商业思考:亚马逊在忽悠投资者?

若干年前,我去中国寻找投资机会,和一位在国内做实业颇为“成功”的朋友聊国内的机会。他的成功体现在他的营销成长数据上:从第一年的30万人民币,到第二年的100万,第三年的300万,第四年的1000万,和三年之后轻轻松松的突破一亿人民币。伴随这个的,是他口中还不错的毛利润率:大约在10%!

我当时是惊讶不已。国内的机会真的是让人惊讶:如此快的成长和“利润”,在美国是难以想象的。而且,这位仁兄口中的自信更是让我佩服的五体投地:只要是有市场,我什么都可以造:汽车、飞机当然不在话下!(这句话很技巧!市场是因为你能够造就有的?还是因为有了你就能够造,那你又怎么样“能够”呢?)

我当时问:如此快的成长速度,公司三年之内上市应该是肯定的事情:十个亿的销售额和一个亿的利润,那可就是至少五十亿的市值了!为此,引入策略投资者,让对方也大赚一笔,也是值得的。可惜,这一切都没有发生,这也是我当时无法想象的。中国人玩资本市场玩倒投资者,可是世界第一的。

随后不久,一位当地的地方政府官员告诉我这些数字背后的实情:原来,他们说到底,充其量就是一个最终组装车间外加贸易公司!一切的都来自外包。一切来自外包的数字最终都成为自己销售额的一分子。

即使是这样,做过生意的人都会知道,靠10%的毛利折腾,公司是不可能盈利的,至少是在美国和对于美国的多数公司。美国零售业的毛利(进货成本与销售价格之间的差价,沃尔玛和好事多的“毛利率”,估计和国内人说的不是一个概念)很多都在50%以上,不少的在75%。这也是为什么。即使是50%的对折,他们也能够生存的原因所在。我自己曾经做过零售,20-25%的毛利,根本上就无法生存。一美元店每个美元商品的进货成本,估计也就是一半的样子。

国内的公司这么折腾还能够继续生存下去,一方面是靠从外贸补贴中套利,再则,也是最重要的,就是籍此来从地产上套利——有了公司,你才能买地做公司,你才有靠地产升值大赚的前提。现在看来,结果就是这样!

在这两者不存在之后,大批曾经辉煌公司的败落和破产,就是顺理成章的事情了。

想不到,在美国的亚马逊,好像也在走和中国公司类似的经营之道,而且还很成功:至少,这种成功是在股价的持续上升上体现了出来。

下面的中文是篇来自《万维网》的文章,说出了部分实情。亚马逊目前的经营逻辑,颇有点当年微软的式样:什么都做,只要是他人证明成功的模式和产品。

也就是说,亚马逊就是一个超级“山寨”公司,靠价廉和销售渠道的畅通取胜。而且,它的所谓快速成长的销售业绩,很可能有很大的水分:这也是为什么,这些销售业绩没有向你显示足够高的盈利水准的原因。

亚马逊的优势,很快就会短命终结。销售税的免除不可能持续永远!免运费的成本支出,它也难扛很久。

再者,至少对于我,在亚马逊的购买欲望,已经越来越多的被好事多所取代。我的购买量和普通的消费者比不算小!有时候是因为就近更便宜,更多的时候是,就近更能够确保质量和方便,虽然成本付出上可能会稍微高一点,即使是在支付了8%的销售税之后。想想看,在没有这个8%的独特优势之后的亚马逊,还有多少价格优势?

这也是为什么,亚马逊现在猴急,趁着大家还相信他的故事的时候,大量向其它的领域扩张。在这点上,它颇有自知之明。只是,即使这样做,在只卖吆喝不赚钱的现实面前,它最终到底能够走多远?

苹果公司靠打造一个独特的生态体系获得了巨大的成功,成功背后是独特的创新能力;亚马逊也在尽力打造一个“独特”的“生态帝国”,虽然背后的基石是“山寨文化”。但是,即使如此,对于公司的经营者特别是拥有巨多股权的管理者,已经是实实在在的获得了巨大的成功:股价的一再高升,是他们唯一需要在乎的。目的已经达到,最终的帝国是不是真的能够像人们和自己吹嘘的那样获利巨大,谁在乎呢?投资者因此而遭受巨大的经济损失,值得同情吗?好像答案,对于公司的经营者,是否定的。

链接:

今年诺奖得主的代表作《逃离》全文

亚马逊赔本赚吆喝能坚持多久?

