【古风按】Kyle Bass 前不久在2012年AmerCatalyst会议的主题演讲(http://youtu.be/JUc8-GUC1hY)里说出了如下的话:

We sit today at the world's largest peacetime accumulation of debt in world history…

…You know how this ends right?

This ends through war…

…I don't know who's going to fight who, but I'm fairly certain in the next few years you will see wars erupt, and not just small ones…

在2011年12月29日岁末的一篇有关中国北斗资讯的最后,古风留下了如下的按语: 2011年的确是个值得大书特书的一年。在西方一片衰败情景中,中国继续保持着高速发展的健康势头。中国的北斗赶在这个岁末开始了试运行,瞄准的其实不是什么商业上的效益,而是对美国竖起了金箍棒,明确地昭示:处于经济崩溃边缘的美国不要把战争的祸水引入中国周遭的亚洲区域。如果发生中美间的直接或间接热战,美国现在与中国基本上处于同一技术水平之上,到时候美国及其喽啰们就会吃不了兜着走了。在另一方面,中国开始北斗的试运行正好跟北韩的领袖金正日逝世、日本的新任首相野田佳彦访华、美国大力颠覆叙利亚、伊朗与俄国,美国大张旗鼓推动TPP,美国高调屯兵澳大利亚,美欧债务危机进一步恶化,欧元濒临瓦解,美国预算再陷僵局,美欧经济毫无起色,西方平民示威暴乱日益严重等诸多重大国际事件都凑到了一起,这难道仅仅是个巧合吗?如果仔细把握世界局势的脉络,就会发现人类历史基本上沿着如下的剧本在演绎:一强称霸→经济军事竞争→列强争霸→货币战争→贸易战争→肉体战争→热战决出新霸主→新的轮回开始。自从2007/08年西方爆发金融危机以来,整整4年过去了,整个世界于2010年进入了全球货币战争的阶段,现在已经处于全球贸易战争的临界点,2012年将是人类走向长久和平还是第三次世界大战的关键一年。中国赶在2011年末把北斗投入试运行、在2012年底让北斗达到美国GPS同样的精度,的确不是仅仅在从事民用商业竞争而已。在2011年岁末,古风许下新年愿望:祈祷中国在军事与经济上能够继续快速发展,彻底打消西方非和平势力的战争图谋,给全世界人民带来和平繁荣! 到2012年4月22日,在一篇介绍和总结《时轮》的短文中,古风留下了如下的文字: 对于大家理解现在和未来15-20年将要发生的一切都会大有助益。比如,当您读到《时轮三部曲》的第三部末尾时就会看到文章的作者预计:在未来的15年内中美间会爆发世界大战。再比如《时轮三部曲》的第一部和前传都明确地说明:自从2008年以来,美国已经进入时轮的第四个阶段——全面危机。从1773年以来,美国已经经历过了三次“全面危机”,每一次全面危机都伴随着整个社会的全面战争: American Revolution (1773–1794),美国独立战争

Civil War (1860–1865),美国南北内战(统一战争)

Great Depression & World War II (1929–1946),大萧条及二战

Millenial Crisis (2008–????),中美间的全面战争或美国分裂战争(后者为古风个人预言) 如果中国在习李十年后的下一代最高领导层没有足够的智慧与忍辱力,中美间的全面战争就极有可能在10-15年内发生;如果中国的最高领导层不陪着美国一同毁灭,那么美国国内就会发生自毁的分裂战争。第一种选择将是整个人类文明的末日,第二种选择将是美联邦的谢幕show。可是,不论哪一种结局在美国的华人都完了。网友们要记住二战时日裔美国人和犹太裔德国人的遭遇哦。 同时,古风个人预计5年内,金融超级炸弹(那700万亿的衍生坏账)就会被引爆了。 最后,古风祝愿各位网友能够成功度过这一面临整个人类文明的劫难! 古风在2012年10月21日给网友“mzl9876”的回复中写到: 在下估计:不到亡国,中国绝不会跟日本开战;即便日本人登(钓鱼)岛,中国也不会打起来。现在还不是打的时候,就如同快开的水,虽然很响,可是还没有到最后即将爆开的阶段(水真要开之前的一段极短的时间,水会突然由很响变得不响了)。您回去现煮一壶水,看看在下描述得是否准确。哈哈……

