低人权优势、战狼外交、经济武器化有效对付西方规则,却长期无价值——结构性失衡延缓改革,掩盖紧迫性(如放下意识形态谎言,让“人民共和国名副其实”)。若继续,将大概率倒退四十年前的深渊:产能过剩、民生欠债、社会动荡。 乘法思维的GDE提供升级路径:结束操纵、回归市场,引入“生产-交换-生活”模式。文末强调,GDE非简单统计变现,而是规范经济结构,避免利益集团腾挪。它需多学科团队(至少三月脑力激荡)与资金支持,成为国际共识与负责政府指南。 GDE乘法思维将“赶超”的血汗泪转化为真正文明进步:从资本奴隶到共生者(Symbioners),实现全球化3.0可能性三角——安全、可拓展、可持续。 一句话:GDP“加”出数量神话,GDE“乘”出生命价值共生。选择乘法,方能避祸福相依的陷阱。

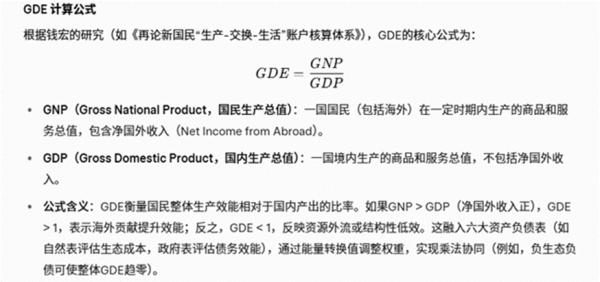

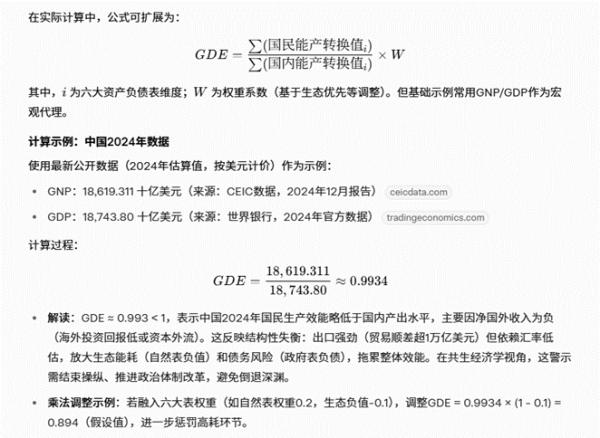

附录四:GDE价值参量的计算公式示例

GDE指数(Gross Domestic Energy,国民生产效能指数)是由钱宏(Archer Hong Qian)在共生经济学(Symbionomics)框架下首创的新型国民账户核算体系,旨在以资源能效/能耗(energy efficiency/energy consumption)为核心参量,取代传统GDP的资本增值/减值逻辑,衡量政治经济组织行为的整体效能。GDE强调“生产-交换-生活”三位一体,让生产回归生活、生活呈现生态、生态激励生命,通过非线性动态(希格斯场自耦合破缺、普里高津耗散自组织)评估六大资源综合配置效率,促进个体与整体的动态健康平衡。以下基于《再论新国民“生产-交换-生活”账户核算体系》一文,系统详解GDE的计算框架,包括理论基础、核心指标、计算逻辑、操作路径及挑战。

1. GDE 计算框架的理论基础 GDE源于“降本赋能”的健康黄金律,针对GDP的缺陷(如忽略生态成本、非市场价值、收入分配)而设计。它以能量转换(Energy Conversion)的能效或能耗为计量基础,体现质量、效能法则: 区别维度:数量 vs 质量、成本 vs 回报、短期 vs 长期、速度 vs 效率。 价值导向:生活幸福度、尊严感、生态平衡率。人类如自然般自行调节循环,无“垃圾”或“负能量”。 创新点:整合绿色GDP(生态调整)、GEP(生态系统生产总值)、GNH(国民幸福总值),从“投资-内需-出口”,转向“生产-交换-生活”模式。 哲学内涵:生态文明的“态”(业态、心态、生活态)跃升,解决三大极限(增长、对抗、操控)和三大陷阱(泛中等收入、泛产业化、城市化)。

强调:GDE评估边际成本与国民福祉,体现共生经济学“让生产回归生活,生活呈现生态,生态激励生命”的乘法协同——系统环节互乘,高能效放大价值,高能耗惩罚整体。 2. GDE 的核心指标体系 GDE框架提出三个互补参量,形成共生经济的综合评价体系: GDE(国内能产转换总值):以境内能量转换效率为核心,衡量生产过程的能效/能耗。包括自然、人文、社会、经济、政治、生态六大领域。 GNE(国民能产转换总值):扩展到国民层面,评估交换环节的效能平衡(如贸易、分配)。 GHE(人类能产转换总值):全球视角,融入生活环节,强调可持续共生与人类整体福祉。

