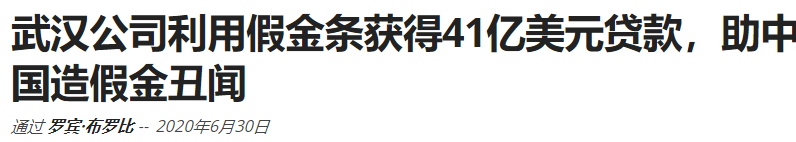

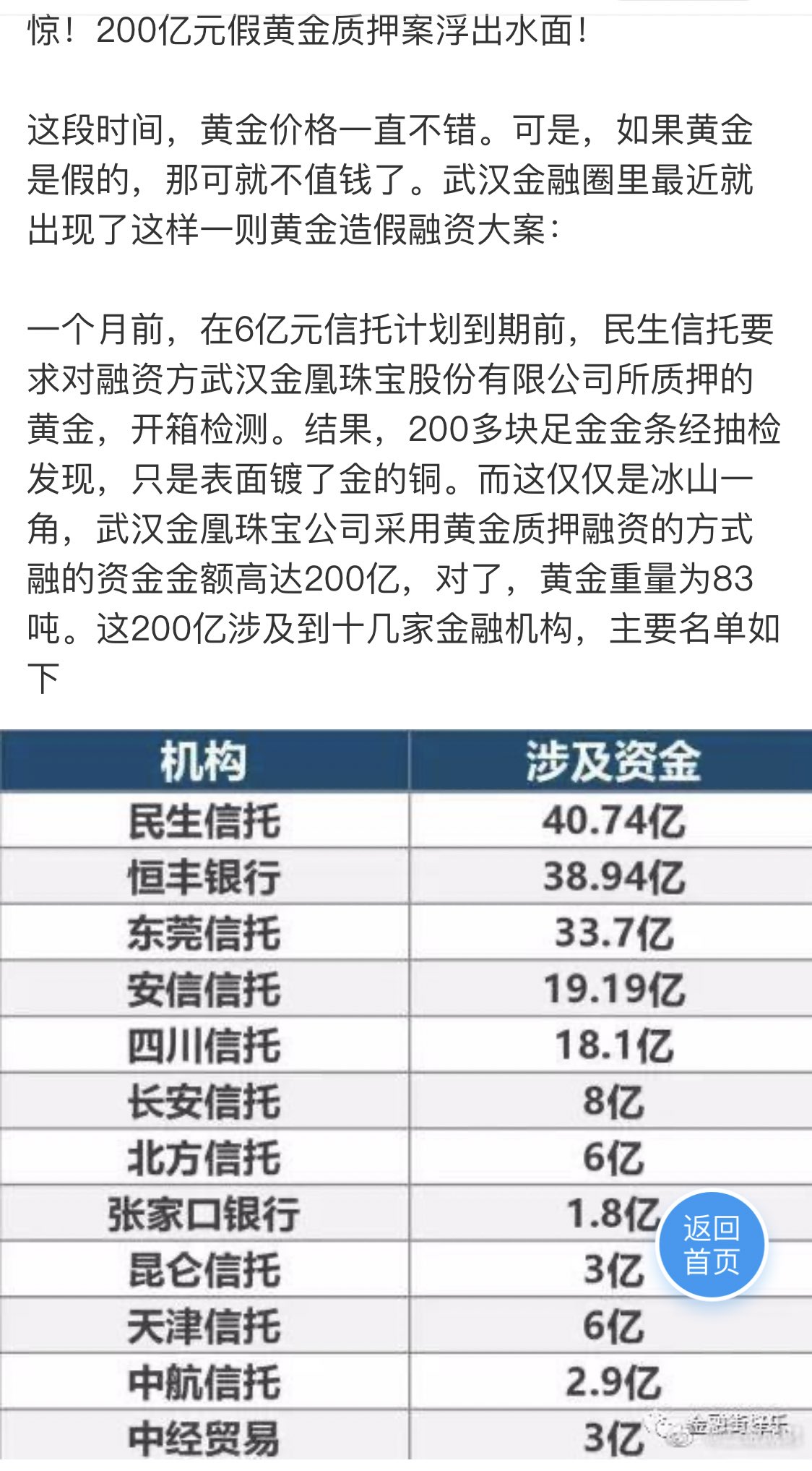

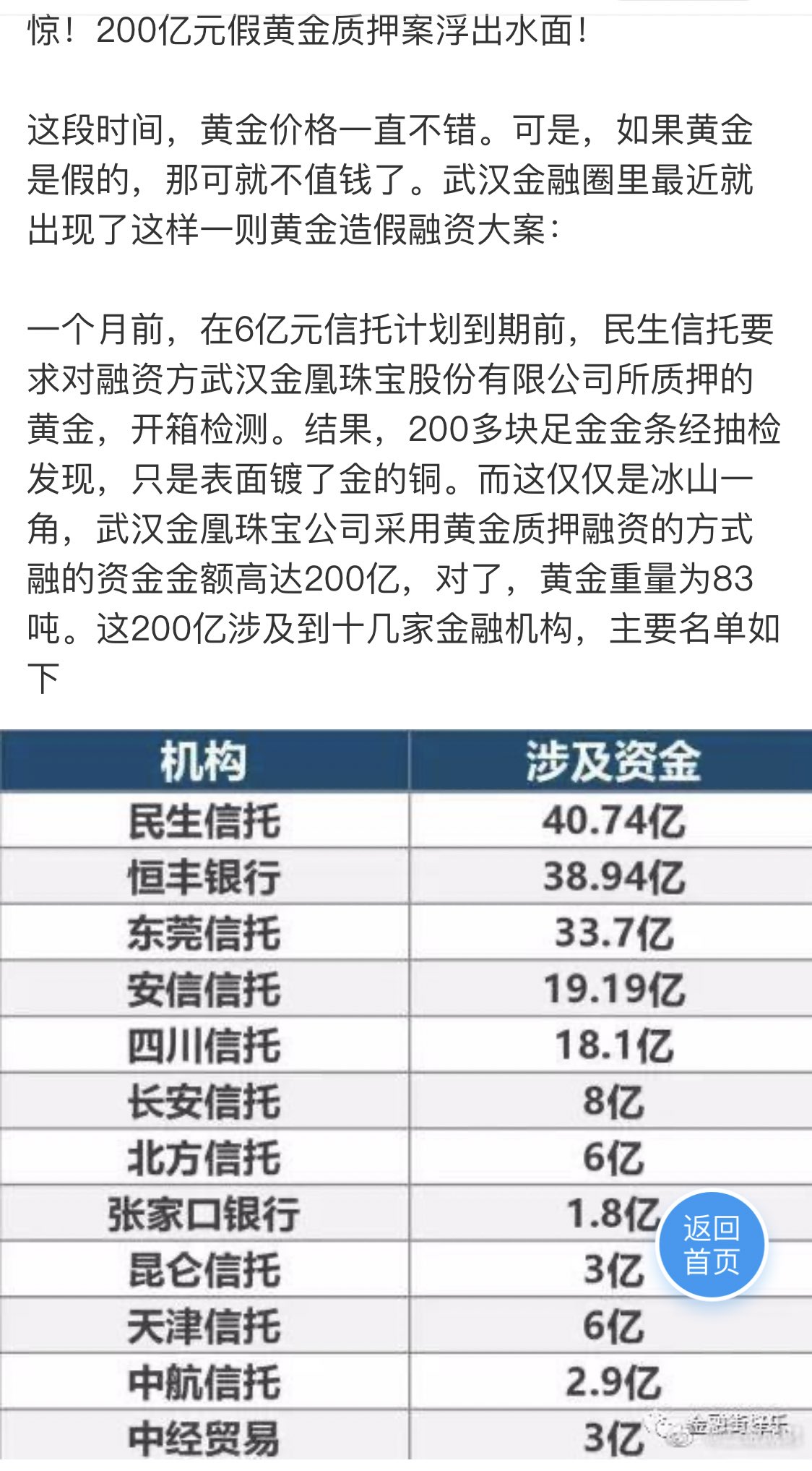

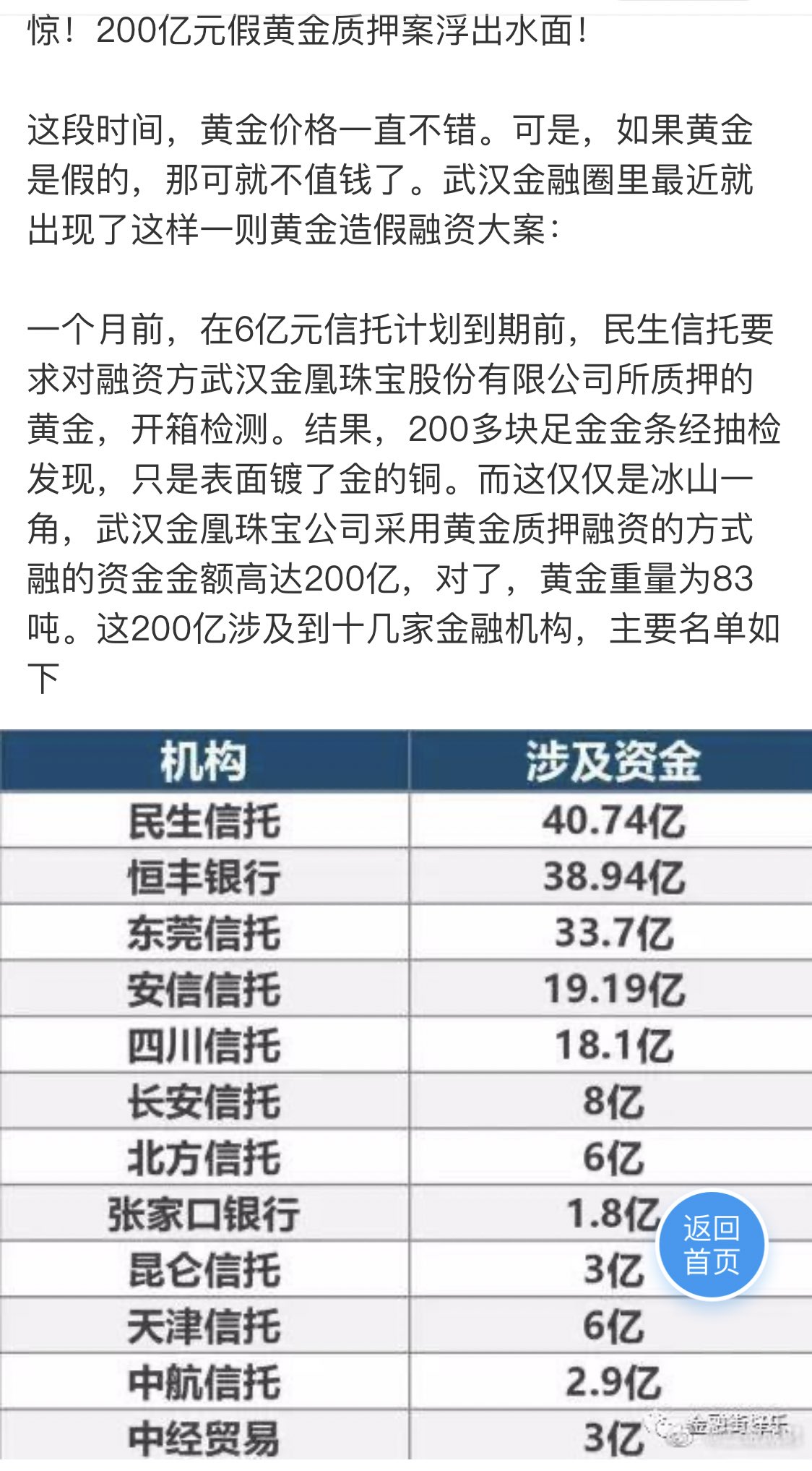

NASDAQ-listed Kingold Jewelry is being investigated over allegations it deposited fake gold bars as collateral for loans. NASDAQ-listed Kingold Jewelry is being investigated over allegations it deposited fake gold bars as collateral for loans.126SHARESFacebookTwitterLinkedInEmailPrint One of China’s largest gold jewellery manufacturers, Wuhan-based and NASDAQ-listed Kingold Jewelry, is being accused of depositing fake gold bars as collateral to obtain loans from 14 Chinese financial institutions. The 83 tonnes of gold were