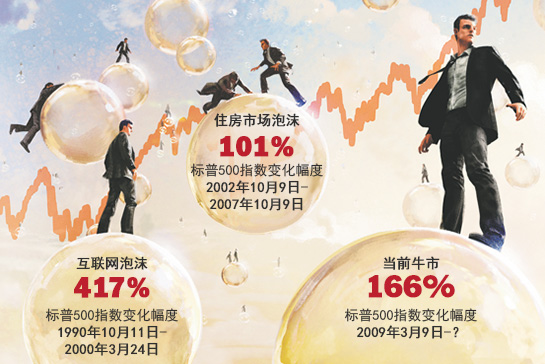

股市进入泡沫还是余威继续强盛

多次成功预测股市和资产泡沫的记录,让席勒今年获得了诺贝尔经济学奖。那么,面对一再创新高的股市,面对一片片涨声之后的股市,投资者开始有点紧张:股市是不是又一次产生了泡沫,是不是又到了该破灭的时候?

应该怎样判断当前的股市行情?是该继续持有,甚至是加仓?还是撤?

股市价格比较高了,是大家的共识。是不是到了泡沫该破灭的时候?比较少的人会给予肯定的答案。经济复苏还处于初期,股市先行也很正常。只是,有些部分还是有比较明显的泡沫,投资者,在这个阶段,以谨慎乐观为妙。

如果你是比较保守的投资者,选择股价对应的市盈率不是很高的蓝筹股,在目前阶段持有是比较好的选择。如果你是比较喜欢冒险的投机者,那些暂时被杀下来的高价股里面,或许也有比较好的投资机会。再者,JCP,TSLA, 甚至是两房股票,似乎也可以小赌一回。

一般来讲,股市不可能直上九重霄。估计,在随后的几个月,回调的机会比较大。如果你喜欢等待,也可以等到回调之后再加股。

不管怎么样,下面两篇文章值得你好好读读。

The next 10 investment bubbles

11/23/13 | Marketwatch

Bloomberg Asset bubbles are funny

things. You're not sure something is in a bubble until it pops. Ever since

investors first bid up the price of tulip bulbs to ridiculous levels back in

the early 1600s, one thing many economists seem to agree on is that pre-popped

bubbles defy formal identification. This past year Princeton economist Paul Krugman said there's no standard definition for them. Last week, Columbia University economist Guillermo Calvo

said at a San Francisco Fed conference that we still don't have a theory about

them. "Irrational Exuberance" author and Yale economist Robert

Shiller, who recently said stock prices are high but not at alarming levels,

called market bubbles a form of "social mental illness." While we may

not have an academic definition of bubbles, investors certainly have fresh

memories of getting burned by the U.S. housing bubble in 2006 and the

dot.com bubble in 1999. With this in mind, MarketWatch looked at 10 assets that

are showing that sort of frothiness that could indicate a bubble in the making.

--Wallace Witkowski

1. U.S. stocks lack a 'wall of worry'

The bull market is almost five years old, and the

Standard & Poor's 500-stock index SPX) is

up around 170% since the March 2009 low, making this once-raging bull now an

aging one. Since the last true correction of at least 10% ended in June 2012,

the S&P 500 has gained almost 40%. Corrections are healthy for markets --

they help to reset investor expectations -- and such a long run without a

reversal is concerning. The stock market might well have had more typical ups

and downs if not for a Federal Reserve intent on boosting stocks and other

assets by suppressing interest rates. Now corporate earnings growth is slowing,

and the Fed is close to scaling back, or "tapering," the bond-buying

program that has kept yields artificially low and put a floor under the market.

Yet many investors are ignoring the caution signs. The market needs a

"Wall of Worry" to climb, but retail buyers have become brave and

confident -- two qualities investors should avoid except at points of extreme

pessimism, which this is surely not.

The only thing we have to fear about the current U.S. market

is the lack of fear. It's time to invoke Bob Farrell's Market Rule No. 5:

"The public buys the most at the top and the least at the bottom,"

the respected former Merrill Lynch market tactician noted. Tellingly, Bank of

America Merrill Lynch's favored multi-asset measure of global investor

sentiment, the "Bull & Bear Index," is nearing a sell signal.