共生经济学全息图,它清晰展示了“三自组织人行为”(Political, Cultural, Economic Self-Organisers)框架下的六大资产(资源)负债表: 自然资源责任表、家庭资源责任表、社区资源责任表、企业资源责任表、政府资源责任表、社会(或生态)资源责任表。这与文章中提到的六大维度(自然、人文、社会、经济、政治、生态)互为对应,其中人文可能涵盖家庭与社区,经济对应企业,政治对应政府,生态融入社会整体。下面,我修正之前的描述,统一采用附图所示的六大表框架,系统详解GDE计算框架,整合理论、逻辑、方法与实施。 GDP基于“政府资产(资源)负债表”与“企业资产(资源)负债表”两张表,以加法思维累计资本增值/减值;GDE则基于“自然”“家庭”“社区”“社会”“政府”“企业”六大资产(资源)负债表框架(确保经济活动全景式摄入),以乘法思维有正有负统计资源能效/能耗。 3. GDE 的核心指标与六大资产负债表 “六大资产(资源)负债表”(以下简称“六大资产负债表”)是GDE指数的核心工具,源于钱宏的研究(如《共生经济学》,2010;《经济要参》2013年第4期),包括自然、社会(道德伦理规范)、家庭、社区、企业、政府六个维度。这些负债表不是单纯的财务报表,而是综合评估资产(资源)的流入、流出、效能与可持续性的动态框架,类似于“有界距离”的全息共生结构(个体资产含整体信息,整体包容个体多样)。 以下结合六大资产负债表(相对GDP参量基于政府、企业两大资产负债表),探索GDE指数的应用条件(前提与环境)和方法(步骤与整合),以通俗方式呈现,以引发公益讨论。分析基于共生经济学的健康黄金律(通过共生智慧优化资源配置,促进健康平衡)和8大转变(从竞争到协作、孤立到互联、线性到非线性、占有到共享、同质到多元、控制到赋能、短期到长期、自我到共生)。 六大资产负债表,将经济系统视为“时空意间”的共生网络,每个表评估特定领域的资源资产(输入)与负债(消耗/风险),以能量能效/能耗为统一参量,确保从微观(个体)到宏观(全球)的平衡: 自然资产负债表:评估生态资源(如水、能源、土壤)的可持续利用。资产:可再生能源;负债:污染、资源枯竭。 社会资产负债表:评估道德伦理规范和社会资本(如信任、公平)。资产:社会凝聚力;负债:不平等、冲突。 家庭资产负债表:评估个体身心灵健康(如教育、情感支持)。资产:家庭福祉;负债:压力、疾病。 社区资产负债表:评估地方协作(如公共服务、邻里互助)。资产:社区韧性;负债:资源分配不均。 企业资产负债表:评估生产与创新(如技术、劳动力)。资产:创新效能;负债:浪费、垄断。 政府资产负债表:评估公共产品(如基础设施、政策)。资产:治理效率;负债:腐败、债务失衡。 这些负债表通过“熵减-熵旋模式”互联:低熵(高效能)状态通过共生反馈实现,避免高熵失衡(如中美119%公债的两级分化)。 4、GDE指数应用的条件 GDE指数的应用需满足特定前提,以确保数据可靠性、政策支持和技术可行性。这些条件呼应8大转变,从线性统计到非线性评估,从自我中心到交互共生。 数据可用性条件(从孤立到互联、同质到多元): 需要跨领域数据整合:自然(生态监测数据,如卫星遥感碳足迹);社会(调查指数,如世界价值观调查的信任数据);家庭/社区(微观调研,如健康APP数据);企业/政府(财务报表与政策评估)。 条件:数据透明度高,避免信息孤岛。例如,在数字化社会(如中国“智慧城市”),物联网(IoT)可实时采集能量能耗数据;若数据碎片化(如发展中国家),需补充社区调查。 挑战与解决:如果数据不足,采用代理指标(如能源消耗/GDP比率),并通过共生权(Symbiorights)机制鼓励共享(从占有到共享)。 政策与制度条件(从控制到赋能、短期到长期): 需政府或国际组织支持,如联合国SDGs框架或《全球共生公约》,以GDE取代GDP作为政策评估标准。 条件:制度包容多元(如诺贝尔经济学奖2024年强调的良好制度),避免权力导向(如中国基建债务的“举国经济”)。