| 到了该买点苹果股票的时候了 苹果股票跌跌不休,到了今天这个价位,我觉得,是该买点的时候了。至于原因,下面的文章说了一些,还有一些没有说到的: · 很多分析师在下调股价,让人实在害怕。但是,如果你注意一下,就会发现,即使是下调,股票的目标价位,很多人也只是从800美元什么的下调到750美元,甚至是700美元。即使是在这个已经被降低了很多的价位,和现在的510美元相比,依然是高高在上。 · 担心苹果产品的利润率下降:因为,沃尔玛都开始搞促销了。这个理由你还是得深入分析才能够明白。沃尔玛这么做,是不是想借苹果的名气,搞点促销自己的商品,获得点甜头?这部分促销的开支,是不是由苹果来承担?还是有沃尔玛自己来承担?! · 平板电脑的市场机会有限:因为,价格“高高在上”的苹果平板电脑,很快就会因为没有价格优势而失去竞争力。这种看法有点不着边际:最近的观察我注意到,在沃尔玛销售的标价399.99美元的平板电脑,在75美元的沃尔玛credit之后(Target给的是50美元),你付出的实际价格325美元,已经和对手的300美元非常接近了。为了这个25美元的差价,我会会义无反顾的选择苹果的产品。我估计,很多消费者会有我类似的选择。而这个75美元的促销优惠,也很可能是沃尔玛自己掏的腰包。有人如此慷慨的掏腰包为你的产品搞促销,你的产品不畅销都很难。 · 苹果产品在中国市场因为没有中国移动的参与而很难成就大业。说这话的人是在用书呆子的逻辑,基于美国的做法来套中国的市场行情。中国人使用手机的方式,和在美国的,非常的不同,你仔细比较这种不同之后,就知道为什么离开一个“大佬级”的中国移动,对于苹果在中国市场的成功,实际上不会有很大的影响了。 至于苹果公司值得投资的原因,除了下面所说的,除了苹果公司自己手里留存的大量现金和不错的产品和极低的市盈率,和他很快就会推出的电视会带来不错的盈利之外,你们可能还忽视了苹果店的巨大价值。 你可别小看这些苹果店,她们现在只是销售苹果自己的产品,其销售业绩就已经遥遥领先历史上的任何对手,如果再在此之外搭配销售点其它的高端产品,我估计,这部分的“附带”的业绩,也会是潜力无穷。当然,如果苹果店采用了我的这个建议,我是不是该诉他侵犯“专利”而大赚一笔呢?这个我倒是得好好想想。(窃笑) 最近,让科技界很不愉快的一点,就是在专利侵权上的瞎胡闹! 哈哈,如果你不怕继续的下跌,如果你对苹果公司有点信心,投资点苹果的股票,目前很可能就是不错的时机。 对了,如果是横向比较,视谷歌为苹果的竞争对手,那么,苹果手里的现金远比谷歌多,而苹果的市盈率(PE)又只有谷歌的一半,这似乎也说明点什么。 如果你再将苹果公司看做只是一家普通的电子产品制造公司,并且,基于这样的假设来和国内的电子产品制造“大鳄”们相比,那么,你购买苹果的股票,和你购买那些在国内牛哄哄的“大鳄”的股票相比,就像是你在美国用美元买奔驰,享受奔驰的质量和品位,而在国内,则用同类奔驰产品的人民币标价购买但获得的却是普通的桑塔纳的“享受”,那样巨大的差别了。 链接:如果美国地方政府大量破产 Apple investors: should you panic?