--Jonathan Burton

2. 'Momentum' stocks

A rush of money into equities has propelled a handful of stocks

to dizzying heights, creating a new class of momentum plays such Tesla

Motors Inc.TSLA) and Facebook

Inc. FB) that

some find hard to justify. Tesla and Facebook shares have behaved as if they

were on Red Bull for most of this year, far outpacing the S&P 500, which

rallied 24% year to date as of Friday. Tesla surged 307% while Facebook soared

almost 80%. But not everyone wants to jump on that turbo bandwagon. Famed short

seller Jim Chanos of Kynikos Associates is staying far away from Tesla and

Facebook, calling Tesla a "cult stock" that's risen on speculation

rather than fundamentals. Jamie Albertine, an analyst at Stifel Equity

Research, also believes Tesla's stock rally is overdone. "I would feel

different about the company if it wants to be a niche luxury car manufacturer.

Instead it's trying to become a high volume manufacturer," he said. As for

Facebook, MarketWatch columnist Mark Hulbert says the social networking

company's stock is overvalued by 45%. "Even if Facebook is able to live up

to Wall Street's estimates (a big if, I might add), and assuming the same

[price-to-sales ratio] of 6.44 as in my previous example, Facebook's market cap

in early 2017 would be $110.1 billion. That's nearly 10% below its current

market cap," he recently wrote..

--Sue Chang

3. Bitcoin

Bitcoin prices skyrocketed nearly 76% in November through

Friday, and they're up more than 20 times this year, breaking through records

at a pace that has many market participants bracing for a correction. "If

you look at the history of bitcoin trading, it's a series of bubbles,

corrections and setting of a new floor," said Barry Silbert, founder and

chief investment officer of SecondMarket, which launched a bitcoin trust in

late September. In response to whether bitcoin is in bubble territory, he said:

"Looking at a price chart, it's hard to say that we're not." Several

factors have come together. Demand for bitcoin has surged in China, making the

Chinese bitcoin exchange BTC China the most heavily traded in terms of 30-day

volume. The Chinese yuan now makes up about 50% of trading on exchanges, up

from single digits earlier in 2013, said Greg Schvey, head of research at the

Genesis Block, a bitcoin research firm.

The virtual currency received a credibility boost in October

after federal authorities shut down the online drug market Silk Road, which

exclusively accepted bitcoin. "You saw a lot of high net worth individuals

and institutions start to buy after that," said Jaron Lukasiewicz, chief

executive of Coinsetter. And venture-capital firms have raised the virtual

currency's profile by pouring money into bitcoin companies, including $9

million in Series A funding for Circle, a company that aims to make bitcoin

payments easier. Interest in SecondMarket's Bitcoin Investment Trust could also

be driving prices higher. The trust has about $15 million in assets under

management, hitting its year-end target in just four weeks, Silbert said. At

its launch, the trust had established buying relationships with more than 100

players in the bitcoin space in order to meet demand.

--Saumya Vaishampayan

4. Top Scotch

Talk about a liquid asset. In the past few years, rare

whiskies, especially Scottish single malts, have become a hot collectible

category. Whisky Highland, a Scottish company that tracks auction prices and

compiles an index of the top-selling Scotches, says prices have soared by 170%

since the end of 2008. And with buyers purchasing more than $18 million worth

of bottles at auction in 2012 and with the rarest of whiskies routinely

fetching four and five-figure prices, some collectors say the market has

nowhere to go but up. But others caution we could be seeing the beginning of a

whisky bubble, particularly as more distilleries release limited-edition

bottles and potentially push the supply beyond the demand. Complicating the

issue: A lot of these limited-edition whiskies may not cut it from a

connoisseur's standpoint, says Noah Rothbaum, editor-in-chief of Liquor.com.

"Just because something costs $5,000 doesn't mean it's an amazing

whisky," he says. The chart at left shows the increase since 2008 for the

Investment Grade Scotch 1000 index, on a monthly basis.

--Charles Passy

5. London property prices

It's been some incredible years, not to talk about some

fantastic past months, for the London housing market. In October alone, asking

prices in the capital soared by 10% and with continued upbeat data about the

U.K. economy, some analysts fear we're entering a dangerous boom-bust cycle.

"The key thing in London is that demand exceeds supply and there isn't

enough new supply coming on tap," said Frances Hudson, global thematic

strategist at Standard Life Investments.

But it's not just domestic demand that drives London

real-estate prices. Foreign demand is also heating up as wealthy overseas

buyers look for safe-haven investments. While the demand for London location

doesn't seem to be slowing anytime soon, the developments in interest rates

could cap the impressive growth rates. "One thing to consider is what

happens with interest rates. If the U.S. tapers and the U.K. remains on a

sustainable growth path, you could see rates rise and it would be more

expensive to get a mortgage. That would take some of heat out of the property

market," Hudson said.