例如,在欧盟绿色协议中,GDE可评估碳中和效能。 挑战与解决:政策路径依赖(如中美债务的“互害机制”)需通过“三零规则”(零关税、零壁垒、零歧视)转型,实现从短期增长到长期健康。 技术与方法条件(从线性到非线性、竞争到协作): 需AI、区块链和大数据工具支持,非线性模型(如蒙特卡罗模拟)处理不确定性。 条件:技术基础设施成熟,如孞態场网(Minds field-network)监控生理-心理-认知反馈,整合六大表。 挑战与解决:计算复杂性通过开源平台(如Linux-like协作)降低成本,确保从自我到共生。 社会文化条件(从占有到共享、自我到共生): 需“三本通学教育”(本心:身心健康;本事:觉知教育;本分:人格教育),培养共生意识。 条件:文化包容(如轴心时代智慧之爱到爱之智慧Amorsophia),避免文化惰性。 总体条件: 应用GDE需“仨自组织人”(政治、经济、文化自组织人)生态协同,适用于成熟经济体或转型国家(如中美债务对比),以化解LAFE(生命形态)-AI(智能形态)-TRUST(组织形态)冲突。 5、 GDE指数应用的方法 GDE指数的应用方法是动态、非线性的评估过程,结合六大资产负债表,通过“成本收益消长定律”和资源生产率计算能量能效/能耗。以下是步骤化方法,融入健康黄金律和8大转变,适用于公益讨论演示(如PPT Slide 17:共生经济学)。 步骤1: 数据采集与六大资产负债表构建(从孤立到互联): 收集各表数据:自然(能源消耗数据);社会(信任调查);家庭(健康指标,如WHO数据);社区(地方调研);企业(生产率报告);政府(财政支出)。 方法:使用区块链记录资源流,确保透明共享(8大转变:占有到共享)。例如,中美119%债务中,评估自然表(基建能耗)与家庭表(消费福祉)。 工具:AI分析(如机器学习聚类)整合数据,避免线性统计偏差。 步骤2: 能量能效/能耗计算**(从线性到非线性):  步骤3: 评估与优化(从控制到赋能、短期到长期): 比较基准:GDE >1 表示高效能(低耗高产);<1 表示失衡(高耗低产)。 方法:应用健康黄金律优化资源(如AI实时调整),通过蒙特卡罗模拟预测长期影响。例:中美债务中,优化政府表(基建债务)与自然表(生态成本),转向可持续投资。 工具:孞態场网监控反馈,奖抑机制(如激励低耗项目)。 步骤4: 政策应用与迭代**(从自我到共生、竞争到协作): 输出报告:GDE作为决策指标,取代GDP(如联合国改革)。 方法:迭代循环——基于8大转变调整(如从短期基建到长期生态),通过全球共生公约推广。例:COVAX疫苗合作中,GDE评估国际资源能效,促进公平分配。 挑战解决:数据不全时,用代理指标(如碳足迹/GDP);通过“三零规则”实现全球协作。 应用案例与启示 案例:社区花园项目:结合六大表,GDE评估自然(土壤能效)、家庭(身心健康)、社区(协作效能),优化资源(从竞争抢地到协作共享),实现健康繁荣。 案例:中美119%债务:GDE揭示美国(社会/家庭表高能效)vs.中国(企业/政府表高耗),通过8大转变(线性到非线性)化解两级分化,优化全球链。 启示:GDE应用推动共生经济学革命,从“增长黄金率”到“健康黄金率”,在“时空意间”构建“孞元宇宙”。条件成熟时,可驱动公益项目(如您的讲座),鼓励听众从家庭表开始评估个人GDE。 6、计算公式示例 GDE(Gross Domestic Energy,国民生产效能指数)作为共生经济学(Symbionomics)的核心指标,以能量能效/能耗为参量,评估资源配置的整体效能。它不同于GDP的加法累计资本增值/减值,而是通过乘法思维(有正有负)统计六大资产(资源)负债表的动态平衡。基于您提供的文章截图和相关研究,GDE的计算公式在概念上简化为国民生产总值(GNP)与国内生产总值(GDP)的比率,反映净国外收入对国内效能的调整效应。这是一个宏观效能指数,值越接近或超过1,表示资源配置越高效;小于1,则揭示结构性失衡(如净国外收入为负)。

