alternatively cleptocracy or kleptarchy,

(from Greek: κλέπτης - kleptēs, "thief"[1] and

κράτος - kratos, "power, rule",[2] hence "rule by

thieves") is a form of political and government

corruption where the government exists to

increase the personal wealth and political power of

its officials and the ruling class at the expense of

the wider population, often with pretense of honest

service. This type of government corruption is

often achieved by the embezzlement of state funds.

盗 贼 统 治

(英语:Kleptocracy)源自于希腊文字根,希腊语:

κλέπτης(kleptēs)意思是盗贼,希腊语:

κράτος(kratos)意思是权力与统治。合并起来,

代表它是由一群盗贼来统治人民。

盗贼统治通常出现在威权主义政府中,

特别是独裁专政、寡头统治以及军事统治的政府中。

The Chinese Kleptocracy Is Like Nothing

In Human History

中国当前的盗贼统治 人类史上绝无仅有

JOHN HEMPTON, BRONTE CAPITAL JUN. 10, 2012, 8:45 AM

中国盗贼统治的规模,在人类历史上绝无仅有。本篇旨在解释这波盗窃是如何在经济上运作的,如何得以维持,以及怎样才能杜绝这种现象。我采访了几位中国专家,不过,文章是由我合成的。有些受访人不希望自己的谈话被引用。

中国盗贼统治对宏观经济的影响,以及欧洲的巨大固定汇率危机是目前全球经济的主要宏观经济的推手。

中国是盗贼统治

我的分析始于中国是一个由盗贼统治的国家。这是一个很大胆的断言,但我要这样断言。我认识的那些与中共及其中共权贵子女打交道的人认可我这一说法。我的个人经历包括以下几点:

1)中共中央委员会的子女和亲属在美国的股票欺诈风波中是受益者。

2)(中国当局)对美国和香港的股票欺诈的反应不是去打击股票欺诈的罪犯(以便让市场更好的运作),而是让中国的法定账面更难获取,使得检查股票欺诈更为困难。

3)当有直接证据显示在美国登记的(中国)帐号欺诈,而中共权贵家庭是受益人或管理人的时候,big 4 audit firm在清楚知道他们欺诈的情况下还是会签署帐目。那些审计师配合中国窃国大盗的利益。

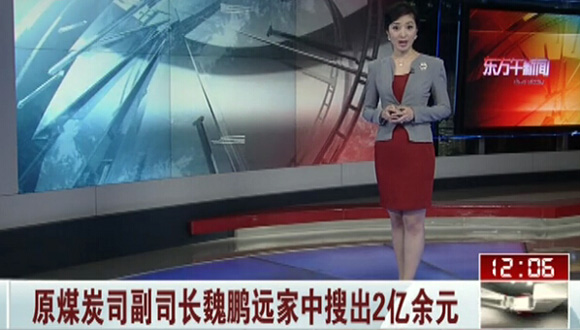

然而,这只是中国欺诈的开始。中国是一个黑手党国家,薄熙来只是最近被公开的一种(黑手党)的表现形式。如果你想找到关于中国盗贼统治的好的指南,包括薄熙来的犯罪,去看看John Garnaut在美国对中国研究所的讲话。

一胎化造成了高储蓄

由于中国的一胎化政策,一个人需要养四个祖父母。这就意味着老人指望不上后代养老。由于没有国家福利,老年人也没有福利可以养老。于是中国人就省 钱,不然老了没有保障。这使得存款水平有时达到GDP的50%。亚洲国家储蓄率一直很高,然而中国的储蓄率是其他亚洲国家的储蓄率的两倍,这是历史上最高 的储蓄率,主要原因是一胎化政策。

储蓄意味着负回报

中国低收入者和中产阶级的储蓄选项极其的少。由于国家控制资金,个人不能将钱转移海外,所以没有机会投资国外。而国内的投资市场又是不可想象的腐败。我曾经看过上海上市的很多中国股票,他们腐败的水平与在纽约上市的中国股票腐败水平接近。可以预见欺诈的发生。