purportedly valued at 20.6 billion yuan (A$4.2 billion) but many of them have turned out to be gilded copper, according to reports from Beijing. Two New York law firms have already begun investigations into securities fraud on behalf of investors in Kingold Jewelry Inc (NASDAQ: KGJI). The story broke after a Beijing-based website investigated complaints and then posted the news under the headline: “The mystery of [US]$2 billion of loans backed by fake gold”. Kingold is denying it lodged fake bars with Chinese lenders such as China Minsheng Trust, Hengfeng Bank, Dongguan Trust and Bank of Zhangjiakou. The trust companies involved are largely what are known as “shadow banks”. Fake gold used as collateral after loan defaults在纳斯达克上市的金诺德珠宝公司(Kingold Jewelry)正在因指控其存放假金条作为贷款抵押而受到调查。126分享脸书推特领英电子邮件打印 中国最大的黄金珠宝生产商之一,总部位于武汉,在纳斯达克上市的金德珠宝,被指控存放假金条作为抵押品,以从14家中国金融机构获得贷款。 据北京报道,据称这83吨黄金的价值为206亿元人民币(42亿澳元),但其中许多竟然是镀金铜。 纽约的两家律师事务所已经开始代表Kingold Jewelry Inc(NASDAQ:KGJI)的投资者调查证券欺诈行为。 总部位于北京的网站调查了投诉之后,这个故事破裂了,然后在标题下发布了该消息:“ [20亿美元由假黄金支持的贷款之谜”。 金诺德否认它向中国民生信托,恒丰银行,东莞信托和张家口银行等中国放贷机构放假证。所涉及的信托公司主要是所谓的“影子银行”。 假黄金在贷款违约后用作抵押当金old拖欠东莞信托的贷款时,涉嫌的欺诈行为在今年早些时候曝光。抵押品保证金条被证明是镀金铜合金。民生信托的“金”条也被证明是镀金表面下的铜合金。  Kingold Jewelry获得了十几家公司的贷款。 Kingold Jewelry获得了十几家公司的贷款。

据报道,大部分借来的钱被用于投资中国的房地产泡沫,其中一些投资显然变质了。 Kingold收购了一家名为Tri-Ring的公司,该公司以部分借入的资金在武汉和深圳拥有土地。 军事支持帮助Kingold筹集资金金戈德的控股股东贾志宏被描述为“一个令人生畏的前军人”。 贾先生曾在武汉和广州服役,曾为中国人民解放军管理过金矿。Kingold最初是中国人民银行在武汉的一家黄金工厂。 关于这个突破性故事的评论认为,贾先生与中国强大的军队的联系意味着他可以做任何他想做的事,而不会提出任何问题。 实际上,一家国有保险公司承担了部分贷款,但受益人是金戈德,而不是贷方。 武汉金王是湖北省最大的黄金加工企业。 关于中国的黄金“硬资产”是否根本不存在的疑问已经提出。 这并不是同类丑闻中的第一个丑闻:2016年,作为陕西省19家贷方的抵押发行的“金”条也被证明是掺假的–在这种情况下,金条的核心由钨组成。 担心其他中国的黄金生产商和珠宝制造商也可能卷入类似的欺诈行为。 据悉,上海黄金交易所已经取消了金old的会员资格。 消息传出后,Kingold股价下跌23.77%,报0.85美元。 The alleged scam came to light earlier this year when Kingold defaulted on loans to Dongguan Trust. The gold bars pledged as collateral turned out to be gilded copper alloy. Minsheng Trust’s “gold” bars have also turned out to be copper alloy under the gilded surface.  Kingold Jewelry secured loans from over a dozen firms. Kingold Jewelry secured loans from over a dozen firms.