By Brett Arends,Dec 21, 2012 You're a stockholder in Apple . And -- how should I put this? -- you're freaking out. Your wonderstock has collapsed by 25% in the past three months. That amounts to $170 billion in market value. (To put this in context, the amount of value Apple has lost is three times the entire market value of Boeing.) Should you be panicking? Should you sell? Stick your head under the pillow? Here's the bad news -- and the not-so-bad news. The first piece of bad news is that Apple stock is still way too popular among investors and analysts. The conventional wisdom is that this is just a temporary setback and shares will soon resume their upward trajectory. Of the 57 analysts who cover the stock on Wall Street, 48 still rate it a "buy" and just three as a "sell," according to Thomson Reuters. This is usually an ominous sign in a stock. The best stocks are often the ones nobody wants. The next piece of bad news is that despite the recent plunge in Apple's stock price, its market value is still enormous. The company has 945 million shares outstanding. At $522 a share, they value the entire company at $491 billion. That's more than Exxon, and twice the size of Procter & Gamble or Pfizer. Elephants don't dance, the old saying goes. It's harder to make big returns from a big stock. For Apple to grow by just 10% a year for the next five years -- a very modest return for investors used to spectacular gains -- it would have to add another $300 billion in market value over that time. That is more than the entire value of Johnson & Johnson today. The third piece of bad news is that, as some idiot predicted two years ago, tablets, like touchscreen phones, are rapidly becoming a commodity item. The first iPads, like the first iPhones, were greeted like liberators when they arrived. People crowded around to see them. How long ago that seems now. That was only a few years ago. But already these products, and their rivals, are everywhere. You can get excellent tablets running on Google's Android and other systems. I have a very good one that runs Microsoft Windows 8. Naturally, when everyone is producing a tablet, prices will come under pressure. Apple may still charge more than many rivals, but customers do have other choices. Furthermore, in an industry that has such rapid replacement cycles, any competitive advantage is always going to be fleeting. But against all this gloomy stuff, there are some more-promising signs for investors as well. The first is the valuation. The company's market value is gigantic, but so are the profits. The current stock price is still only about 10 times forecast earnings for the next twelve months -- a very low valuation for a quality company. The stock market average has historically been about 14 to 15 times forecast earnings. And Apple's true valuation is really even lower than that, because the company is sitting on about $96 billion in effective net cash. Subtract that and you have an effective underlying stock price of about $430. That is less than nine times forecast earnings of $49.31 per share. (Most of the cash is offshore, and would be subject to hefty federal corporation tax if brought home. So it is still sitting offshore, depriving investors, and the U.S. economy, of its benefits. Yet even net of those taxes, Apple's cash is worth about $70 a share.) Cashflow per share is forecast to rise from $57 in the fiscal year ending in September to $70 in the subsequent twelve months, and to $77 in the twelve months through September 2015. if Apple delivers on those forecasts, the stock is inexpensive. Investors shouldn't worry too much about these lawsuits with rivals such as Samsung, either. They're a sideshow. They attract a lot of media attention, but they are not a reason to own, or not own, the stock. Apple was never going to be able to stop other companies from launching touchscreen phones and tablets with pinch-to-zoom capabilities and so on. They were always going to find a way to compete. Apple didn't invent the tablet -- I saw Bill Gates unveil the Windows Tablet in Las Vegas in 2000, 10 years before the first iPad. What Apple did was do it right. Apple still has a reputation for design, excellence and ease of use that is well-founded and hard to dislodge. It can lose that reputation, and losing a reputation is easier than gaining one, but as long as it can hold on to that, it can continue to charge a premium for its products. This should be viewed as a luxury-goods company as much as a technology company. Millions of people choose to pay more to own an Apple. My late friend Dan Bunting always said that one of the best routes to riches was to earn the trust of the consumer. I am frequently amazed at the power of brands. There isn't a stronger one on the planet than Apple (though, of course, in the fast-moving world of technology, a reputation can fade a lot faster than it can be earned). The cost difference between a $500 iPad and a $350 rival may not work out as very much for those who use these devices a lot, either. Apple also has a huge installed base of current users who like the company's products and just don't want to switch. And there is also the appeal of China and emerging markets. You could argue that everyone in America who wants an iPhone has one. In the rest of the world, that is far from the case. James Cordwell, analyst at Atlantic Securities, says initial sales of the new iPhone 5 in China are impressive and a positive sign for the company. Finally, and oddly, I think there is huge potential for the Apple TV set-top box. I was an early adopter, and for a long time I felt like I was the only person who bought one of these things. But I dumped cable years ago for an Apple TV and for a rival, Roku, which gives me access to TV and movie services like Amazon, Netflix and Hulu Plus. Such things, I strongly suspect, are the future of TV. This may be a huge opportunity for Apple. Today, for all this, Apple is still a phone stock. The iPhone's profits account for about 60% of the stock price, according to analysts. The iPhone has faced competition from Android and others for years and still succeeds in each replacement cycle. All this is good news. And before investors panic, they should understand why the stock has fallen. The introduction of the cheaper iPad Mini, and growing competition in the tablet business, has caused a flurry of uncertainty. Fund managers hate uncertainty. They run from it, irrationally. Furthermore, the looming "fiscal cliff" has caused a number of people to rush to cash in some of their enormous capital gains on Apple stock before taxes rise. That rush caused the stock to fall. Others, seeing the stock falling, rushed to cash in their capital gains ... and so the cycle continued. It's a stampede. I'm skeptical of any stock everyone loves, and I am not surprised at the recent reversal hitting Apple. I'm actually surprised it has taken so long. And it's needlessly risky to have more than about 10% of your portfolio in any one stock. Is the current panic overdone? It wouldn't be the first time.