2013-10-24 21:36:22 纽约时报

旧金山——几乎每一天,亚马逊(Amazon)都会宣布一项新的投资。

它刚刚收购了一家在线教育公司,还推出了一个面向网络零售商、与贝宝(PayPal)相竞争的支付系统。它首次在纽约开卖葡萄酒,更新了平板电脑产品线,新批准了三部试播版喜剧节目的制作,并启动了亚马逊时装部的设计比赛。此外,为了加快配送速度,它正在宝洁(Procter&Gamble)等供货商内部建立迷你仓库。

但它本月要宣布的事情中,并没有获得可观利润这一项。

谁在乎呢?亚马逊2012年处于亏损状态,而且分析人士预计,该公司周四发布第三季度的业绩时,亏损的消息将再次传出。但其股价目前却创下历史新高。

与2010年中期相比,亚马逊股价上涨了150%左右。或许并非巧合的是,从那时起,该公司就没再实现过大规模盈利。换句话说,只有当净收入开始下滑时,投资者才真正得出结论:他们喜欢这家公司。

“本不该发生这样的事。”经济学家及风险投资人威廉·H·詹韦(William H. Janeway)说,“它与主流金融理论相悖。如果不存在系统性泡沫,很少有公司会被这样估值。”

亚马逊今年的销售收入可望达到750亿美元(约合4560亿元人民币)。尽管没有谁宣称亚马逊完全是一个泡沫,但是投资者正在越来越激烈地争论,亚马逊的净利润什么时候才能达到投资者要求同等收入水平的其他企业实现的水平。

该公司拒绝就此发表评论。

一些分析人士指出,相对于亚马逊创始人和首席执行官杰夫·贝佐斯(Jeff Bezos)的目标市场,那些销售收入根本不值一提。詹韦说,“市场实际上是无限的,包括全球消费品市场,或许还有B2B商务市场。”詹韦著有《创新经济中的资本主义经营》(Doing Capitalism in the Innovation

Economy)。

如果把争夺市场当作目标,现在就要赚钱的想法一定会妨碍这个目标。正如伦敦的分析师本尼迪克特·埃文斯(Benedict Evans)所言:“贝佐斯已经做出的选择是,让亚马逊在20年后成为世界上最大、实力最强、最成功的零售商。如果想让它现在就盈利的话,傻瓜都办得到。”

另外一些人则认为,一朝是廉价零售商,就永远是廉价零售商。亚马逊正在大举涉足多种商业形态和多种形式的技术,但在本质上,它是一家廉价销售日用货品的公司,购买自亚马逊的书或者尿布,与来自其他任何零售商的并无不同。而且亚马逊运费低廉,客户服务的口碑也很好。

不过,要获得可观的利润,就必须对上述可变因素进行部分或全部的调整,这样做可能造成顾客的流失,并让原本极快的收入增长出现放缓。而这反过来又会导致投资者要求公司更快地实现盈利。

最好别冒险走那条路,BGC Partners科技产业高级分析师科林·吉利斯(Colin Gillis)表示。他说,“比起卖出东西并且赚钱,卖出东西但不赚钱要容易一些。”

按照这种观点,亚马逊旋风一般的举动,只是对其零售业主体的有益补充而已。根据预期亚马逊可能很快就会推出一款机顶盒,从而更直接地与Netflix展开竞争,与此同时,亚马逊推出智能手机的传言也不会消失。

一种设想是,亚马逊可以改变自己的商业模式,从出售他人产品赚取微薄利润,变为出售他人商品赚取高额利润,但这种设想“是靠不住的”,Asymco公司的分析师贺拉斯·德迪欧(Horace Dediu)写道。

他还说,企业根本不会那么容易地改变商业模式,比如微软尽管既有钱又有智慧,但仍然无法转向,脱离基于PC的战略,抓住移动计算的趋势。

当前关于亚马逊的讨论,会让人回想起1999年上一次系统性泡沫发生时关于这家公司的辩论。当时和现在一样,企业的目标就是快速壮大,在其他人赶上之前,尽快抢占新市场。

但是崩盘发生时,所有“潜力无限”的谈论都消失了,人们开始严格地关注盈利,而亚马逊经常形容盈利就近在眼前。

2001年,贝佐斯说亚马逊会“严格地管理所销售的产品,确保只销售有利润的产品。30磅一盒的钉子,已经不再适合我们的世界了”。这番话安抚了投资者,公司也生存了下来。