在战略上讲,现在开战,就让美、日、欧有了共同的敌人,那么他们就会合力对中国落井下石,甚至连俄国都靠不住。中国目前最好就是舆论上讨伐、军事上演习、战备上快马加鞭、经济上完成产业转移和升级。只要再忍个五年,打或不打都成世界霸主了。

古风在2012年10月29日给网友“mzl9876”的回复中写到:

预计习上台后,会大力推动官员的财产公开制度,打击贪腐现象,同时也会加大缓和贫富差距的力度。中国的下一个5年将会逐渐走上和谐之路,为10年后稳健地成为全球霸主打下坚实的基础。

http://www.shtfplan.com/headline-news/they-are-getting-ready-no-obvious-reason-for-why-chinese-rice-stockpiles-jumped-400-massive-boosts-in-dry-milk-iron-ore-precious-metals-imports_01092013 China is Getting Ready for the Incoming World War

by Mac Slavo, SHTFplan.com, 9 January 2013 If there were ever a sign that something is amiss, this may very well be it. United Nations agricultural experts are reporting confusion, after figures show that China imported 2.6 million tons of rice in 2012, substantially more than a four-fold increase over the 575,000 tons imported in 2011. The confusion stems from the fact that there is no obvious reason for vastly increased imports, since there has been no rice shortage in China. The speculation is that Chinese importers are taking advantage of low international prices, but all that means is that China’s own vast supplies of domestically grown rice are being stockpiled. Why would China suddenly be stockpiling millions of tons of rice for no apparent reason? Perhaps it’s related to China’s aggressive military buildup and war preparations in the Pacific and in central Asia. If a 400% year-over-year increase in rice stockpiles isn’t enough to convince you the Chinese are preparing for a significant near-term event, consider that in Australia the country’s two major baby formula distributors have reported they are unable to keep up with demand for their dry milk formula products. Grocery stores throughout the country have been left empty of the essential infant staple as a result of bulk exports by the Chinese. A surge in sales of one of Australia’s most popular brands of infant formula has led to an unusual sight for this wealthy nation: barren shelves in the baby aisle and even rationing of baby food in some leading retail outlets. We’d be more apt to believe the Chinese were panic-buying baby formula had the Chinese milk scandal occurred recently. The problem is that it happened four years ago. Are we to believe the Chinese are just now realizing their baby food may be tainted? In addition to the apparent build-up in food stocks, the Chinese are further diversifying their cash assets (denominated in US Dollars) into physical goods. In fact, in just a single month in 2012, the Chinese imported and stockpiled more gold than the entirety of the gold stored in the vaults of the European Central Bank (and did we mention they did this in one month?). Their precious metals stockpiles have grown so quickly in recent years that Chinese official holdings remain a complete mystery to Western governments and it’s rumored that the People’s Republic may now be the second largest gold hoarding nation in the world, behind the United States. We won’t know for sure until the official disclosure which will come when China is ready and not a moment earlier, but at the current run-rate of accumulation which is just shy of 1,000 tons per year, it is certainly within the realm of possibilities that China is now the second largest holder of gold in the world, surpassing Germany’s 3,395 tons and second only to the US. But the Chinese aren’t just buying precious metals. They’re rapidly acquiring industrial metals as well. Spot iron prices are up to an almost 15-month high at $153.90 per tonne. The rally in prices, which started in December 2012, is mainly due to China’s rebuilding of its stockpiles as the Asian giant gears to boost its economy, which in turn, could improve steel demand. The official explanation, that China is preparing stockpiles in anticipation of an economic recovery, is quite amusing considering that just 8 months ago Reuters reported that China had an oversupply, so much so that their storage facilities had run out of room to store all the inventory! When metals warehouses in top consumer China are so full that workers start stockpiling iron ore in granaries and copper in car parks, you know the global economy could be in trouble. At Qingdao Port, home to one of China’s largest iron ore terminals, hundreds of mounds of iron ore, each as tall as a three-storey building, spill over into an area signposted “grains storage” and almost to the street. Further south, some bonded warehouses in Shanghai are using carparks to store swollen copper stockpiles – another unusual phenomenon that bodes ill for global metal prices and raises questions about China’s ability to sustain its economic growth as the rest of the world falters. Now, why would China be stockpiling even more iron (and setting 15 month price highs in the process) if they had massive amounts of excess inventory just last year? Something tells us this has nothing to do with an economic recovery, or even economic theory in terms of popular mainstream analysis. Why does China need four times as much rice year-over-year? Why purchase more iron when you already have a huge surplus? Why buy gold when, as Federal Reserve Chairmen Ben Bernanke suggests, it is not real money? Why build massive cities capable of housing a million or more people, and then keep them empty? It doesn’t add up. None of it makes any sense. Unless the Chinese know something we haven’t been made privy to. Is it possible, in a world where hundreds of trillions of dollars are owed, where the United States indirectly controls most of the globe’s oil reserves, and where super powers have built tens of thousands of nuclear weapons and spent hundreds of billions on weapons of war (real ones, not those pesky semi-automatic assault rifles), that the Chinese expect things to take a turn for the worse in the near future? The Chinese are buying physical assets – and not just representations of those assets in the form of paper receipts – but the actual physical commodities. And they are storing them in-country. Perhaps they’ve determined that U.S. and European debt are a losing proposition and it’s only a matter of time before the financial, economic and monetary systems of the West undergo a complete collapse. At best, what these signs indicate is that the People’s Republic of China is expecting the value of currencies ( they have trillions in Western currency reserves) will deteriorate with respect to physical commodities. They are stocking up ahead of the carnage and buying what they can before their savings are hyper-inflated away. At worst, they may very well be getting ready for what geopolitical analyst Joel Skousen warned of in his documentary Strategic Relocation, where he argued that some time in the next decade the Chinese and Russians may team up against the United States in a thermo-nuclear showdown. Hard to believe? Maybe. But consider that China is taking measures now, in addition to their stockpiling, that suggest we are already in the opening salvos of World War III. They have already taken steps to map our entire national grid – that includes water, power, refining, commerce and transportation infrastructure. They’re directly involved in hacking government and commercial networks and are responsible for what has been called the greatest transfer of wealth in the history of the world. Militarily, the PRC has been developing technology like EMP weapons systems, capable of disabling our military fleets and the electrical infrastructure of the country as a whole, and has been caught red-handed manufacturing fake computer chips used in U.S. Navy weapons systems. If you still doubt China’s intentions and expectations, look to other governments, including our own, for signs that someone, somewhere is planning for horrific worst-case scenarios: Perhaps there’s a reason why former Congressman Roscoe Bartlett has warned, “those who can, should move their families out of the city.” As Kyle Bass noted in a recent speech, “it’s just a question of when will this unravel and how will it unravel.” Given how similar events have played out in history, we think you know how this ends. It ends through war. Governments around the world are stockpiling food, supplies, precious metals and arms, suggesting that there is foreknowledge of an impending event. Should we be doing the same?

http://www.washingtonsblog.com/2013/01/the-war-on-terror-spreads-to-africa-u-s-sending-troops-to-35-african-nations.html In Africa US is Already Fighting with China