Much of the money borrowed was reportedly used to invest in China’s housing bubble, some of which investments obviously went sour. Kingold bought a company called Tri-Ring that owned blocks of land in Wuhan and Shenzhen with some of the borrowed money. Military backing helped Kingold raise moneyKingold’s controlling shareholder is Jia Zhihong, described as “an intimidating ex-military man”. Mr Jia, who has served in the military in Wuhan and Guangzhou, once managed gold mines for the People’s Liberation Army. Kingold was originally a gold factory in Wuhan affiliated with the People’s Bank of China. Commentaries on this breaking story argue that Mr Jia’s connections with China’s powerful army meant he could do anything he wanted, no questions asked. In fact, a state-owned insurer covered some of the loans — but with the beneficiary being Kingold, not the lenders. Wuhan Kingold is the largest gold processor in Hubei province. Questions are already being raised as to whether more of China’s “hard assets” of gold simply do not exist. This is not the first scandal of its kind: in 2016 “gold” bars issued as collateral to 19 lenders in the Shaanxi province also turned out to be adulterated – in that case, the core of the bars consisted of tungsten. Fears are that other Chinese gold producers and jewellery makers may also be involved in similar frauds. It is reported that the Shanghai Gold Exchange has cancelled Kingold’s membership. Shares in Kingold fell 23.77% overnight on the news to US$0.85.

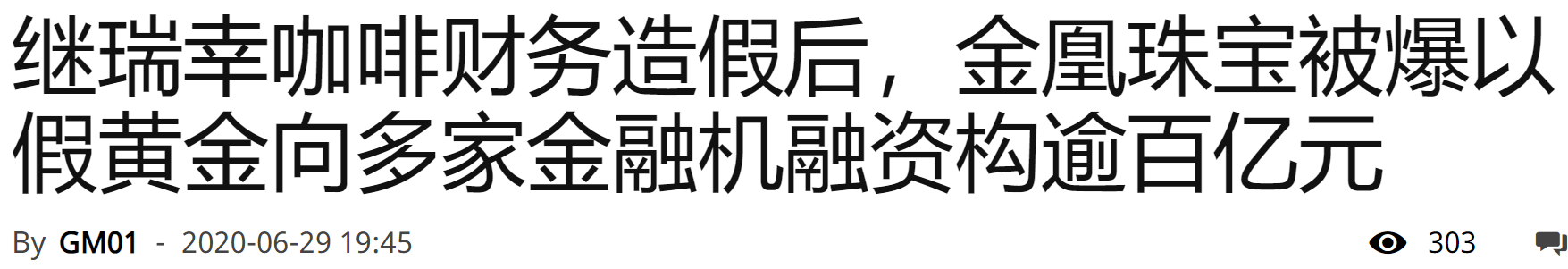

继瑞幸咖啡财务造假后,在美股那斯达克挂牌的中概股金凰珠宝,被爆出以假黄金,向多家金融机构质押人民币逾百亿融资,再传虚假爆雷。中国基金报报导,以设计、製造大型黄金首饰闻名,中国最大的黄金首饰製造商之一的金凰珠宝,向包括民生信託、东莞信託、安信信託、四川信託、长安信託等多家金融机构,质押了大量黄金融资。这些黄金都被存放在银行的保险箱,直到金凰珠宝因发生信託兑付危机,遭法院强制执行质押,结果开箱验金,检验发现竟然全是假黄金,令人傻眼。目前未到期融资额约人民币160亿元,对应质押黄金超过80吨。今年的黄金价格走势涨疯,但在黄金牛市行情之下,连中国大妈都解套了,为什麽金凰珠宝却用假黄金诈骗融资,成为被执行人?凤凰珠宝执行董事兼总经理贾志宏长袖善舞,有「股神」、资本圈「名角」、「珠宝大王」的封号,目前实控深交所挂牌的襄阳轴承和金凰珠宝两家上市公司。报导指出,金凰珠宝 从2016年到2019年约三年陆续向八家信託公司融资达人民币上百亿,而金凰珠宝信托融资主要用来挹注襄阳轴承的财务漏洞。只是金凰珠宝注金襄阳轴承,业绩并未得到好转,而2020年第1季就亏损人民币3200万元,终于爆发财务危机。 新闻链接:https://udn.com/news/story/7333/4667842

|