不过那是当时。现在,顾客又能从亚马逊上买到4000枚一盒的钉子了,配送重量38磅(约合17公斤),而且还能免费送货上门。但是这家零售商已经远远不再满足于这种平平无奇的优惠了,“雷鸟牌饼干制做机”(Thunderbird Cookie

Dropping Machine),售价32329美元,重量1260磅,可是亚马逊还是会免费帮你配送。(现在已经没货了。)

位于芝加哥的第三方销售商,商用食品服务设备公司(Commercial Food

Services Equipment)在亚马逊上出售一台雷鸟机器,不过会收取2600美元运费。

“亚马逊卖出的饼干机要比我卖出的多很多。但即使你从我这里买,而不是从亚马逊买,亚马逊仍然能从销售额和运费中抽取提成,”这家设备公司的老板李孝(Hyo Lee,音译)说。“现在你知道为什么亚马逊的销售额从2010年的340亿美元,提高到2012年的610亿美元了吧?”

不过,她也提到亚马逊正在美国各地修建数十座仓库,也正在雇佣数万人来为这些仓库服务。“现在亚马逊有了这么多固定成本,”她说。“我觉得他们必须得开始收更多运费了。”

其他人也同意,没有什么东西能一直向上发展。

弗雷斯特研究公司(Forrester Research)的CEO乔治·科隆尼(George Colony)说,“总有一天需要付出代价的。”

怎么支付呢?“提价,我看不到其他任何办法。”

TellApart公司是一家帮助零售商管理数据的初创企业。该公司CEO乔希·麦克法兰(Josh McFarland)从亚马逊上买了一双20美元的人字拖,之后麦克法兰又从别的地方找到了一双更喜欢的人字拖,打算退掉从亚马逊买的那双。可是亚马逊却告诉他不用麻烦,会直接给他退款。

没有多少零售商以为自己有实力做出这么慷慨的举动,可是亚马逊的其他购物者最近也说遇到了相同的经历。这是一个瞄准长远的策略,可是消费者明年还会记得你今天为他们做过什么吗?

“亚马逊想做的是提高我对零售商的期待,从而最终让我什么东西都从亚马逊买,”麦克法兰说。“总会有一天,其他竞争者都消失了,到时候我也不会知道价格是不是提高了,因为已经没有比较对象了。”

DAVID STREITFELD2013年10月25日。翻译:李琼、王童鹤

I Concede Defeat

In Amazon.com

Oct 25 2013, 08:40

When

I started writing about Amazon.com (AMZN), I had a divergent view from the market. It was late October

2011, and the consensus was that the earnings weakness was temporary due to an

"investment phase". My own view was that the earnings weakness was

structural, driven by several unfavorable trends working against Amazon.com,

from the changing mix of sales, to the migration to digital OS-integrated

stores, to the need to collect sales taxes. My own view was that earnings would

get worse and the "investment thesis" was basically false. My own

view was that Amazon.com would soon post earnings losses, instead of showing

strongly growing earnings as expected.

And back then, I thought earnings mattered.

Thus, with the stock already trading at 169 times 2011 estimates at the time

($1.28 per share), I thought that if I was right regarding what was going to

happen to earnings, I'd be right regarding the stock.

I was wrong.

I

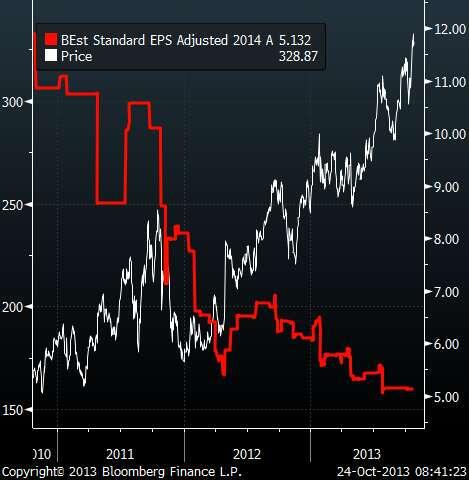

was not wrong regarding the earnings, though. Amazon.com went on to post a

quarterly loss (in Q3 2012). It even went on to post a yearly loss for the

whole of 2012. And even more brutal, this is what happened to 2014 estimates

over the last 3 years (Source:bwolf, Twitter stream. This is non-GAAP, so it includes

compensation paid in stock)

In a way, Amazon.com did worse in the

earnings front than even I could have ever imagined. I didn't expect it to post

a yearly loss, and it did. Time and time again, Amazon.com failed to deliver

the expected earnings and estimates were drawn lower and lower quarter after

quarter. At some point, each passing quarter meant estimates for the next

quarter got cut 80% or more. And it was not just short-term earnings estimates

that were being cut, as we can see above with the 2014 non-GAAP estimates.