--Sara Sjolin

6. China's housing market

In October, new home prices in 100 Chinese cities rose 10.7%

on average, year-on-year, according to data tracker China Real Estate Index

System. That was the highest growth rate since records became available in June

2011. "Fears of a renewed housing bubble are probably driving the central

bank's credit tightening policies, which may help to stabilize China's growth

through into next year, but could also contribute to social unrest," said

Usha Haley, a professor at West Virginia University and author of Subsidies to

Chinese Industry. "Indeed, many Chinese view investing in the U.S. housing

market as a better alternative for their investments, as they also seem to have

lost faith in their murky stock market," said Haley. "U.S. housing is

viewed as cheaper and better quality. This will have an effect on U.S. property

prices, probably artificially boosting them." In the photo, empty

apartment developments stand in the city of Ordos, Inner Mongolia on September

12, 2011.

--Myra Picache

7. Farmland

The price of prime U.S. farmland has been on a tear,

particularly in the corn- and soybean-growing heartland, over at least the last

decade. That's only accelerated over the last four years, fueled by a

combination of soaring commodity prices, low interest rates, and big crops. The

average acre of Iowa farm real estate jumped 20% in 2013 to $8,400, according

to the U.S. Department of Agriculture. Most experts aren't yet ready to call

farmland a bubble, but they see an important test ahead as prices for corn and

soybeans retreat from recent highs and interest rates begin to creep higher. If

farmland prices continue to soar in the face of such headwinds, it could mark a

fundamentally unsupported mania for productive dirt. And it could be capable of

presenting a danger to lenders and the overall economy should it burst.

Fortunately, experts say there are some preliminary signs that prices are

cooling, though it's too early to draw any major conclusions.

--William Watts

8. Cattle and beef futures

Prices for cattle futures have climbed around 9% in the last

six months, as tight supplies contributed to record retail beef prices.

"Drought and high feed costs have led to a liquidation in the cattle herd

during the last few years," and the cattle herd this year fell to its

lowest level since 1952, said David Maloni, president of the American

Restaurant Association Inc. Live cattle-futures prices hit a high around $1.34

a pound in late October, the highest based on records going back to Nov. 1984,

according to FactSet data. "Consumers are still buying beef and we have

not seen a real drop off in demand due to pricing," but prices "will

reach an inflection point" and consumers may push back from the table and

choose alternative meats like chicken and pork, said Kevin Kerr, president and

CEO of Kerr Trading International. Maloni said lower feed costs and better

pasture conditions this year are encouraging ranchers to start to build their herds.

"Eventually, this will lead to better cattle and beef supplies,"

though maybe not until the back half of 2015 at the earliest, he said.

--Myra Picache

9. Student loan debt

Americans are now carrying more than triple the federal

student debt that they had 10 years ago – and the total amount owed to the

government topped $1 trillion for the first time in the quarter that ended in

June, according to the Department of Education's National Student Loan Data

System. They're also increasingly likely to default on that debt. The Education

Department says 10% of those who began paying back loans in October 2010 were

in default by Sept. 30, 2012. With one exception, the rate has been rising

nonstop for almost nine years. Yet investors in the billions of dollars of

student loans that are securitized each year (called SLABs) don't seem to be

taking much notice. The risk premium that investors are demanding for the

triple-A-rated seven-year version has collapsed by more than a third in the

past two years and earlier this year hit the lowest level since 2007, according

to an index calculated by Barclays. For its part, the U.S. government is

increasingly docking Social Security payments from retirees who have fallen

behind on student-loan payments--as if millennials won't have enough problems

being able to retire. Even Ivy League grads aren't immune to the growing

default trend.

--AnnaMaria Andriotis and Silvia Ascarelli

10. Tech start-ups, IPOs

Twitter Inc.'s (TWTR) initial

public offering highlighted the strong and growing interest in Internet and

social media IPOs. There's been speculation that other startups, such as Square

Inc., the mobile payments firm, and Snapchat, the popular messaging service,

and social media site Pinterest are also about to take the plunge, and their

reported valuations have raised eyebrows. Also, last week, data storage company

Box was reported to be picking bankers for its IPO. But while investor worries

about social media have eased in the wake of Facebook's strong performance,

especially in mobile, it is still an evolving industry that analysts and

investors are still struggling to figure out. "It is important to note

that because Twitter is so early in its growth, valuation is extremely

difficult," Wedbush analyst Michael Pachter told clients in a note on

Twitter. He could very well have been talking about other web startups.

