投资者在歧视苹果公司吗?

歧视和被歧视,都不是什么好滋味。对于股市投资,学院派最流行的说法就是长期的“理性”和短期的“随机性”。也就是说,短期而言,股市会波动,产生“不理性”的投机行为。而长期则基本上会基于公司的业绩,就像是投资公司实业本身一样的“理性”和“充满智慧”。

苹果公司的存在,倒是让我们有机会看看,股市的双重标准和“歧视”到底是个什么样子.下面的文章给你一个不错的分析。至于是不是对的,还得基于你自己的思考,人们”歧视”苹果和宠爱谷歌,甚至是已经”过气”的微软,或许也有几分”道理”:毕竟,人家是软件公司,不”像”苹果那样只是一家”硬件公司”。

很多人对于苹果打造的生态系统的价值视而不见。从长期看,很可能很多人会看走眼:最终苹果很可能会证明多数是错误的,它所打造的生态系统就是一个独立的充满价值的”软件”王国。这份价值,很可能最终会给投资者带来不错的回报。

自己读读,自己想想。

不过,还是那句话:我无意给谁推荐股票,也不想被人埋怨。

股市投资的成功,远不仅仅只是选择正确的投资对象那么简单。时机把握的重要性,不仅仅只是体现在买入,还有卖出时机的选择。心态和智慧的结合,才会增加你成功的可能性。分析和把握时机,还得靠你自己。

如果你是一个急性子,我觉得你不应该在股市晃荡。

记住一句话:你可能买对了时机,但最终还是因为买错的时间而亏钱。

这种亏我吃过很多次,而且还很难不继续吃同样的亏。很弱智?是吗?有点!很有点!!!这就是人性的弱点决定的。想改都难。大师也有吃这种亏的时候,何况我们这些普通人。

Apple Bears Getting Really

Desperate

Nov 4 2013, 02:56

When

it comes to Apple (AAPL), there are those who just don't like the company (or the

stock). No matter what Apple does, the bears will criticize the company. Just

last week, Apple had a great quarter and

issued stronger than usual guidance. But guess what? It didn't seem good

enough, and the Apple bears were out in full force. Even when Apple does

something these people want, they find a way to criticize the company for it.

Today, I'll take another look at Apple, and explain why the Apple bear crowd is

getting really desperate.

The quarter was NOT

disappointing:

Literally, just a

few hours after Apple reported, and after my article above was published, this

is what was seen on Yahoo! Finance's homepage. Look at the headline.

(Source: Yahoo!

Finance homepage)

This

was the actual Reuters article that

goes with that headline image. Here are the first two "paragraphs"

from the article:

(Reuters) - Apple Inc's profit and margins slid despite selling

33.8 million iPhones in its September quarter, prompting a brief but sharp

selloff as disappointed investors cashed in some of the stock's recent strong

gains.

Wall Street had hoped for a stronger beat on quarterly sales

after the company predicted in September that its revenue and margins would

come in at the high end of its own forecasts.

The

second part of that is absolutely hilarious. Apple originally guided to

revenues of $34 billion to $37 billion, and gross margins of 36% to 37%. After

the great iPhone weekend, Apple, as the article states, said that revenues and

gross margins would be at the higher end of its ranges. What did Apple come in

at? How about $37.47 billion and 37.02%, respectively. Apple came in half a billion above in terms of revenues and above the high end of the gross

margin range. Apple beat analyst estimates for the iPhone, iPad, and Mac, its

three most important lines. The only product category that missed was the iPod,

whose unit sales totaled just 1.53% of Apple's quarterly revenues.

So

how was this a disappointment? It wasn't. Apple beat by $630 million on the

revenue front and $0.33 in earnings per share. Where does the Reuters article

state this? The second and third to last sentences of the article. Yes, buried at the bottom, the fact that

Apple crushed estimates. Sorry Apple bears, but trying to say this quarter was

a disappointment is just wrong. Find someone else to pick on. Apple came in

well above the high end of its revenue range, and above its gross margin

guidance too. Oh, and unlike Microsoft (MSFT) or

Google (GOOG), the beat wasn't fueled by dramatically lowered

expectations. By the way, Google's beat was not as impressive, and yet the

stock soared to new all-time highs. Google is certainly held to a different standard, and that is partially due to all

of those Apple bears out there. Microsoft saw its revenue estimates come down

by more than a billion between quarters and more than a dime for earnings. That

didn't happen to Apple.

Guidance was very good:

Another complaint of

Apple bears was that guidance, particularly gross margin guidance, was not very

good. Well, Apple guided to a revenue midpoint of $56.5 billion, and the

analyst estimate was $55.65 billion, so Apple was almost a billion ahead.

Remember, for fiscal Q4 the original midpoint was $35.5 billion, and Apple beat

that by nearly $2 billion. While Apple has been giving more realistic guidance

in the past few quarters, the company still has been conservative to some extent.