by Washington’s Blog, 12 January 2013 America Sets Its Sights On Controlling African Resources … And Reducing Chinese Influence The U.S. is sending troops to 35 African nations under the guise of fighting Al Qaeda and related terrorists. Democracy Now notes: U.S. Army teams will be deploying to as many as 35 African countries early next year for training programs and other operations as part of an increased Pentagon role in Africa. The move would see small teams of U.S. troops dispatched to countries with groups allegedly linked to al-Qaeda, such as Libya, Sudan, Algeria and Niger. The teams are from a U.S. brigade that has the capability to use drones for military operations in Africa if granted permission. The deployment could also potentially lay the groundwork for future U.S. military intervention in Africa. NPR reports: [A special American brigade] will be able to take part in nearly 100 separate training and military exercises next year, in nearly three dozen African countries Glenn Ford writes: The 2nd Brigade is scheduled to hold more than 100 military exercises in 35 countries, most of which have no al-Qaida presence. So, although there is no doubt that the U.S. will be deeply involved in the impending military operation in Mali, the 2nd Brigade’s deployment is a much larger assignment, aimed at making all of Africa a theater of U.S. military operations. The situation in Mali is simply a convenient, after-the-fact rationale for a long-planned expansion of the U.S. military footprint in Africa. Timothy Alexander Guzman argues: AFRICOM’s [the U.S. military's Africa command] goal is to eliminate China and other countries influence in the region. Africa’s natural resources is another important element to consider because it includes oil, diamonds, copper, gold, iron, cobalt, uranium, bauxite, silver, petroleum, certain woods and tropical fruits. In a must-watch interview, Dan Collins of the China Money Report agrees that the purpose of the deployment is to challenge China’s rising prominence in Africa:

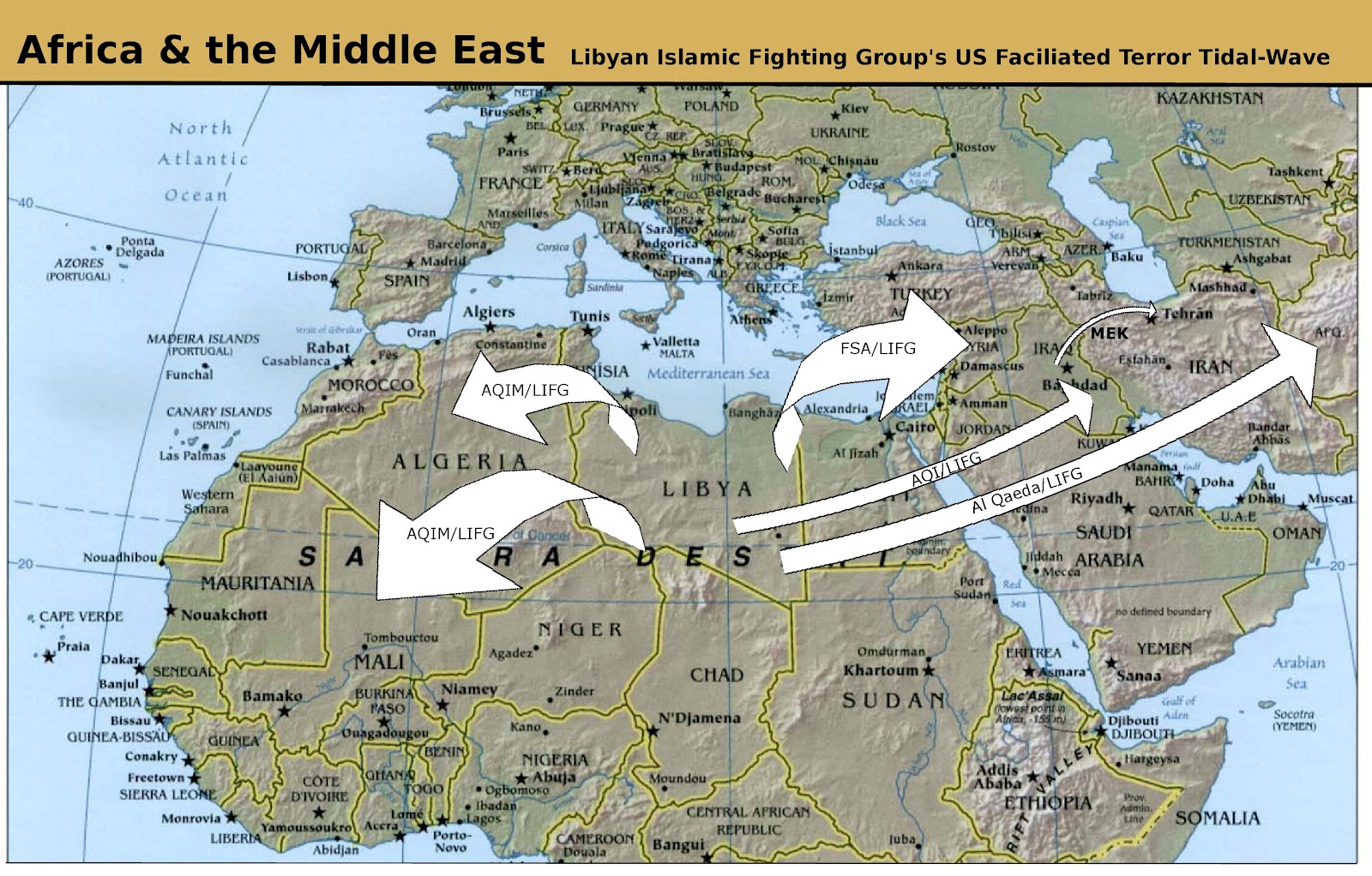

(Indeed, the U.S. considers economic rivalry to be a basis for war). In reality – as we’ve repeatedly noted – the U.S. sends in the military to fight “terrorists” in any country which has resources we want (and see this). And the U.S. is not shy about backing our “mortal enemies” to topple those standing between us and resources we pine for. Anthony Carlucci argues that the overthrow of Gaddafi (largely through American support of terrorists) was really the opening salvo in the war for African resources:

http://www.zerohedge.com/news/2013-01-10/chart-day-chinese-november-gold-imports-soar-91-tons-2012-total-720-tons Chinese November Gold Imports Soar To 91 Tons; 2012 Total 720 Tons

by Tyler Durden, Zero Hedge, 10 January 2013 Regular readers are familiar with our monthly series showing the inexorable surge in Chinese gold imports. It is time for the November update, and it's a doozy: at 90.8 tons, this was the second highest gross import number of 2012, double the 47 tons imported in October (which many saw, incorrectly, as an indication of China's waning interest in the yellow metal), and brings the Year to Date total to a massive 720 tons of gold through November. If last year is any indication, the December total will be roughly the same amount, and will bring the total 2012 import amount to over 800 tons, double the 392.6 tons imported in 2011.

Indicatively, should the full year total import number indeed print in the 800 tons range, it will mean that in one year China, whose official reserve holdings are still a negligible 1054 (and realistically at least double, if not triple, this number), will have imported more gold than the official holdings of Japan, last pegged at 765.2 tons (and well more than the ECB's 502.1 tons).