GDE=GNP/GDP公式变体,是通过GNP/GDP作为宏观代理示例进行计算(如中国2024年GDE≈0.9934),以验证理论模型。这并非将GDE简化为GNP/GDP,而是贯通 的逻辑延伸:详细公式(基于六大资产负债表的乘法求和)是微观基础,GNP/GDP是简化代理,用于宏观应用。下面是GDE指数公式的完整框架。 的逻辑延伸:详细公式(基于六大资产负债表的乘法求和)是微观基础,GNP/GDP是简化代理,用于宏观应用。下面是GDE指数公式的完整框架。 7、GDE指数公式的本质:不止是GNP/GDP关系 为什么涉及GNP/GDP?:用GNP/GDP作为代理示例,因为GNP(国民生产总值,包含净国外收入)扩展了GDP的“国民”维度,隐含能量转换的宏观调整(净收入正值提升效能,负值揭示外流失衡)。这不是GDE的“全部公式”,而是应用简化:当数据不足时,用GNP/GDP代理六大表的整体效能比率,反映结构性问题(如中国出口依赖放大能耗,但净收入负值拖累GDE<1)。这与文章核心一致:GDE强调“生产-交换-生活”账户,从资本导向转向生命服务,避免互害机制。 三公式的贯通逻辑: 微观基础(公式1/3):GDE = ∑_{i=1}^6 (资源效能输出_i / 资源能耗输入_i) × W_i 这直接基于六大资产负债表,乘法评估能量转换(正值放大,负值惩罚)。文章截图描述:GDE以资源生产率反比例于成本收益,综合自然(生态服务)、社会(道德规范)等维度。 宏观代理(公式2):GDE = ∑ [国民能产转换值 / 国内能产转换值] × W 这将微观求和聚合为国民/国内比率,GNP代理“国民能产”(含海外效能),GDP代理“国内能产”(境内产出)。连贯点:当权重W=1且简化时,趋近GNP/GDP,方便宏观验证(如图片示例GDE=0.9934,揭示净国外收入负值导致效能低)。 整体框架:三公式不是孤立,而是从理论(乘法分解)到实践(比率代理)的链条。文章强调:GDE超越GDP的“增值”局限,转向能量效能评估,解决财政两级分化(如中美119%公债:美国消费导向高能效,中国基建导向高耗)。如果净收入为负,GDE<1警示改革(如结束汇率操纵,推动政治体制改革,让“人民共和国名副其实”)。