--Ben Pimentel

The other side of the bubble story is that there can be

plenty of money to be made in the months or years before a bubble bursts. In

the famed 1990s bull-market run, U.S. stocks rallied about 70%

between 1994 and 1996--and then went on to double before topping out in 2000.

For all the warning signs near-vertical ascents give off, plenty of strategists

can point to reasons why these rallies are likely to have a bit more life. The

prevalence of bubbles, and the stakes at catching them before they burst, has

made a cottage industry of bubble watching among financial media, academics,

and regulators, and even helped earn Robert Shiller a Nobel Prize. But for all

the number crunching, they are inextricably tied to swings in popular

sentiment, which makes them tricky to time. Here's what George Soros had to say

about them last year: "Financial bubbles are not a purely psychological

phenomenon. They have two components: a trend that prevails in reality and a

misinterpretation of that trend. " And he added: "I treat bubbles as

largely unpredictable."

--Laura Mandaro

应为美国股市大幅走高做好准备

2013-11-28

华尔街日报

一些热门股票今年以来价格上涨了逾一倍。首次公开募股(简称IPO)市场如火如荼。散户投资者正重新入市购买股票。

这种“泡沫论”在社交媒体公司Twitter

11月7日上市交易后进一步升温。当天该公司股价飙升73%。

Twitter股价目前的升幅仍达69%。

电动汽车公司Tesla

Motors 2013年股价飞涨300%,网上零售巨头亚马逊(Amazon.com)股价攀升了47%。股市上表现出众的股票那么多,以至于人们很容易就淡忘了标准普尔500指数今年已经36次创下纪录新高,有望实现26%的年增幅——他们还忘记了就在一个月之前,经济还受到联邦债务上限危机的威胁。

11月14日,美国参议院就珍妮特·耶伦(Janet Yellen)被提名接替本·贝南克(Ben Bernanke)担任美国联邦储备委员会(Federal Reserve, 简称美联储)主席举行确认听证会。内布拉斯加州共和党参议员迈克·约翰斯(Mike Johanns)表示,他认为美联储宽松的货币政策正在拉动股市和房地产市场走高。

他说:“我漏说了什么?我认为存在资产泡沫。”

耶伦回答说:“我们必须对此进行非常仔细的观察,但我并不将其视为资产泡沫。”

其他人也同意耶伦的观点。嘉信理财(Charles Schwab)首席投资策略师利兹·安·松德斯(Liz Ann Sonders)表示:“坦率地说,这么多人问起关于泡沫的问题,让我感觉很困惑。也许是因为近年来我们已经遇到两次来势汹汹的泡沫,现在我们更加认同泡沫论了。”嘉信理财管理着2万亿美元的客户资产。

如果观察更仔细些,我们会看到投资者这一次表现出的是有选择性的乐观。

洛杉矶57岁的电影制片人戴维·T·弗兰德利(David T. Friendly)试图以IPO价格购买Twitter股票,但找不到能让他买成股票的经纪人。在Twitter首日大涨之后,他说他会等到股票回落时再买。

他说,他对股市整体仍然保持警惕。他说:“太让人紧张了。股市的起伏太大了。”

弗兰德利说,在金融危机之前,他把投资组合的30%至40%配置在股票中。如今他仅将20%的资产投入股市。

他说:“夜里我比以前睡得好多了。”

对泡沫论表示怀疑的还有耶鲁大学经济学家罗伯特·席勒(Robert Shiller)。席勒10月份获得诺贝尔经济学奖,他曾多次成功地发现资产价格的过度投机。

他在互联网热潮达到顶峰时出版的《非理性繁荣》(Irrational Exuberance)一书中,准确地预测到股市的崩溃。2005年,他在该书的修订版中正确地指出,住房市场出现了投机性繁荣。

席勒是这样形容今天的股市的:“市场价格是有一点高,但没有到我要写《非理性繁荣》的时候。”