Finally, putting the November import number in context, so far in 2012 China has bought some $39 billion worth of gold. How many US Treasurys has China bought in the same time period? Under $10 billion. Finally, let's not forget that recently China surpassed South Africa as the world's biggest producer of gold with annual output in the hundreds of tons. Add the net imports number to this total (which amounted to some 281 tons in 2012 according to Bloomberg) and one can get a sense of how big China's appetite for hard assets, instead of trillion dollar coin-backed "promises of repayment", has become.

http://www.paulcraigroberts.org/2013/01/07/washingtons-hegemonic-ambitions-are-not-in-sync-with-its-faltering-economy-paul-craig-roberts/ Washington’s Hegemonic Ambitions Are Not in Sync With Its Faltering Economy

by Paul Craig Roberts, 7 January 2013 In November the largest chunk of new jobs came from retail and wholesale trade. Businesses gearing up for Christmas sales added 65,700 jobs or 45% of November’s 146,000 jobs gain. With December sales a disappointment, these jobs are likely to reverse when the January payroll jobs report comes out in February. Family Dollar Stores CEO Howard Levine told analysts that his company’s customers were unable to afford toys this holiday season and focused instead on basic needs such as food. Levine said that his customers “clearly don’t have as much for discretionary purchases as they once did.” For December’s new jobs we return to the old standbys: health care and social assistance and waitresses and bartenders. These four classifications accounted for 93,000 of December’s new jobs, 60% of the 155,000 jobs. Obviously, the economy is not going anywhere except down. It takes approximately 150,000 new jobs each month to stay even with population growth and new entrants into the work force. Few of the jobs that are being created pay well, and the constant, consistent demand for more poorly paid waitresses, bartenders and hospital orderlies is difficult to believe. If Americans cannot afford toys for their kid’s Christmas, how can they afford to eat and drink out? Media spin seeks to create a recovery out of thin air, but these graphs from John Williams (shadowstats.com) show the reality:

Keep in mind that the 7.8% unemployment rate (U.3) that is headlined by the financial media does not include discouraged workers who have ceased to look for jobs. The government’s U.6 rate includes workers who have been too discouraged to seek work for less than a year. This rate of unemployment is 14.4%, almost twice the U.3 rate that the media prefers to report. In 1994 the US government defined out of existence unemployed Americans who have been discouraged from finding work for more than a year. John Williams estimates the long term discouraged workers. When his estimate is added to the U.6 measure, the US unemployment rate stands at 23%, three times the reported rate. The rate of unemployment is so high because millions of US jobs have been offshored and given to Chinese, Indian, and other workers and because remaining businesses have been concentrated in few hands in violation of the anti-trust laws. (Go to this URL to see the concentration of the media: http://frugaldad.com/2011/11/22/media-consolidation-infographic/ ) We need to be concerned about a financial media and economics profession that believes a recovery is underway when the unemployment rate is so high and the real median income is so low. It is a mystery how any set of policymakers could possibly have believed that a country whose economy is driven by consumer expenditures can continue to expand when the jobs that produce the incomes that drive the economy are given to foreigners in foreign lands. Essentially, Americans were told a packet of lies designed to win their gullible acceptance to an economy that produces high returns for Wall Street, shareholders, and corporate executives at the expense of everyone else in the country. The wage savings from the use of overseas labor means large rewards for the one percent and Family Dollar customers who cannot afford to buy toys for their children at Christmas.

http://www.economist.com/blogs/graphicdetail/2013/01/daily-chart-7 (US's) Unhealthy Outcomes

by Economist.com, 11 January 2013 America fares badly in a comparison of health measures in rich countries

IT IS hardly news that America spends more on health care than any other country. Nor is it news that this money fails to make Americans healthy. But a new report from America’s Institute of Medicine and National Research Council illuminates the many ways in which America’s health lags that of other rich countries and tries to explain why. Health spending reached $2.7 trillion in 2011, equal to 17.9% of America’s GDP (and more than the entire GDP of Britain). Yet America performs poorly on nearly every measure. Life expectancy has risen, but not as quickly as among America’s peers. In a ranking of 17 rich countries, America’s death rate from non-communicable diseases is higher than any country except Denmark. The statistics are particularly bleak for the young. America has the highest infant-mortality rate of the 17 rich countries examined. Its teenagers are more likely to become pregnant or die from a car accident or violence. Shockingly, deaths among under-50s account for roughly two-thirds of the gap in life expectancy between American men and those in comparable countries. The old fare better. If an American is lucky enough to reach 75, he can expect to live longer than his peers elsewhere. America is obviously doing something wrong. But what, exactly? That is the $2.7 trillion question. The report offers a few tentative answers. The structure of America’s health system is partly to blame. Different types of care are siloed, which is inefficient. Doctors are paid for providing lots of services, rather than keeping patients well. There are fewer general practitioners. More citizens lack insurance and more find care unaffordable. The gap might also be explained by behaviour. Americans may smoke and drink less than people in other countries, but they tend to eat more, take more drugs, own more guns and are more often in drunk-driving accidents. They have sex younger, with more partners, using protection less frequently. But circumstance and behaviour cannot explain all. Interestingly, even rich, insured, non-smoking, normal-weight Americans are less healthy than adults with similar traits in similar countries. How all these factors relate to one another is difficult to untangle. Even harder is getting politicians to agree on which problem to tackle first. Barack Obama’s health reforms, which will take full effect in 2014, expand insurance and start to tweak doctors’ perverse incentives. This new report is a reminder of how much is left to be done.

|