总之,此示例基于宏观数据;实际应用需微观整合(如IoT实时能耗数据)。这里的分析并非“仅讲关系”,而是展示GNP/GDP作为GDE指数公式的应用代理,帮助揭示中国经济失衡(GDE<1)。真实GDE需六大资产负债表数据全覆盖,实现乘法共生。GDE转向乘法思维,促进全球化3.0可能性三角——从互害到共生。

Deep Concerns on China's Exchange Rate Manipulation and Economic Overtaking from the PPP Perspective(Four Appendices) Archer Hong Qian December 17, 2025, in Vancouver First, thanks to Mr. Zhan Jun, former deputy editor-in-chief of the "China Real Estate Yearbook," for recommending: "Anti-China figures worldwide and most economists have always predicted a trend of depreciation for the RMB. However, several news items at the end of the year suggest the rationality and necessity of a trend toward RMB appreciation." How should we view this? Allow me to conduct a simple analysis from the perspective of Symbionomics. Sheng Songcheng, former Director of the Survey and Statistics Department of the People's Bank of China, is one of the few officials who has access to almost all core economic data. Now teaching at China Europe International Business School in Shanghai, he recently stated in a speech at a financial conference on purchasing power parity (PPP, which refers to the exchange rate level that should be reached to make prices of similar goods and services consistent across different countries): From the PPP perspective, the exchange rate is far below the current level of 1:7.1, and some calculations suggest it could be around 1:3.5. If the RMB appreciates to this level, China's GDP total, denominated in US dollars, will surpass the United States to become the world's largest economy. It can be said that Sheng Songcheng's view is quite representative, but it is difficult to be adopted by the annual "Central Economic Work Conference." Obviously, central decision-makers know that China's per capita GNP still lags behind more than 40 countries worldwide. Moreover, from the perspective of China's current obvious economic downturn, the strength of the three carriages of investment, consumption, and exports shows that investment and consumption are weak to the point of deflation, with only exports remaining strong. Data released by China shows that its global trade surplus in the first 11 months of this year has exceeded 1.08 trillion US dollars. And what benefits this strength? In the end, isn't it benefiting from this huge price difference where prices of similar goods and services in China are inconsistent? And this "huge price difference," besides China's low human rights advantage in productivity and preference for economic structural imbalances, can only be attributed to artificial control of the exchange rate—that is, exchange rate manipulation! Therefore, purchasing power parity, although it can reveal a country's (such as China) true GDP total, can also reveal whether that country engages in exchange rate manipulation in international trade. RMB strengthening (appreciation) will push up the prices of Chinese export products, weakening their competitiveness in overseas markets, while making it easier for domestic consumers to afford imported goods. Of course, RMB appreciation will also raise consumer prices in the United States and other countries, making it difficult for them to afford Chinese goods. Conversely, keeping the RMB to USD exchange rate in a long-term depreciation trend, maintaining the "huge price difference" where prices of similar goods and services in China are inconsistent with those in other countries, facilitates low-price dumping, absorbing excess capacity, and obtaining a large global trade surplus (especially with developed countries), making consumers in various countries "increasingly dependent" on China's cheap goods and services, to the point of gradually losing part or even the entirety of their productivity! However, from the perspective of national political civilization and medium- to long-term economic development, government intervention in exchange rate manipulation is a double-edged sword, and the pros and cons of pursuing high surpluses cannot be measured in miles. This is the "mutual harm mechanism" in the "free trade illusion" of globalization 2.0 pointed out by Symbionomics, which in turn leads to "structural imbalances" in political, economic, cultural, and social life organizations. If the lesson the United States needs to learn from this is the "Steffen-Rodrik Dilemma," this is precisely why US President Trump came to power, set aside "political correctness," and rewrote the "free trade rules" of globalization 2.0 since World War II with "reciprocal tariffs." Then, what problem does China need to reflect on? I think it is probably the "Mundell-Qian Hong Trilemma." Government Deficit "Mundell-Qian Hong Trilemma" The "Mundell-HongQian Trilemma" of Government Deficit Inflation As some friends have observed, "China's national system, low human rights strategy, corner-cutting overtaking strategy, commodity dumping strategy, etc., are generally successful and effective when dealing with Western countries that abide by rules, and even the three tools for handling political, diplomatic, and internal relations—diplomatic wolf warriorism, weaponization of economic relations, and criminal hostage-taking of dissidents—will have gains in the short term" (not to mention the self-indulgent part), but in the long run, this "gain" has no real value for the overall healthy operation of the country and changing the "structural imbalance" (proposed by Hu and Wen in 2003)! Therefore, continuing to view whether China's GDP total "catches up with Britain and surpasses the US" from PPP thinking inertia, if it cannot prompt China to end exchange rate manipulation and return to the market, cannot change the severely imbalanced political, economic, cultural, and social organizational structure, cannot "let production return to life, let life present ecology, let ecology motivate life" (2015), besides strengthening the national system and fattening one batch after another of individuals and communities close to power capital (insiders), it also has no real value for China's social growth and for China to become a normal, modern country in name and reality (such as a republic)! As the saying goes, misfortune and fortune depend on each other. Is China's GDP total "catching up with Britain and surpassing the US" a good thing? It counts (after all, it contains the blood, sweat, and tears of generations of Chinese people), but the serious problem is that it will continue to mask the urgency of China's "path to republic," drag down China's modernization process of integrating into world modern civilization—the focus is on the "political system reform" mentioned by Wen Jiabao at his last press conference with Chinese and foreign journalists in 2012. He emphasized that without the success of political system reform, economic system reform cannot be carried through to the end, and the achievements already obtained may still be lost, and historical tragedies like the "Cultural Revolution" may recur; in Qian Hong's words, it is to put down the illusions created by ideology for decades, "rebuild the People's Republic" (1986), that is, to make the People's Republic worthy of its name—ultimately likely leading to China's economy falling into an abyss of regression for forty years (hard days)! In fact, from the perspective of Symbionomics, the broad world economic problems with China's participation, in the end, are a question of what value standard to use to measure the political, economic, social, and organizational behaviors of various countries. Seventeen years ago in 2008, in two correspondences with Mr. Zhao Qizheng, then Director of the State Council Information Office, I discussed that the "investment-consumption-export" national accounts calculation "GDP championship" formed after World War II should end, and there is an urgent need to create a national "production-exchange-life" accounts calculation system with GDE value parameters. Today, I increasingly feel that such "GDE value parameters" should become the consensus of the international community and become the action guide for the governance performance of responsible governments in various countries! Returning to the PPP perspective, China's economic scale has long "caught up with Britain and surpassed the US," but if it relies on exchange rate "undervaluation" and the existing mode, this achievement is only superficial prosperity, which will amplify structural risks: export dependence exacerbates weak domestic demand, debt accumulation, international friction, and ultimately may fall into the middle-income trap, with the economy regressing to the level of the early reform and opening up. Only by ending manipulation, returning to the market, and promoting political system reform can we avoid the mutual harm cycle and achieve the paradigm shift of globalization 3.0 (Paradigm Shift), and China and the world can step into a new way of life that is great-healthy again. Appendix One: The Thinking Inertia of China's GDP Total "Catching Up with Britain and Surpassing the US" Will Mask and Drag Down the Urgency of Political System Reform, and Trigger the Risk of Economic Regression The following argues from three dimensions—economic data, political-economic interaction, and long-term risks—that China's GDP total "catching up with Britain and surpassing the US" (i.e., surpassing the UK and approaching or surpassing the US) will mask the urgency of political system reform, while dragging down the reform process, ultimately likely leading to economic regression to the abyss level of forty years ago (about the early reform and opening up in 1985). This argument is based on the latest economic forecasts and analysis, emphasizing structural issues rather than short-term fluctuations. The Current Situation and Forecast of China's GDP "Catching Up with Britain and Surpassing the US": The Cornerstone of Superficial Prosperity

