沃爾瑪和Costco誰更值得投資?

都是零售公司的巨頭,雖然沃爾瑪的銷售規模比Costco大很多,股價就市盈率來判斷也“便宜”很多。但是,就在商業市場的競爭力而言,我還是覺得“好事多”更為強大一些。這也是為什麼,市場給予它的市盈率會比給予沃爾瑪的要高很多。

可惜,我只是最近幾年才開始在好事多購物,並且才有機會理解和觀察它的經營邏輯和效率。很多過去在亞馬遜和本地其它公司購買的事,現在多被好事多奪走。如果自己喜歡這樣做,並且覺得這樣做很有道理的話,我估計,很多人也在做,或者會這樣做。這就是基於本能和直覺對於公司好壞的判斷。

類似的,雖然JCPenny的股價一再創新低,但是,它到底有多大的繼續活下去的可能性,估計也是個巨大的未知數。你只要到它的店去看看,見識一下那個不死不活的樣子,估計你也不難感覺出來。

投資和選擇一個好的投資對象,有時候其實很簡單。同時,簡單的,反倒多數時候比複雜的要有效率。

從短期看,好事多是很貴,但是,從長期看,如果你有機會在回調時進入,你可能會有低風險前提下比較理想的投資回報。

下面的分析非常的具體,也比較到位。

只是,股價的高低,還是和當時的市場大環境關係很大。如果經濟繼續復甦和繁榮,比較高的市盈率就是“正常”。這時候,股市是先行“提高”市盈率,也就是先買進再說,隨後就是懶洋洋的等待利潤成長帶來的調整。

沃爾瑪在美國的成長空間可能已經有限。它期待通過在中國市場的快速成長來保持歷史慣性的可能性,我覺得比較小。中國的市場運行邏輯和美國的差異太大。沃爾瑪想在中國獲得像在美國類似的成功,或者說,想像麥當勞那樣在中國大賺特賺,我覺得可能性不是很大。

麥當勞和肯塔基能夠在中國獲得巨大的成功,而沃爾瑪卻不可以。對此的分析,有機會再單獨聊。

Is Costco A Potential Sell?

Oct 21 2013, 09:32

The

time has come for the retail sector to ready itself for the holiday season.

Many analysts expect that the government shutdown could have negative

consequences on consumer spending and the revenues of the retail sector.

However, a recent survey suggests

that the shutdown will not affect more than two-thirds of U.S. consumer

spending. Therefore, the retail sector can expect slightly brighter holiday

sales which should account for 20 to 40 percent of a retailer's annual sales.

The

predictions and expectations will largely benefit the Costco Wholesale

Corporation (COST). Since the company offers discounted prices to its

customers the store will attract many customers affected by the shutdown.

I will analyze the company's financial

strength based on its historical performance and future outlook.

Company

Profile

Costco is the leading retail wholesaler in

the USA.

Besides the USA, Costco has

warehouses in Puerto Rico, Canada, Australia, Mexico, the United Kingdom, Japan, Taiwan and Korea. More

than 70% of its operations are in the USA.

The company is aggressively expanding its

operations. Since 2008, it has opened 96 new warehouses. In 2012, Costco

purchased 100% interest in its 32 warehouses in Mexico from its joint venture

partner. Previously Costco only held a 50% share. By the end of 2013, the

company is expected to open 14 new warehouses. The expected square footage

growth is 4.5% in comparison to last year's 3% growth.

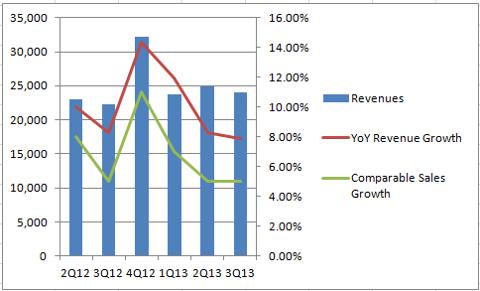

Revenues

Costco's revenues have shown a positive year

over year growth over the last six quarters due to the increased net sales and

higher membership fees. In the last three reported quarters the year over year

growth plunged but still remained positive. The company creates loyal customers

by offering memberships that allow customers access to products at discounted

prices.

Membership fee revenue increased by 12% in

the third quarter of FY2013 and 14% in the first thirty six weeks of FY13

compared to the same periods of the previous year. This was a result of the

raising of annual membership fees, new membership sign-ups, and higher

membership renewal rates at warehouses open for more than one year. The

membership renewal rate of the company increased slightly in the last reported

quarter and reached 89.9% in U.S. and around 86.4% on a worldwide basis.

In addition, the year over year net sales

increased by 8% in both the third quarter and the first thirty six weeks of

FY13 due to an increase in the comparable warehouse sales and sales at 25 new

warehouses opened since the end of the third quarter of FY12. Comparable sales

in the third quarter increased by 5% in FY13 and increased by 6 % in the first

thirty six weeks of FY13 due to a higher frequency of shoppers.