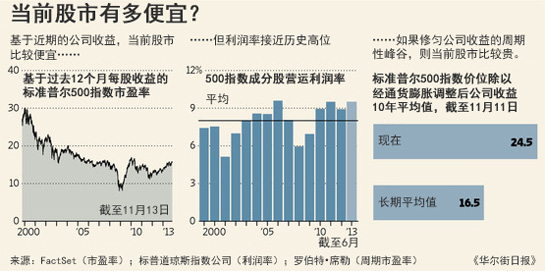

他比较喜欢使用的股票估值标准显示,股市仅仅是偏贵而已,而不是出现了泡沫。

投资者常常将股价除以公司既往或预期每股收益,以衡量股票价值。为修匀这些收益数据的周期性峰谷,席勒用标准普尔500指数除以该指数成分股过去10年每股收益的平均值,两者均经过了通货膨胀调整。

用这种方式来衡量,标准普尔500指数的市盈率约为24.5倍,比1881年以来美国股市16.5倍的平均市盈率高48%左右。

这个数字乍听起来可能很高。但在住房市场泡沫破裂之前,美国股市市盈率曾接近28倍——而在互联网泡沫最高潮时,市盈率曾达到44倍。

席勒表示,虽然股市并没有出现泡沫,但估值还是很高的。包括席勒在内的许多分析师和经济学家认为,小投资者如果能在市场上找到价格水分不那么大的领域,则有望取得不错的投资回报。

说了这么多,下面我们将指导投资者寻找股市中残余的“便宜”领域,我们还将告诉投资者应该警惕些什么。

股市依然昂贵

尽管股市看起来比较贵,但我们有许多理由相信本轮牛市会持续下去。最关键的是:现在投资者不应该仅仅因为他们认为股市即将出现回落就逃离股市,而是应该为市场可能大幅走高而做好准备。

原因之一,散户投资者才刚刚回归市场。

研究公司晨星(Morningstar)的数据显示,从今年年初到10月份,投资者已向美国股票共同基金和交易所交易基金(简称ETF)投入了1,110亿美元,但尚未达到2009年以来撤出股市的资金规模(共计1,340亿美元)。

晨星的数据显示,在2000年科技行业泡沫达到顶点之前的四年里,投资者共向美国股票基金投入4,710亿美元。

尽管席勒市盈率看起来比较高,但其他衡量股市的指标远没有那么高。比方说,FactSet数据显示,基于过去12个月每股收益的标准普尔500指数市盈率为15.8倍,而1999年以来的平均市盈率为16.9倍。

S&P

Capital IQ首席股票策略师萨姆·斯托瓦尔(Sam

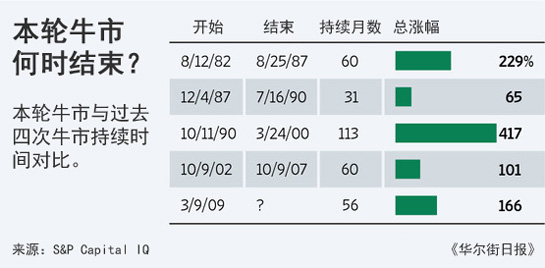

Stovall)称,本轮涨势给人的感觉似乎是已经持续了很久很久,但其实并没有任何超出普通牛市特征的地方。(牛市的定义是,以收盘价计算的股市涨幅达到20%,且接下来未出现20%的回落)

始于2009年3月9日的涨势到目前为止已经持续了56个月,涨幅达到166%。在1921年以来的其他16轮牛市中,有六轮牛市持续的时间比本轮牛市长,有五轮牛市的涨幅比本轮牛市大。

斯托瓦尔担心市场可能即将迎来回调(定义是回落幅度达10%-20%),但他指出,标普500指数尚未进入需要拉响警钟的区间。

此外,尽管利率已经上升,但债券价格仍然接近历史高位,因此不是现金持有者合适的投资对象。债券价格与利率走势相反。

康涅狄格州格林威治(Greenwich)的投资公司AQR Capital Management的主要创始人及执行负责人克利夫·阿内斯(Cliff Asness)称,他的公司今年年初对股市持适度看涨预期,但现在是“彻底的中性预期”。该公司管理着约900亿美元资产。

阿内斯认为,经通货膨胀调整后,一个持股比例60%、持债券比例为40%的典型投资组合未来10年里年涨幅可能在2.5%左右,而历史回报率是该涨幅的两倍左右。

席勒为《华尔街日报》进行的一项对长期数据的分析发现,当市场经周期性因素调整后的市盈率达到24.5倍时,其后10年里扣除通货膨胀因素的年回报率往往在2.5%左右。

由于股票和债券的预期回报率比较低,为退休做准备的投资者将不得不存更多的钱来弥补缺口。比方说,在年回报率为5%时,投资者一个月可以存2,500美元,20年后就会有100万美元的投资组合。