银行储蓄利率是被控制的。银行储蓄利率通常在1%左右。人寿保险合同(巨大的储蓄机制)只是变相的银行储蓄,它比较有吸引力是因为利率略高。

这是一个糟糕的储蓄机制,因为通膨已经达到6%到8%之间(现在在下降中)。几乎所有的时间中,通膨都高–经常远远高于银行存款利率(或人寿保险合同利率)。

换句话说,银行账户的实际收益一直是负数,有时候是很大的负回报。

你可能会问,为什么回报是大大的负数的情况下,人们还要储蓄呢?因为人们需要面对老的时候没有所养的问题。不仅如此,因为潜在的经济增长,存款的数量逐年增加。存款的负收益和银行存款数量的增加这组矛盾驱动着惊人数量的全球经济,让中国国内国外的很多事情看起来合乎情理。

中国的房地产也是一种储蓄机制

中国人没有多少储蓄机制。主要的储蓄机制(银行存款,人寿保险合同)的收益一直都是大大的负数。

除此之外,房地产也是一个。

银行储蓄有时负回报高达5%。如果房地产的负回报率是1%,也比那强。如果将来你可以卖得掉,买个空的公寓房闲着也不错。

银行储蓄负回报和中国的盗贼统治

不过,大多数中国人并没有投资房地产,储蓄还是主要的存钱手段。中国的银行是人类历史上最赚钱的储蓄业务了。他们可以借巨额资金,只需支付负回报。

而这些储蓄大多都借给了国有企业。

这些国有企业是中国盗贼统治的中心环节。如果你能爬到中共的高层,玩政治玩的好,你可能当上国企的高管。这让你有机会搜括到人类历史上前所未有规模的钱财。

如果你想要向中国的国企销售东西(例如高端铁路控制设备),你不直接卖给国企,而是卖给中间公司。从西方的角度来看,只是多付了几个百分点。从中方的角度,这是搜刮的一种简单方法。

这不是抢掠的唯一方法。他们用各种方法抢劫国有企业。

一个正常的商业运作,尤其是被官僚机构运行的大型国企,在如此规模的抢掠下会垮掉。但这里的关键是:中国的国有企业的(贷款)资金来源,是负利率。

一个公司,即便是经营不善的公司,如果很大,并且资金来源是负利率,也可以禁得住很多的抢劫。

这些负利率只能在国家控制的银行用极低利息获取大量银行存款的基础上才有可能实现。

中国资金是负成本

中国政府(银行是政府的一部分)用负的实际成本,掌控着看起来无限多的银行储蓄。

当你拥有负成本的大量资金,很多看起来很愚蠢的投资,忽然之间看起来就是明智的了。美国的国库券看起来也不错。不要以为中国当局会停止持有美国国库券。从美国国库券得到的收益远远高于中国当局支付农民的。持有低回报率的美国证券,让中国当局还是赚了。

对中国权贵们的金钱威胁

中国的盗贼统治,还有全球经济的几个主要趋势,都依靠着低收入和中等收入的中国人提供的实际回报率为负数的大量存款。

这个盗贼统治系统(要维系)有两个主要的威胁,一个被广泛讨论,一个没怎么讨论。

人们都知道通货膨胀(被广泛讨论)造成了中国的骚乱和示威,被西方人视为是对中共当局的坏消息。中国人有很好的理由因为通货膨胀而闹事,因为那些为了养老而存钱的穷人,他们的存款被通货膨胀抢走了。

但从根本上讲,中国当局喜欢通货膨胀,这是确保他们的偷盗行为能有资金来源的方法。

更严重的危险是通货紧缩,或即使通货膨胀率降到1-3%,也足以构成威胁。如果通货膨胀率太低,那么国有企业–中国盗贼统治的中心–就弄不到足 够的资金来维持抢劫的水平。这些企业可以在资金利率为负5%的情况下还能维持被抢劫。但正的资金利率,就是完全不一样的结局了。

对中国的权贵来说,真正的危险是通货膨胀率降低,低到非常接近1-3%的范围。

中国通货膨胀率低意味着中国低收入和中等收入的人的存款回报更合理。这可能对农民也是好消息。

但经济增长成果分配比例的改变会摧毁中国的权贵(这个权贵系统依靠特有财产和分配不公来支撑)。国有企业也不再能够支付正的回报来维持财富的重新分配。农民需要从国企那里拿到收入,而国企被盗窃的同时,就不会总有能力支付他们。