And yet, I was wrong.

The stock proceeded to march ever higher on

ever lower earnings estimates. The stories started being more and more

otherworldly, with analysts even pulling targets from 2019 earnings multiplied

by 50, when they couldn't get next quarter's earnings right 3 months ahead.

But I was the loser in all of this.

Let there be no doubt, I was the loser. I

would have been better served by complete ignorance of Amazon.com's

fundamentals. I would have been better served by not knowing that investments

are capitalized and depreciated over time - because time and time again we see

analysts, commenters, authors, pulling the "earnings are not there because

they are being reinvested" meme.

I would have been better served by not

understanding Amazon.com's business, not seeing the flaws and structural

problems. Not seeing shipping costs shooting up even with the expanded

distribution network. Not seeing how 3P and AWS are not really 100% gross

margin businesses, like Amazon.com accounts them for, and how that inflates

gross margin as a percent of sales.

I simply knew too much, where ignorance would

have been bliss.

I knew too much, because if I was going to

go back to October 2011 with the knowledge I have today of what happened to

Amazon.com except for the share price, I'd have done it all again. And I would

have lost, again, just like I did.

Yes, I lost because I knew too much.

Perhaps this is simply what Bernanke wants

from the markets. To drive compliance into people's skulls, or have them lose

heavily no matter what happens. Thou Shalt Not Sell Short, no matter what. I

had partially learned my lesson, in that I no longer sold short and held

anything except Amazon.com. But it was not enough, the point had to be driven

home.

And it was, I lost. No matter what.

Regarding this latest quarter

A quick comment regarding Q3 2013:

·

Earnings met expectations due to an income tax benefit; they'd

be somewhat lower without it;

·

Amazon.com is again seeing CSOI margins dropping, unexpectedly;

·

Amazon.com's revenues were probably helped by the ebook

accounting change, driving revenues from 3P to 1P. Amazon.com won't

say how much this effect was, I'd estimate it at around 3.9% of revenues ($666

million);

·

Gross margin dropped from 28.62% (Q2 2013) to 27.65% (Q3 2013),

an effect that was expected if the accounting change helped revenues. This drop

is consistent with around $666 million in additional revenues from the

accounting change;

·

Gross shipping costs continued up;

·

Net shipping costs also increased marginally, which is

surprising.

All in all, a quarter that was like many

which preceded it. Not becoming of a $170 billion market capitalization

company, but it all doesn't matter.

Regarding

the accounting change, the analyst from JPMorgan, Douglas Anmuth, did ask

Amazon.com in the earnings conference call about the impact. This was the

question and answer:

Douglas

Anmuth - JPMorgan

Great, thanks for taking the question. Just

want to ask two things. First, Tom, can you give us some color on where you are

in the shift from third-party to first-party e-books and how much of the factor

that's been in reaccelerating media revenue, you have seen reacceleration in

media in the last three quarters, I think in North America? And then secondly,

it looks like there is six fewer shopping days this holiday season between

Black Friday and Christmas, just curious what you do with anything differently to

prepare for that and do you think that could actually even drive more holiday

shopping online? Thanks.

Tom

Szkutak

Sure. In terms of your second one, second

question, there are fewer days. There is not a lot that we do different. We

certainly see when that happens. And there is some behavioral differences on

behalf of customers just because of the shorter time period that we have

certainly some more sizable days during that period, but there is not a lot to

add to that. In terms of the transition for e-books, in terms of our total

growth across Amazon both North America total, our global total, it's not a

significant or meaningful impact to the overall growth rates and certainly this

transition has been going on for you know some number of quarters now so it's

not a lot I can help you with there.

Amazon.com brushed it off as "not a

significant and meaningful impact". But we need to understand what's

significant for Amazon.com. Amazon.com once brushed off an inquiry from the SEC

regarding Kindle sales as not being material. Amazon.com seems to have taken an

accounting threshold to it - as long as it's less than 10% of revenues, it's

not material. Here, I'd estimate the impact from the accounting change to have

been 3.9% of sales, or $666 million. The difference between a revenue beat and

a miss. Not material. Even though Amazon.com breaks off things like the

currency impact well below that threshold.

Anyway, it doesn't matter.

I lost, I concede defeat.

链接: 今年诺奖得主的代表作《逃离》全文

|