According to purchasing power parity (PPP), China's GDP has surpassed the US between 2014-2016, becoming the world's largest economy, expected to reach over 30 trillion US dollars in 2025, accounting for over 25% of the global share. In nominal exchange rates, China's GDP is about 19 trillion US dollars, expected to surpass the US by 2045 (US about 30.6 trillion US dollars), with some predictions suggesting it could be advanced to 2030-2040 if a 4-5% growth rate is maintained. The IMF has raised China's growth expectation for 2025 to 5%, higher than the US's 2%, benefiting from exports and manufacturing dominance. This has far exceeded the UK (about 3 trillion US dollars), achieving "catching up with Britain." This "surpassing the US" superficially strengthens national confidence and legitimacy, but in essence, it is driven by a state-led investment-export mode, with consumption accounting for only 50% of GDP (80% in the US), relying on trade surpluses (over 1 trillion US dollars in the first 11 months of 2025). High growth data (such as 5% growth equivalent to 1.5 trillion US dollars increment, exceeding the sum of the US and Europe) is often promoted as the success of the "China model," masking underlying problems. How "Catching Up with Britain and Surpassing the US" Masks and Drags Down the Urgency of Political System Reform

High GDP growth provides "performance legitimacy" for the political system, allowing the government to avoid deep reforms such as judicial independence, freedom of speech, or separation of powers, instead prioritizing "security over growth." China's leadership regards economic growth targets as political tasks, with local officials gaining promotions by pursuing high growth (such as debt-financed infrastructure), which strengthens top-level design rather than market spontaneity. The result is that superficial prosperity (such as GDP overtaking) blurs the necessity of reform: when the economy slows down (such as consumption and investment weakness in 2024-2025), the government is more inclined to stimulus measures rather than structural changes, avoiding touching politically sensitive areas. The specific drag is manifested in: Suppressing market-oriented reforms: The state controls exchange rates and resource allocation (such as subsidizing exports), maintaining growth but distorting distribution, leading to widening urban-rural income gaps (political promotion mechanisms exacerbate this problem). This allows the political system to not transform toward a more open direction, because the "growth myth" maintains social stability. Strengthening party control: The Fifth Plenum emphasizes "political and economic reform" but focuses on regulation rather than decentralization, prioritizing the party's control over the economy. The bureaucratic system is risk-averse, imitating the US but paying more attention to superior instructions, hindering innovation and rule of law progress. International friction amplifies domestic pressure: Trade wars (such as Trump tariffs) expose dependence, but the government responds with "anti-involvement" rather than internal reform, further delaying political adjustments.

If there is no reform, growth will continue to mask the urgency of corruption, inefficiency, and inequality, as some analyses point out, the China model prioritizes security over sustainability. Ultimately Falling into Economic Abyss: The Risk of Regression for Forty Years

If GDP "overtaking" continues to rely on the existing mode, rather than transformation driven by political reform, China will face the middle-income trap (MIT) and stagnation, similar to Latin American countries or Japan's "lost decade," possibly regressing to the 1985 level (per capita GDP about 300 US dollars, economically closed). Evidence of the middle-income trap: China has approached the MIT threshold (per capita GDP 1.5-1.6 trillion US dollars), growth slows to below 5%, debt/GDP exceeds 325%, population aging (working population decline) intensifies. Inequality, if continued, will fall into "inequality trap" turning to MIT, excess capacity and deflation (such as 2025 factory output slowdown) leading to long-term stagnation. Structural abyss: Real estate crisis, export dependence (if tariffs escalate, supply chain relocation) will amplify unemployment, weak consumption turns into a vicious cycle. 2023-2025 US growth has surpassed China, highlighting the bottleneck of authoritarian mode. If not reformed (such as floating exchange rates, reducing intervention), it may replay the "lost thirty years," with economic scale shrinking, returning to a closed state. Quantification of regression for forty years: In 1985, China's GDP was about 3000 billion US dollars, per capita low-efficiency agriculture dominant. If the trap is realized, growth stagnates for 5-10 years, debt crisis erupts (public-private debt doubles 2010s), possibly leading to social unrest, economic regression to low-growth, low-innovation "stone age" mode.

Conclusion China's GDP "catching up with Britain and surpassing the US" is an achievement, but if it continues to mask political reform (such as from party control to rule of law market), it will drag down transformation, amplify risks, ultimately falling into the abyss. Historical lessons (such as Soviet stagnation) show that authoritarian growth is not sustainable; need through reform (such as GDE system) to shift to domestic demand and innovation, to avoid regression. This is not inevitable, but the current trajectory shows urgency. Appendix Two: "Mundell-Qian Hong Trilemma" In the Symbionomics framework, the classic Mundell-Fleming Impossible Trinity (monetary policy independence, exchange rate stability, capital free flow cannot be achieved simultaneously) has been originally transformed and expanded, creatively named the "Mundell-Qian Hong Trilemma," and applied to the analysis of government macroeconomic policy dilemmas. The following conducts a systematic in-depth interpretation based on Symbionomics ideas and comparison with the classic Mundell-Fleming model. Brief Review of the Classic Mundell-Fleming Impossible Trinity

Independent Monetary Policy Fixed Exchange Rate Stability Perfect Capital Mobility

Core conclusion: A country can achieve at most two goals simultaneously and must give up the third. Policy implications: In an open economy, these three goals conflict with each other, often leading to financial crises (such as the 1997 Asian crisis).