如果国企拿不出钱支付,那么银行也会陷入麻烦。

这都是因为通货膨胀率在下降。或许当局能够阻止其下降。中国的权贵们已经是中国通胀率高的既得利益集团。因此,如果他们不能阻止其下降,就很难控制后果。

除非当局维持通货膨胀率居高不下,否则可以预见革命就会到来。

民间狂传的超长段子集 —— 有必要重温

|

文章评论

|

|

|

|

|

作者:Pascal

|

|

留言时间:2014-11-30 03:12:02

|

|

|

|

哪的话啊,开博多日,牌楼上一直高悬 “ 自带干粮的境外野生五毛委委员 ” 的牌坊,简称 ———— 野生毛委员,以示与野生五毛党党员同志们的

区别。

这会儿,装满棒子渣贴饼子的褡裢,不还斜背在肩头 ?

|

|

|

|

|

作者:catcat

|

屏蔽该用户

|

留言时间:2014-11-30 10:23:49

|

|

|

|

|

作者:Pascal

|

|

留言时间:2014-11-30 11:49:03

|

|

|

|

有一个体会,如果短时间内一下子转帖 2、3、4、5、6 篇他山之石的文萃,后面的5篇,基本无人无暇御览。码字的、二传的、编纂的、夹叙夹议的、放箭的、围观的、拱火的、观棋不语的、娱乐至死的、不屑一阅的、关我鸟事的、大会不发言小会不发言XXX也不发言的、狂笑不止的、心静似水的、波澜不惊的、拍案而起的、痛心疾首的、怒不可遏的、为官不聊生请命的、靠拢组织的、黑白通吃的、拉偏手的、救场子的每一位官爷、款爷、侃爷和看官,都是日理万机,只瞥浮头儿的。万维网罗的博主们,高手云集,个个是爷和奶奶。你看江苏卫视孟非同志的昵称,一个爷字还不够他使的。

|

|

|

|

|

为把这开了头的评坛场子维持下去,不妨让这头篇多停留一些时辰。废话少表,直奔主题:

|

|

|

|

中国大陆版的99%屁民编造了上面哪些数字,惹得Catcat这位看官字字匕首、句句封喉范儿地

投射过来? 粗略一看,好像只有8年打鬼子这8个数字最乍眼,让浙江横店儿8年灭掉的 7、8亿

鬼子情何以堪 !

现如今,万事不用问他/她人,查查 Google 就是了:

夏雨婷 @cherylnatsu 17 Dec 2012

中流砥柱 RT @lin_lwy: 确实如此,日本人记录的很仔细,有名单@ssfy 中共百团大战击毙

日寇302人;平型关大捷167人;晋察冀1938年秋季反围攻39人;39年冀南春季反扫荡37人;

1939年冀中冬季反扫荡27人;1940年春季反扫荡11人;115师陆房突围16人

https://twitter.com/lin_lwy/status/277313998624534529

“ 编造数字的好手 ” 就这么简单明了地跳将出来,原来是女侠 ———— 夏雨婷

乡政府有言:不信谣、不传谣,政府的解释是唯一依据 !还是以体制内杰出代表 ————

现役少将毛新宇将军的指示为依据:二次大战全世界范围最重要的反法西斯武装力量有两支;

一支是斯大林同志统帅的苏联红军,另一支就是我爷爷领导的新四军、八路军!

|

|

|

|

|

Read more: http://www.businessinsider.com/how-the-chinese-kleptrocracy-works-2012-6#ixzz2sUjcfBS4

China is a kleptocracy of a scale never seen before in human history. This post aims to explain how this wave of theft is financed, what makes it sustainable and what will make it fail. There are several China experts I have chatted with – and many of the ideas are not original. The synthesis however is mine. Some sources do not want to be quoted.

The macroeconomic effects of the Chinese kleptocracy and the massive fixed-currency crisis in Europe are the dominant macroeconomic drivers of the global economy. As I am trying a comprehensive explanation for much of the world's economy in less that two thousand words I expect some kick-back.

China is a kleptocracy. Get used to it.

I start this analysis with China being a kleptocracy – a country ruled by thieves. That is a bold assertion – but I am going to have to assert it. People I know deep in the weeds (that is people who have to deal with the PRC and the children of the PRC elite) accept it. My personal experience is more limited but includes the following:

(a). The children and relatives of CPC Central Committee members are amongst the beneficiaries of the wave of stock fraud in the US,

(b). The response to the wave of stock fraud in the US and Hong Kong has not been to crack down on the perpetrators of the stock fraud (so to make markets work better). It has been to make Chinese statutory accounts less available to make it harder to detect stock fraud.