如果回报率为2.5%,则同一名投资者一个月要存3,250美元左右才能达到100万美元的目标。

波士顿投资管理公司GMO的资产配置业务联席主管本·因克(Ben Inker)称,如果标准普尔500指数再上涨15%或更多,投资者就应该准备削减他们的美国股票资产配置了。该公司管理着约1,100亿美元资产。

席勒的研究显示,如果股价比今天的水平再高15%,而公司收益保持不变,则预计未来10年经通货膨胀调整后的年回报率会低于1%。这就几乎与通货膨胀保值债券的回报率相当了,而后者的风险要小得多。

因克说:“我们没有任何具体的理由去相信股市本周、本月或者到明年会走低。我们只是认为美国股市目前的风险回报比很糟糕。”

其他选择方案

存更多的钱是更快增加养老金的唯一有保障的方式,但也有其他方式能够提高投资者获得更高回报的几率。

首先,尽管美国股票整体偏贵,但美国也有一些类股(以及除美国之外的所有其他地区的股票)比较便宜。

以欧洲为例。洛杉矶管理2.6亿美元资产的投资管理公司Cambria Investment Management的首席投资长梅布·费伯(Meb Faber)表示,市场对通货紧缩的恐惧以及围绕希腊和其他南欧国家财政问题的持续担忧对股票构成了打击,使这些国家的股市处于很长一段时间以来最便宜的水平。

费伯发现,如果将席勒的市盈率计算方法运用于其他国家,则希腊截至10月31日的市盈率仅为4倍。爱尔兰、意大利、葡萄牙和西班牙(它们均为面临债务问题的欧元区国家)的市盈率均为10倍或以下。

就连德国(远未像其他国家那样面临严重的经济问题)的席勒市盈率也仅为15.6倍。

中国大陆、台湾和墨西哥等新兴市场国家的席勒市盈率也低于美国。

费伯说:“世界上多数国家的股市都相当便宜。例外的是美国。”

当然,投资者不应该把鸡蛋都放在一只篮子里,对估值最便宜的国家孤注一掷。最好的选择或许是投资海外的整体市场指数基金。针对发达市场的选择方案包括安硕摩根士丹利资本国际欧澳远东ETF基金(iShares MSCI EAFE ETF)(该基金年费率为0.34%,相当于每投资10,000美元交纳34美元管理费)或先锋富时发达市场ETF基金(Vanguard FTSE Developed Markets ETF)(费率为0.1%)。

针对新兴市场的先锋富时新兴市场ETF基金(Vanguard FTSE Emerging Markets ETF)和安硕核心摩根士丹利资本国际新兴市场ETF基金(iShares Core MSCI Emerging Markets ETF)的费率均为0.18%。

席勒指出,美国的一些类股也比较便宜。席勒发现,根据他的市盈率计算方式,最便宜的类股是能源、消费必需品、医疗和工业股。

道富银行(State

Street)提供以特定行业为目标的ETF基金,如能源行业优选SPDR (Energy Select Sector SPDR)或医疗行业优选SPDR (Health Care Select Sector SPDR),这两只基金的年费率均为0.18%。

AQR的阿内斯还建议投资者尝试用其他方式提高投资业绩,比如投资所谓的价值股(股价相对于公司收益或 资产而言比较低),采用套利或顺势交易等策略。

AQR等一些公司运营使用这类策略的基金。投资者还可以通过先锋价值ETF基金(Vanguard Value ETF)(费率为0.1%)等ETF,以低廉的成本将投资向价值股倾斜。

与此同时,投资者还应该远离过去一年出现的热门“泡沫股”,这是北卡罗莱纳州查珀尔希尔(Chapel Hill)的投资顾问公司Morgan Creek Capital Management首席投资长马克·尤斯科(Mark Yusko)的建议。该公司管理着68亿美元资产。尤斯科指出,亚马逊目前基于过去12个月每股收益的市盈率超过1,000倍。

尤斯科说:“我认为不可能有任何一家公司在我支付1,000倍市盈率的情况下仍能在未来10年里有出色走势。这家公司在10周甚至10个月里可能表现不错,但作为投资者,你首先应该为资产保值,其次才是追求增值。”( Joe Light)(本文来自《万维网》,放在这里为了方便阅读和保存)

|