This belongs to the "Impossible Triangle," emphasizing the hard constraints of policy choices. "Mundell-Qian Hong Trilemma": Innovation from "Impossible" to "Possible Upgrade"

Transform the classic model into: Left triangle (traditional mode): Mundell Impossible Trinity Right triangle (upgrade mode): Qian Hong Possibility Triangle? Arrow pointing: Government Deficit Inflation Advanced Aphorism: Government deficit inflation market stagnation: Official benefits increase without reduction, people's debts must be repaid

This is obviously a critical inheritance and development of the classic theory: Retain "Mundell": Pay tribute to the original model's profound revelation of policy conflicts. Add "Qian Hong": Inject Symbionomics perspective, shifting the focus from international open macro to domestic fiscal-monetary-growth structural imbalances, especially the stagnation risk caused by government deficit inflation (Government Deficit Inflation). Core innovation: The classic is "impossible triangle" (three cannot be achieved simultaneously), the new version through the "upgrade version" arrow, implies that through symbiotic mechanisms (such as GDE account system, decentralization) can shift from "impossible" to "possible triangle"—achieving sustainable balance, avoiding stagnation abyss.

Specific Connotation Interpretation of the "Mundell-Qian Hong Trilemma"

The new trilemma may focus on three mutually conflicting goals under the government-led mode: Government deficit expansion (continuous fiscal stimulus, debt investment, national system) Monetary over-issuance relaxation (low interest rates, printing money to hedge debt, inflation concerns) Economic high-speed growth (GDPism, catching up with Britain and surpassing the US, export-oriented)

These three goals can be temporarily achieved through intervention in the short term (such as exchange rate undervaluation, debt snowball), but must conflict in the long term: Deficit + monetary relaxation → Inflation pressure or asset bubbles High-speed growth relies on deficit money → Debt unsustainable, stagnation risk Final result: Official benefits increase without reduction (government interest group debt expansion), people's debts must be repaid (people bear deflation, unemployment, inequality)

This is in line with the "mutual harm mechanism" of exchange rate manipulation: Effective in the short term (surplus, growth), imbalanced in the long term (structural deflation/stagnation, political reform drag). Globalization 3.0 Possibility Triangle Vision

The following chart shows the vision of the Globalization 3.0 Possibility Triangle Globalization 3.0 Possibility Triangle (Globalization 3.0 Possibility Triangle) Three vertices: Security (GDE value parameters, symbiotic rights) Scalability (decentralization, community economy) Sustainability (civilized self-organizing people, symbiotic peace)

Center: Symbioners Bottom: Decentralization Contrast classic: The small triangle on the left is the traditional "impossible triangle" (Triffin-Rodrik Paradox, etc.)

Self-organizing connection of life value, social stability and prosperity, and global symbiotic peace This is precisely the solution to the "Mundell-Qian Hong Trilemma": Through decentralization (community priority, society priority, government service-oriented), upgrade from the "impossible" dilemma of government deficit inflation stagnation to a "possible triangle" of security, scalability, and sustainability. Implementation path: GDE national "production-exchange-life" account calculation system, emphasizing value parameters rather than pure GDP, achieving production returning to life, mutual benefit symbiosis.

Significance in the Symbionomics Context

In the discussion of exchange rate manipulation and GDP overtaking, the "Mundell-Qian Hong Trilemma" profoundly reveals: China's current mode (exchange rate undervaluation + deficit investment + monetary intervention) has achieved "growth + surplus + relative stability" in the short term, but in essence, it is a domestic variant of the classic trilemma: sacrificing long-term sustainability in exchange for short-term performance legitimacy. If not reformed (ending manipulation, promoting political system reform, introducing GDE), it will fall into the stagnation abyss, regressing forty years ago. Way out: Transform to the Globalization 3.0 Possibility Triangle, let the "People's Republic" live up to its name, put down ideological illusions, achieve decentralized governance dominated by symbiotic rights.

This theoretical innovation not only continues Mundell's policy conflict analysis spirit but also endows it with a "possibility" way out through symbiotic philosophy, with great originality and practical guidance value. Appendix Three: Comparison of GDE Value Parameters and GDP Value Parameters The basic framework of the "GDE value parameters" was presented by Qian Hong on June 8, 2010, as a special researcher speech at the Shanghai Academy of Social Sciences Institute of Economics, and later published twice in "Economic Essentials" in 2013 and 2019, with detailed introduction in the upcoming book "Symbionomics SYMBIONOMICS." GDP's Addition Thinking: Limitations of Capital Appreciation Logic