(c). When given direct evidence of fraudulent accounts in the US filed by a large company with CPC family members as beneficiaries or management a big 4 audit firm will (possibly at the risk to their global franchise) appear to sign the accounts knowing full well that they are fraudulent. The auditors (including and arguably especially the big four) are co-opted for the benefit of Chinese kleptocrats.

This however is only the beginning of Chinese fraud. China is a mafia state – and Bo Xilai is just a recent public manifestation. If you want a good guide to the Chinese kleptocracy – including the crimes of Bo Xilai well before they made the international press look at this speech by John Garnaut to the US China Institute.

China has huge underlying economic growth from moving peasants into the modern economy

Every economy that has moved peasants to an export-orientated manufacturing economy has had rapid economic growth. Great Britain industrialized at about 1 percent per annum. It was slow because all the technology needed to be invented for the first time. During the 19th Century US economic growth – once started – ran about twice the rate of the UK. They copied the technology which was faster than inventing it. Later economies (eg Japan, Malaysia, Thailand, Korea) went later and faster. As a general rule the later you industrialized the faster you went – as the ease of copying went up. In the globalized internet age copying foreign manufacturing techniques and seeking global markets is easier than ever – so China is growing faster than any prior economy.

This fast economic growth – which would happen in a more open economy – is creating the fuel for the Chinese kleptocracy.

The one-child policy drives massive savings rates

The other key fuel for kleptocracy is a copious supply of domestic savings to loot. The reason Chinese savings levels are so high is the one-child policy.

In most developing countries the way that people save is they have multiple children hopefully to generate a gaggle of grandchildren all of whom are trained to respect their elders. Given most people did not live to old age if you did you became a treasured (and well cared for) family member.

This does not work in China. Longevity in China is increasing rapidly and the one-child policy results in a grandchild potentially having four grandparents to look after. The “four grandparent policy” means the elderly cannot expect to be looked after in old age. Four grandparents, one grand-kid makes abandoning the old-folk looks easy and near certain.

Nor can the elderly rely on a welfare state to look after them. There is no welfare state.

So the Chinese save. Unless they save they will starve in old age. This has driven savings levels sometimes north of fifty percent of GDP. Asian savings rates have been high through all the key industrializations (Japan, Korea, Singapore etc). However Chinese savings rates are over double other Asian savings rates – this is the highest savings rate in history and the main cause is the one-child policy.

Low and middle income Chinese have very limited savings options

The Chinese lower income and middle class people have extremely limited savings options. There are capital controls and they cannot take their money out of the country. So they can't invest in any foreign assets.

Their local share market is unbelievably corrupt. I have looked at many Chinese stocks listed in Shanghai and corruption levels are similar to Chinese stocks listed in New York. Expect fraud.

What Chinese are left with is bank deposits, life insurance accounts and (maybe) apartments.

Bank deposits and life insurance as a savings mechanism in China

Bank deposits rates are regulated. You can't get much different from 1 percent in a bank deposit. Life insurance contracts (a huge savings mechanism) are just rebadged bank deposits – attractive because the regulated rate is slightly higher.

This is a lousy savings mechanism because inflation has been between 6 and 8 percent (but is now lower than that and is falling fast). At almost all times (except during the height of the GFC) the inflation rate has been higher – often substantially higher – than the regulated bank deposit (or life insurance contract) rate.

In other words real returns for bank accounts are consistently negative – sometimes sharply negative.

You might ask why people save with sharply negative returns. But then you are not facing starvation in your old age because of the “four grandparent policy”. Moreover because of the underlying economic growth (moving peasants into a manufacturing economy) there are increasing quantities of these savings every year. This is the critical point – the negative return to copious and increasing Chinese bank deposits drives a surprising amount of the global economy and makes sense of many things inside and outside China.

The Chinese property market as a savings mechanism

Chinese people have very few savings mechanisms. The major ones (bank deposits and their life-insurance contract twins) have sharp and consistently negative real returns.

Beyond that they have property.

Bank deposits have sometimes 5 percent negative returns. If you got 1 percent negative returns from property – well – you would be doing well. Buying an empty apartment and leaving it empty will do fine provided you can sell the property at some stage in the future.

It is commonplace amongst Western investors to view the see-through apartment buildings of China as insane. And they may be a poor use of capital. But from the perspective of the investors – well they look better than bank deposits.