So

on to gross margins. The company guided to a midpoint of 37%, basically flat

with Q4. This was seen as a huge negative, with many expecting a midpoint

closer to 38%. Well, Apple detailed on the conference call an

issue with deferred revenues. It was stated that about $900 million would be

pushed into fiscal Q1, and that would hurt gross margins. Management stated

that gross margin guidance would have been around 38.5% if not for the

deferral. More on this in the next section. But even with the "light"

guidance, I still calculated Apple's earnings per share, based on all guidance

midpoints, at $13.51. That was below the $13.86 estimate, but I also did not

assume any benefit from the buyback plan. Don't forget, Apple exceeded its

fiscal Q4 guidance by anywhere from 60 to 90 cents in EPS, depending on what

share count you used.

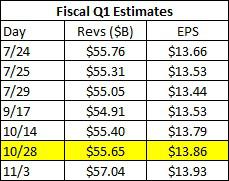

Also,

if guidance was so disappointing, why have analysts raised their expectations since the report? Going into the report, as mentioned above, expectations

were for $55.65 billion and $13.86, respectively.Current estimates call for $57.04 billion and $13.93,

respectively. If Apple's guidance was disappointing, analysts would but cutting

estimates, not raising them. As you can see from the table below, estimates

were already rising into the report, so it's not like estimates were low to

begin with.

Additionally, those

that are criticizing Apple for weak margin guidance are the same that were

arguing for a cheaper iPhone. Those are the people that didn't like the iPhone

5C, because it was priced too high. Well, if Apple had a cheaper phone, margins

would have been lower. So the bears criticized Apple for not having a cheaper

phone, and then also criticized Apple for low margins. You can't have it both

ways.

Back to that deferred hardware

revenue:

I want to get back

to that $900 million in deferred revenue. Apple bears are pointing out that if

it were not for that money, fiscal Q1 revenue guidance would be a bit lower,

and perhaps the midpoint would only be in-line with analyst expectations. Well,

if that were the case, and these revenues instead were booked in fiscal Q4,

Apple would have produced a tremendous revenue beat, roughly $1.5 billion. Had

Apple come in around $38.4 billion in revenues with in-line guidance, the bears

would have criticized the guidance. But in that case, Apple would have had a

tremendous Q4 beat. Again, you can't have it both ways. It was not a

disappointing quarter, and guidance was not bad.

Domestic cash and stock

buybacks:

Apple's cash pile

has been another hot spot for bears to attack the technology giant. There are

those out there calling for Apple to better use its cash, primarily for capital

returns. Carl Icahn is arguing for a $150 billion buyback. To this point, a

larger buyback may be possible, but it all depends on the time frame (2 years,

5 years, 10 or more?). For this argument, I'm not calling Icahn an Apple bear,

because he's been bullish on the stock, and also is invested in Apple. Well,

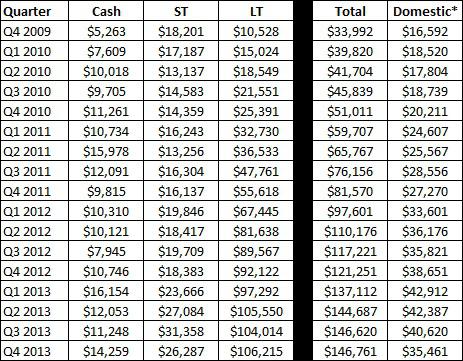

the following table shows some key Apple cash pile statistics, with dollar

values in millions.

*Number may be

slightly off due to rounding of foreign balance.

Apple's domestic

cash pile value declined by about $5 billion as Apple roughly bought back that

much stock in fiscal Q4. The domestic cash pile is key, because it is the only

fund Apple can use for dividends and buybacks. If Apple wants to use its

foreign funds, more than $111 billion at the end of fiscal Q4, it has two

choices. It can bring those funds back into theUS, and face billions in

repatriation taxes, or Apple can borrow against those balances. Apple issued

$17 billion worth of debt earlier this year, to accelerate part of its buyback.

So what's up with

Apple bears here? Well, a number of those people arguing for a larger buyback

are those that are also criticizing Apple's earnings (especially in the last

quarter or two) for being propped up by the buyback. Obviously, as Apple

reduces its share count, earnings per share figures are helped. But again, you

can't have it both ways. How can you argue that Apple needs a bigger buyback,

then criticize it when earnings per share are helped by said buyback?

Additionally, if Apple does take out debt and raises the buyback, don't

criticize the company for having a weaker balance sheet.

Apple is expected to

return about $100 billion to shareholders over a three year period between the

dividend and the buyback. That is a tremendous amount, and should not be taken

lightly. Apple has a little more than $37 billion left on the buyback ($22.86

billion worth of shares bought back already), and the company expects the

buyback to be done by the end of calendar 2015. That means a little more than

$4 billion can be spent on average over the next 9 quarters. Apple should

generate enough cash over the next two years where it could pay the dividend

(and raise it by a fair amount) and finish off the buyback without completely

depleting its domestic cash balance. However, it would not surprise me if the

company did issue a little more debt, just so it has the so-called "margin

of safety" in its domestic cash pile.