The sales in the third quarter were

negatively impacted primarily due to the change in the Japanese yen and

Canadian dollar as well as the gasoline price deflation. Average sales price

gallon of gasoline declined by 5%.

Source: Company's Financials

The revenues in the fourth quarter of FY12

increased due to an additional week in the quarter. The first three reporting

quarters each consist of three periods while the fourth quarter consists of

four periods. The increase in 2Q13 compared to the first and third quarters of

FY13 reflects the seasonality effects. The company generates higher revenues

during the winter holiday season.

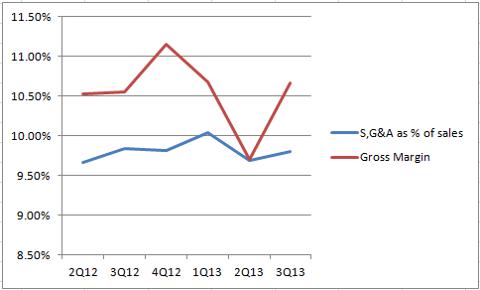

Margins

The company's financial performance depends

heavily on its ability to control costs. Gross margins as well as selling,

general and administrative expenses have a substantial impact on its net income.

Costco's selling, general and administrative

expenses have increased on a QoQ basis. However, the expenses have declined by

3 basis points on a YoY basis. If we exclude the impact of lower gasoline

prices then there is an improvement of 9 basis points on a yearly basis.

The gross margin of the company in the last

reported quarter has improved on both a quarterly basis and yearly basis. Gross

margin, as a percentage of sales, increased 12 basis points compared to the

corresponding quarter of FY12.

The gross margin in the second quarter

declined by 0.98% on a QoQ basis but on a YoY basis it improved by 0.06%. The

gross margin in the second and third quarter was positively impacted by a LIFO

benefit.

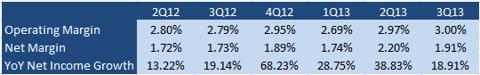

In the third quarter of 2012, Costco's

operating margin was at its best compared to the previous five quarters.

However, its net margin and net income growth have deteriorated due to higher

interest expenses and higher tax expenses. However, the company's three year

net income growth, 16.3, is significantly better than the industry average of

9.5.Its net income increased by 39% on a YoY basis.

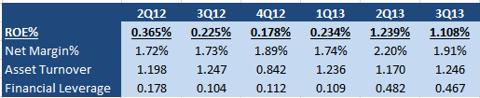

DuPont

Analysis

The company is achieving higher returns on

its equity as a result of its better asset turnover and higher financial

leverage. In December 2012, the company issued $3,492 million in aggregate

principal amount of Senior Notes. In May 2013, the company's Japanese

subsidiary issued $98 million in promissory notes through a private placement

upon which semi-annual interest is payable. On the other hand, the stockholder's

equity, in the last two quarters, has decreased due to lower retained earnings.

The company's asset turnover was highest in

the third quarter of FY13 compared to the first two quarters of the year which

denotes that the company now generates higher revenues for every dollar worth

of assets.

Overall, a DuPont analysis of the company

shows that its return on equity is improving through artificial means since its

financial leverage is increasing and equity is decreasing.

Valuation

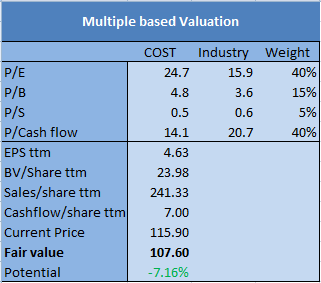

In order to derive the fair value of the

company's stock I have used the multiple based valuation approach. Through this

approach we discover that the stock is highly overvalued on Price-to-earnings

ratio compared to the industry average. It is also overvalued on price-to-book

ratio but slightly undervalued on price-to-sales ratio. It is also quite

undervalued on price-to-cash flows ratio.

As P/E and P/Cash flow ratios are better

indicators of a company's financial health I have assigned higher weightage to

these ratios.

The calculation suggests that the stock is

overvalued with a downside potential of 7.16% showing that the upside potential

is already incorporated into the stock's price. Therefore, the stock will not

give any benefit to the investors in pricing terms.

Dividends

Policy

The company started paying dividends in

2004. Since then it has increasing increased its dividends each year. Its

current quarterly dividend rate is $0.31 per share compared to the $0.275 per

share rate of the end of the third quarter in 2012.This is an increase of

12.7%.

However, Costco's current dividend yield,

1%, is considerably lower than the industry average of 1.9%.

Conclusion

The company has shown mixed performance

results in its last six reported quarters. The upcoming holiday season will

further improve its sales making its income more attractive. However, its

balance sheet is becoming quite unattractive as it has added large amounts of

additional debt and its retained earnings are decreasing which will inevitably

lead to a decrease in the value of shareholder's equity.

The company's stock price is unattractive

since it has a downside potential which creates loss for investors. Therefore,

in my opinion, the stock does not pose a very tempting opportunity for the

investor.

|