Negative returns on bank deposits and the Chinese kleptocracy

Most Chinese savings however are not invested in see-through apartment buildings. Bank deposits still dominate. The Chinese banks are the finest deposit franchises in human history. They can borrow huge amounts at ex-ante negative real returns.

And those deposits are mostly lent to State Owned enterprises.

The SOEs are the center of the Chinese kleptocracy. If you manage your way up the Communist Party of China and you play your politics really well may wind up senior in some State Owned Enterprise. This is your opportunity to loot on a scale unprecedented in human history.

Us Westerners see the skimming arrangements. If you want to sell kit (say high-end railway control equipment) to the Chinese SOE you don't sell it to them. You sell it to an intermediate company who on-sell it in China. From the Western perspective you pay a few percent for access. From the Chinese perspective – this is just a gentle form of looting.

And it is not the only one. The SOEs are looted every way until Tuesday. The Business insider article on the spending at Harbin Pharmaceutical is just a start. The palace pictured in Business Insider would make Louis XIV of France (the Sun King) proud. This palace shows the scale (and maybe the lack of taste) of the Chinese kleptocracy.

A normal business – especially a State Owned dinosaur run by bureaucrats – would collapse under this scale of looting. But here is the key: the Chinese SOEs are financed at negative real rates.

A business – even a badly run business – can stand a lot of looting if it is (a) large and (b) funded at negative real rates.

Those negative real rates are only possibly because there are copious bank deposits available at negative real rates to State controlled banks.

The cost of funds in China and the willingness to hold foreign bonds

The Chinese Government (and the banks are part of the government even though they are listed) has access to seemingly unlimited bank deposits at negative real costs.

When you have copious funds at a negative cost a lot of investments that look stupid under some circumstances suddenly look sensible. US Treasuries look just fine. Don't think the Chinese are going to stop holding Treasuries. The Treasuries yield far more than they pay the peasants. The Chinese make a positive arbitrage on holding low rate US bonds.

Monetary threats to the Chinese establishment

The Chinese kleptocracy – and indeed several major trends in the global economy – depend on copious quantities of savings at negative expected rates of return by middle and lower income Chinese.

There are two core threats to this system – one widely discussed – one undiscussed.

Inflation (widely discussed) is known to produce riots and demonstrations in China – and is considered by Westerners to be bad news for the Chinese establishment. And there are good reasons why the Chinese riot with inflation – the poor who save because they are going to starve – get their savings taken away from them.

But ultimately the Chinese establishment like inflation – it is what enables their thievery to be financed.

The more serious threat is deflation – or even inflation at rates of 1-3 percent. If inflation is too low then the SOEs – the center of the Chinese kleptocratic establishment will not generate enough real profit to sustain the level of looting. These businesses can be looted at a negative real funding rate of 5 percent. A positive real funding rate - well that is a completely different story.

The real threat to the Chinese establishment is that the inflation rate is falling - getting very near to the 1-3 percent range.

Low Chinese inflation rates will mean reasonable returns on savings for Chinese lower and middle income savers. Good news for peasants perhaps.

But that changing division of the spoils of economic progress will destroy the Chinese establishment (an establishment that relies on a peculiar and arguably unfair division of the spoils). The SOEs will not be able to pay positive real returns to support that new division of spoils. The peasants can only receive positive real returns if the SOEs can pay them - and paying them is inconsistent with looting.

If the SOEs cannot pay then the banks are in deep trouble too.

All because the inflation rate is dropping. Maybe they can stop it dropping. The Chinese establishment has a vested interest in getting the inflation rate up in China. Because if they don't all hell will break loose.

Unless the Chinese can get the inflation rate up expect a revolution.

中共总书记习近平在2012年北戴河会议上曾警告,

中共当前面临内忧外患,

失尽民心,就像1948年的国民党。

On Wednesday, February 5, 2014 2:28 AM, George wrote:

近日不见你每日一发BULLETIN, 打电话找不到人。估计你已潜入大陆结党营私(因人在中国断了信息源,故再无BULLETIN)?

George

哪里哪里,人尚在,未远行;数日留白,

皆因心生顾虑,顾虑诸位看官亲们日复一

日,触目皆是,漫天轰炸,浸渍熏染,

难免滋生

审假疲劳、审实疲劳、审恶疲劳 ......

|