当苹果股价从一个多月前的426美元的历史最高价跌到363美元附近的时候(在2011年11月底),有人做过一些简单的计算:市值消去14.8%,而同期标准普500的跌幅是5.4%。对于喜欢和标准普比较的人来看,这种差别,似乎能说明不少的问题,特别是对于处于一个非常特殊时期的苹果公司来说。 这时候,苹果面临的坏消息有: 其一,苹果的灵魂人物乔布斯去世,很多人认为,苹果就是乔布斯,乔布斯就是苹果,所以,离开乔布斯的苹果将会成为一只烂苹果!这种担心似乎有道理,也似乎没有。对于很多人,保守点也是一个不错的选择。 对于这种担心,我觉得有点多余,至少在短期的几年来看会是。对于这点的细说,我后面的文章再谈。 其二,苹果的业绩没有预期的好。很多时候,这也意味着公司盈利成长的势头开始发生变化,数学拐点开始形成。但是,对于苹果,看来不是:这里发生的是新产品推出导致的顾客消费等待和延迟! 其三,欧洲不断传来的坏消息。欧洲进入经济衰退已经不再是可能,而是进行时了。欧洲一次次的坏消息,都带来了美国甚至是世界性的股市大跌。再者,根据2008年金融危机时的表现看,当时,在一个可比期间,标准普下跌38.5%时,苹果的股价下跌了56.9%。由此看来,苹果也不是一个抗风险性能很好的股。

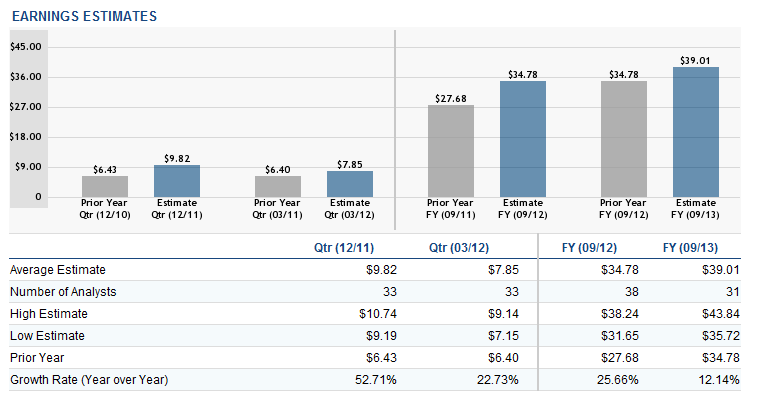

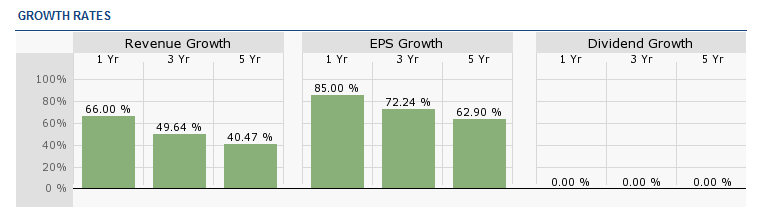

看了坏消息,我们再来看看好消息。 其一,先看成绩单。此前过去十年,苹果股价的年度平均成长为43.5%!五年为32.0%。很多时候,人们会说:已经长了这么多,还能继续上升多少? 从哲学的角度看似乎是很有道理!但是,那不过是外行看热闹而已。 按照周五收盘价381美元计算,苹果的市盈率(P/E比)为13.8,过去十二个月每股的盈利为27.68美元。公司账户上拥有的现金大概在每股80多美元。公司市值为3541亿美元。这些是存量数据。对于华尔街来说,这些都是“历史”,对于投资者价值不是很大! 其二,再来看看未来的潜力,也是华尔街最看重的部分。 在过去四个季度,苹果盈利的成长速度分别是75%、92%、122%和52%!这里的差别主要还是来自季节性因素的影响,不代表成长速度的变化(上升或者下降)。人们估计,未来五年的盈利成长速度平均会下降到19%! 为什么苹果能实现如此之高的长期盈利和销售收入的增长?答案很简单:就是不断推出新产品,而且是做工精良的新产品,并且还能够以很高的边际利润卖给热情的消费者。 这些是让它成功的原因,也是那些不喜欢苹果股票的人不喜欢的理由:为什么世界上会有那么多“愚昧”的家伙,宁愿花高价钱购买来自苹果的产品!