In terms of

increasing the buyback, I've already said Apple could easily do it, but play

around with the timing. I'm on the record saying that Apple could raise the

buyback to a trillion dollars, just with no expiration date. On average, Apple

is going to buy back about $20 billion worth of stock a year for three years.

That is a tremendous amount, and I wouldn't be arguing for them to increase the

buyback into 2015. But once this current $60 billion plan is over, I expect the

buyback to continue, so the current number could be "raised" with an

extension of the timeline.

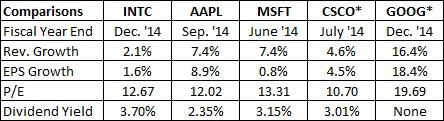

Top tier tech comparisons:

In

many of my technology articles lately, I've shown comparisons between a number

of the top tier tech names. These names include the three I've mentioned

already here today, plus Intel (INTC) and Cisco Systems (CSCO). The

following table shows a comparison of growth, valuation, and dividend yields.

*EPS and P/E numbers

are non-GAAP.

What's the key

takeaway here? Well, Apple might be the cheapest of any of these names,

depending on what kind of conversion you use for Cisco's non-GAAP to GAAP

earnings. But even if Apple and Cisco have the same valuation, Apple would be

the better value thanks to its stronger growth profile and much larger buyback.

Cisco is the only one of these names that has not reported earnings yet, as it

has a slightly different fiscal year. Cisco will report on November 13th. When

it comes to Intel, Apple seems like a much better investment. More growth at a

cheaper price. Intel has risen a couple of percent since reporting its quarter,

something Apple has not done. Intel issued worse than expected guidance, yet

the stock still rose.

When it comes to

Apple versus Google, Google provides more growth, but no dividend or buyback.

Google also trades at nearly double the valuation when you convert Google

earnings to GAAP. Google's stock has soared more than 15.5% since reporting

earnings, despite a very small beat, and thanks to reduced expectations and a

tax break. I mentioned above my article about Google being held to a different

standard, and the company certainly is. Over the last two years, Google has

missed revenue or earnings numbers several times, yet the stock is at all-time

highs.

When it comes to

Apple versus Microsoft, the two have comparable revenue growth, but Apple has

more earnings growth. Microsoft has a higher dividend yield, but Apple has the

more powerful buyback. Microsoft, however, trades at more than a 10% premium to

Apple, thanks to Microsoft also rising after its earnings report. Microsoft's

revenue and earnings beat was due to estimates being cut dramatically, although

the company did issue decent guidance.

Despite decent

growth and a very reasonable valuation, Apple is down almost 2% since its

earnings report. The three other names that have reported have all risen since

earnings. Personally, I think that is ridiculous, as Apple's beat was the most

impressive.

Updating my Apple target:

I've

gotten a ton of questions about my own price target for Apple since the

earnings report, and I promised I'd be back in a week or so with an update. In my preview article for Apple's fiscal 2014, I set a target of

$567 for the technology giant. As I have done in the past, I am providing a

table of estimates and apply a multiple to each level of earnings. If you want

to know what my price target is on any given day, look at the last table I

provided, take the average earnings estimate from analysts, and do the math.

Here's the table.

One

quick note on these numbers. At current, I am not assuming an Apple-China

Mobile (CHL) deal for

my valuation. Obviously, a deal with China Mobile would be extremely positive

for Apple. I think a deal is worth about 10%, so if a deal were to happen, you

could basically up my target by 10%. As of Sunday, the average analyst estimate

for earnings was $43.27. That gives me a price target of about $587, a $20

increase from my last update. Why have I upped my target? Well, here are the

reasons why:

·

Q4 report was strong and guidance was solid.

·

iPad sales came in strong despite no refresh this spring.

·

Company is buying back stock a little faster than I expected.

As

of Sunday, I was basically in between the mean and median price target among Wall Street analysts.

My target still implies about 13% of upside from here. You'll also notice that

I am not one calling for Apple to be a $1,000 stock, or for it to be a $200

stock. I'm giving a fair representation of where I think Apple will go by the

time it reports fiscal Q4 next year. For those that ask, my target including a

China Mobile deal is about $645 right now.

Final thoughts:

It seems that the

Apple bears are getting really desperate. Apple's Q4 earnings report was not

disappointing, as the company raised its guidance during the quarter then beat

it nicely anyway. Apple's guidance for fiscal Q1 was very strong as well. The

Apple bears are doing whatever they can to discredit this name. They will argue

that Apple needs a cheaper phone, but then they complain over margins. The

bears complain that Apple needs a larger buyback, but then criticize Apple's

earnings for being boosted by said buyback. Apple is the most profitable large

capUStech name, yet it is treated the worst. Apple bears are getting really

desperate after another solid quarter, and I believe Apple's stock does go higher

from here.

Additional disclosure: Investors are always reminded that before making any

investment, you should do your own proper due diligence on any name directly or

indirectly mentioned in this article. Investors should also consider seeking

advice from a broker or financial adviser before making any investment

decisions. Any material in this article should be considered general

information, and not relied on as a formal investment recommendation.

|