GDP (Gross Domestic Product, gross domestic product) originated from the Keynesian demand management tool in the 1930s, laid the foundation by scholars such as Simon Kuznets, and standardized by the United Nations SNA (System of National Accounts). It is essentially addition thinking: aggregating all marketized outputs (investment, consumption, exports, government spending), with monetary prices as measurement. The core focus is capital appreciation/depreciation—enterprise profits, asset appreciation, infrastructure spending are all counted as positive contributions, even if accompanied by resource depletion, environmental damage, or increased inequality (such as real estate bubbles "pushing up" GDP, but actually waste). Historical rationality: As you said, GDP originated from war planning and welfare state needs. During World War II, it helped the Allies assess unused capacity; after the war, it became the "anatomy" of policy authority. But the founder Kuznets warned as early as 1934: "A country's welfare can hardly be inferred from GDP." It ignores non-market activities (such as family labor, community services), ecological costs (such as pollution remediation counter-increasing GDP), and simplifies "people" to "consumers," emptying spiritual and physical abilities and self-organization. Addition defects: Linear superposition incentivizes "GDP championships"—local governments and enterprises collude to pursue quantity growth, leading to the dominance of "investment-domestic demand-exports" mode. Short-term apparent performance (such as trade surplus exceeding 1 trillion US dollars) masks latent performance (such as deflation, debt/GDP exceeding 300%). In the context of exchange rate manipulation, addition thinking amplifies the advantages of artificial undervaluation: export cheap dumping "adds" surplus, but ignores the multiplicative level of ecological energy consumption and global mutual harm.

Result: Superficial "catching up with Britain and surpassing the US" (China's GDP has surpassed the US by PPP), in substance falling into the "Mundell-Qian Hong Trilemma"—deficit expansion, monetary relaxation, high-speed growth achieved in the short term, long-term conflict brewing stagnation abyss, dragging down political system reform (such as Wen Jiabao's emphasis on "political system reform" in 2012, to prevent the recurrence of "Cultural Revolution" tragedies). GDE's Multiplication Thinking: Innovation of Resource Efficiency Logic

GDE (Gross Domestic Energy-conversion, gross domestic energy conversion) is the alternative system you proposed, emphasizing resource efficiency/energy consumption as the core parameter. It originates from the "one reduction" of supply-side reform—all-round improvement of unit efficiency, promoting reduction of energy consumption costs—and embedded in the "production-exchange-life" account framework, shifting to multiplication thinking: non-linear synergy, efficiency of system links multiply, total welfare shows geometric growth; if any link is destroyed (such as high energy consumption, low human rights), the overall product tends to zero. Theoretical framework: As described in the text, GDE uses energy conversion (Energy Conversion) as the measurement unit, integrating three values: gross domestic energy conversion (GDE), gross national energy conversion (GNE), gross human energy conversion (GHE). It integrates green GDP (ecological adjustment), GEP (gross ecosystem product), GNH (gross national happiness), distinguishing quantity/quality, cost/return, short-term/long-term, speed/efficiency. Features include: naturally incorporating GDP omitted areas (such as ecological services, community value); organically integrating multiple indicators; life-oriented—"let production return to life," with happiness, dignity, ecological balance rate as ultimate appeals. Multiplication advantages: Unlike GDP's "addition," GDE assesses marginal cost and efficiency balance: high efficiency (such as innovation, management, cultural force) multiplies value amplification; high energy consumption (such as overinvestment, dumping) punishes the whole. The calculation framework requires multidisciplinary research (such as economics, physics, biology), forming six asset balance sheets (natural, family, community, society, government, enterprise), operability achieved through energy conversion balance sheets. No "garbage" or "negative energy"—humans self-regulate cycles like nature. Fit with ecological civilization: GDE "E" at the beginning, encompassing "ecology" "dynamic" "dynamics," embodying the three-dimensional leap of "state" (business state, mindset, life state). Multiplication thinking solves three limits (growth, confrontation, manipulation) and three traps (pan-middle income, pan-industrialization, urbanization), shifting from mutual harm to symbiosis.

Addition vs Multiplication: Mirror and Way Out for China's Reality

In the context of exchange rate manipulation and GDP overtaking, addition thinking amplifies short-term "gains": national strategy, low human rights advantages, wolf warrior diplomacy, economic weaponization effectively deal with Western rules, but long-term no value—structural imbalances delay reform, masking urgency (such as putting down ideological illusions, letting "People's Republic" live up to its name). If continued, it will likely regress to the abyss of forty years ago: excess capacity, people's debts, social unrest. The GDE of multiplication thinking provides an upgrade path: end manipulation, return to market, introduce "production-exchange-life" mode. The end of the text emphasizes that GDE is not simple statistical realization, but norms economic structure, avoiding interest group relocation. It requires multidisciplinary teams (at least three months of brainstorming) and funding support, becoming international consensus and responsible government guide. As discussed seventeen years ago with Mr. Zhao Qizheng, this framework is time to become international consensus! One sentence: GDP "adds" quantity myth, GDE "multiplies" life value symbiosis. Choosing multiplication can avoid the trap of misfortune and fortune depending on each other.

|