对于未来苹果的盈利成长,会不会很快下降到19%,甚至是更低的水平,我们很难估计。但是,有一点似乎会是必然,长期的35%甚至是更高的盈利成长,是不可能做到的。问题是,盈利增长的下降,到底会从什么时候开始?下降之后,带给公司的到底是竞争性的外伤压力还是内伤损害? 十年前每股0.10美元盈利的苹果,五年之前做到9美元,三年前是15美元多,下年度估计会有38.59美元的收获。按照19%的年度盈利增长,五年之后大概在78美元的样子。 那时候,公司的账上现金每股估计会有200美元,如果按照利润的5倍来决定公司运行部分的价值,外加现金,也会有接近700美元的股价了。很多人认为,应该在800美元以上,他们是按照市盈率(P/E)来估算的。如果你拥有一家公司,账户上有大量的现金,你业务带来的盈利,是你投资扣除现金储备外的五倍。你觉得值得吗?这种思考的逻辑,就是价值投资的逻辑。 当然,这里有个很大的风险是:你所投资的公司的管理层,是不是值得你信任? 在乔布斯在世的时候,他一再说,自己的公司只保留一流的人才。那么,这些一流的人才,在离开乔布斯之后的苹果,会出现什么样的博弈结局呢?在乔布斯将公司的CEO大权交出之后,他的那位打开零售业市场的大将果断离开,寻找更好的获利地位。那么,未来的苹果,将由谁来凝聚人心呢?在大家都变得很富有的情况下,又该怎么样保留和打造一个能征善战的军团呢?都是值得投资者关心的问题。 我发现,很多人不喜欢苹果股票,就是因为它已经成长了太多。这种逻辑倒是非常的熟悉,也很有普遍性的真实性。那么,对于苹果,会不会是情况不一样了?如果苹果不能继续开发有竞争力的新产品,如果苹果的市场竞争力下降,最终不得不搞价格战,如果苹果不能够像现在这样,以区区4%的智能手机市场占有率,获得行业超过一半的利润,那么,手里握有大量现金的苹果,会怎么做,又能怎么做呢? 要想投资苹果股票,并且获得更大的胜算,最好还是好好研究一下苹果的文化和经营风格与理念。你投资股票,最终还是在投资公司,相对于是拥有公司! 附录The list of Soros Fund Management’s top high-growth holdings. | Stock | Symbol | Shares Held - 09/30/2011 | Change in shares | Expected topline growth next year | | Adecoagro S.A. | AGRO | 25485394 | -961544 | 20.90% | | Westport Innovations | WPRT | 3160063 | -1859827 | 49.20% | | Amazon.com Inc. | AMZN | 206016 | 193271 | 33.40% | | Apple Inc. | AAPL | 83417 | 12622 | 28.90%* | | Acacia Research Corp. | ACTG | 770125 | -784343 | 24.30% | | Mercury Computer Systems | MRCY | 2220666 | 181397 | 29.20% | Source:13F filing, Yahoo Finance *Current Year (ending Sept. FY12) growth rate I find Adecoagro a good value buy at current prices. Adecoagro is a diversified South American Agribusiness company, with exposure to low cost farming in Argentina, Brazil and Uruguay, and sugar & ethanol in Brazil. The stock is trading at a 47% discount to its NAV, which is at the low end of the historical P/NAV of its peers. One of the main concerns with the stock is a proposed law by the Argentine government regulating foreign ownership of land. If the law is approved as it is, Adeco would face limitations to buy new land in Argentina. However, the limitations only apply to the future, which means the current land portfolio owned by Adeco is not at risk. Further, Adeco's land portfolio still has a significant amount of undeveloped land, implying NAV growth even without buying new land. Trading at 0.53x P/NAV. I believe investors are pricing in the worst case scenario and giving zero value for the Argentine land portfolio, which is not justified. The risk reward profile at this price is skewed to the upside. Apple also looks good trading at just 9.78x forward earnings despite of ~$80 billion in cash and expected 29% growth in sales in the current year. Given the initial momentum iPhone 4S has seen, I believe Apple can post good December quarter earnings. Apple continues to remain a secular growth and market-share-gain story in the smartphone and tablet space. I would recommend buying the company given its low valuations and several upcoming catalysts over next few quarters, like strong iPhone 4S sell-through, holiday sales, and anticipated iPad 3 and iPhone 5 launches next year. Acacia Research is another stock I would go long on. Acacia Research Corporation, through its operating subsidiaries, acquires, develops, licenses and enforces patented technologies. Its operating subsidiaries assist patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies. After the recent Nortel (NRTLQ.PK) IP portfolio sale, the IP market is seeing increased activity. Acacia is seeing growing levels of interest in partnerships from companies that seek to unlock the value in IP portfolios owned by operating companies. Some evidence of this can be seen in Acacia’s last quarter financial results. Acacia reported $50.6 million of revenue and revenue per deal hit an all time high of $1.7M in Q3, despite not signing a major comprehensive deal in the quarter. Going forward, this increased activity in the market will become more apparent after the next few quarterly results. Acacia is also likely to benefit from its strong position in licensing Access portfolio (original Palm patents) for use in leading mobile operating systems (Apple and Android platforms). One stock in the above list which I would like to avoid is Amazon. I find Amazon stock pricey. I understand the growth potential and current investment mode of Amazon (which is keeping earnings depressed), but the current price seems to be already pricing in a lot of positives. Also, I don't agree that growth in international markets will come easy for Amazon without any significant competition from local players. |