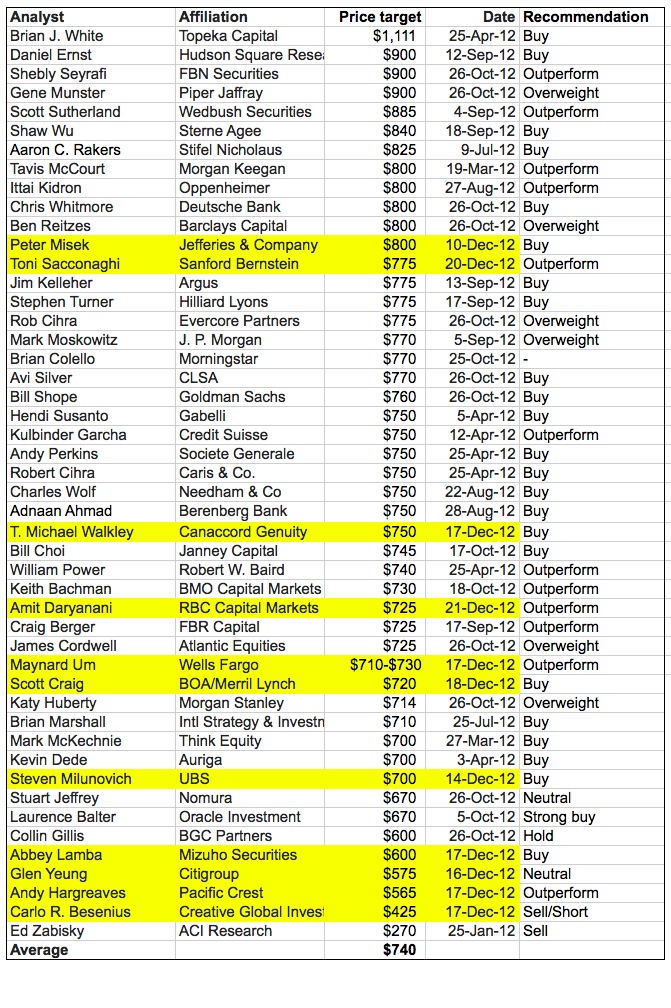

Report Shows Apple Inc. Dominating Smartphone Market in US By CHRIS BIBEY Published: December 21, 2012 at 11:15 am On the surface, it is easy to say that Apple’s iPhone is a dominant force in the United States smartphone market. Recent data from a Kantar Worldpanel ComTech report backs up this claim. In a period covering the past 12 weeks, Apple Inc. (NASDAQ:AAPL) has achieved its highest ever smartphone share in the United States. With the latest sales data in hand, the well-known research company reports that Apple has claimed 53.3% of the market. Dominic Sunnebo, global consumer insight director at Kantar Worldpanel ComTech, added the following: Apple has reached a major milestone in the US by passing the 50% share mark for the first time, with further gains expected to be made during December. While Sunnebo talks about further gains being made in December, it will be interesting to see how much further Apple can pull away from the competition in the United States. Even though Apple Inc. (NASDAQ:AAPL) is dominating in the United States, the same cannot be said for the company’s performance in Europe. When it comes to manufacturing statistics out of this part of the world, some of the data may surprise you: Samsung continues to hold the number one smartphone manufacturer spot across the big five countries, with 44.3% share in the latest 12 weeks. Apple takes second place with 25.3% share while HTC, Sony and Nokia shares remain close in the chase for third position. With such a good performance in the United States, it leaves one to wonder if Apple will eventually put more resources into attempting to takeover the market in Europe. With Samsung holding a large advantage at the present time, Apple definitely has some catching up to do. Right now, it is safe to say that Apple Inc. (NASDAQ:AAPL) isn’t worried too much about Windows sales in the United States. Sunnebo said: Although Windows sales in the US remain subdued, Nokia is managing to claw back some of its share in Great Britain through keenly priced Lumia 800 and 610 prepay deals. The next period will prove crucial in revealing initial consumer reactions to the Nokia 920 and HTC Windows 8X devices." What do you think the future holds for Apple Inc. (NASDAQ:AAPL) smartphone sales? Will 2013 lead to the company grabbing even more of the smartphone market? Apple Inc. (AAPL) Average Price Target Is Now Down To $740 December 28, 2012 By Nicholas Maithya Apple Inc. (NASDAQ:AAPL) maintains its positive analyst recommendation, with almost all the sampled analysts rating the stock with a Buy recommendation, Outperform, Overweight, or Strong Buy. However, the technology giant has seen a majority of these analysts cut down their target prices by significant margins, which has pulled the average price target down to just $740 per share. Nonetheless, a number of the analysts maintain their ambitious price targets of between $800 and $900, with Brian J. White ofTopeka capital being the only outlier with his $1,111 price target.

via: Fortune Despite the drop in average price target for Apple, the iPhone maker boasts the highest average price target in terms of margin as compared to its peers. Apple’s average PT of $740, equates to a premium of $225 per share as per closing price on Thursday, which is 44 percent up. Google Inc. (NASDAQ:GOOG) price target adds a premium of just 13 percent, when compared to yesterday’s closing price, whileAmazon.com Inc. (NASDAQ:AMZN) PT is 12 percent above its closing price. Search Engine giant, Google, maintains the highest average PT of about $800 per share. On the other hand, AOL Inc. (NYSE:AOL) average price target is 39 percent above its Thursday closing price, while Microsoft Corporation (NASDAQ:MSFT) stands at 28 percent premium. Hewlett-PackardCompany (NYSE:HPQ) price target is at a discount of 4 percent of yesterday’s closing. Judging by these statistics, only AOL comes closer to the premium placed on Apple’s Price target. The biggest concern is whether or not some of these ratings and price targets have factored in the most recent developments as far as Apple Inc. (NASDAQ:AAPL) is concerned. For instance, Ed Zabinsky of ACI research rates Apple Inc. (NASDAQ:AAPL) at Sell with a price target of $270 per share, initiated on January 25, 2012. There is no doubt that this PT has contributed immensely toward lowering the average PT. Although, it could be argued that Topeka capital’s $1,111, might have been as effective on the reverse. The most salient fact is that Topeka recently reiterated their rating. I am not sure about ACI research. While I do not take the sampled ratings and price targets for granted, I believe a sample factoring of the last three months ratings, reiterations, and price targets would have been more realistic. Nonetheless, a closer look at the frequency distribution of the price target indicates that the mode lies at $750 per share, with seven analysts including Canaccord Genuity’s Michael Walkley, cutting Apple’s PT to $750. Apple Inc. (NASDAQ:AAPL) stock hit a record high of $705 in late September, triggering a wave of price target increase from various analysts, a majority of whom have since cut down their targets. In one of our recent articles, we features a series of five analysts who reduced their Apple price targets. Some of these reductions have come as a result of supply chain constraint for iPhone and iPad devices as well as a recent management reshuffle by Tim Cook. At the time of this writing, Apple Inc. (NASDAQ:AAPL) was trading at $512.51 per share, down $2.55, or 0.50 percent decline from yesterday’s close. 链接:如果美国地方政府大量破产 |