俺球队大张的太太在新州开业行医,前些日子被两家狼狈为奸的美国公司欺诈。大张怒发冲冠,义粪填鹰!欲借爪哥之笔来控诉一下万恶的美帝旧社会。嘿嘿,没说的,爪四哥为兄弟两肋叉烧,噢不不,是两肋插刀...现在就让这两家骗子公司现现形!提醒自己开业的老中们,千万要小心,别被美国骗子骗进去。

张太诊所从开业第一天起,一直接收信用卡付款。信用卡服务则全权交由 TD bank merchant service 负责。去年六月初,合同再次到期。看到TD的信用卡服务费用不断上涨,张太有心离开TD,换一家收费低的公司。

这件事somehow让张太的一个病人知道。他自告奋勇说自己就是一家信用卡服务公司 Ironwood Payments 的推销员。如果张太鉴约 Ironwood Payments ,费用会比TD低得多。

张太对这个病人不是很感冒。因为他看病总不守时,付钱也总是拖延,所以没打算鉴约他代理的 Ironwood Payments 。但架不住这位病人三番五次来诊所推销他的优惠计划,最后居然还把他的manager带来诊所,誓事旦旦地证明他的优惠价全都是靠谱的。但是,若想要从 Ironwood Payments 拿到优惠价,张太不能再使用诊所原有的刷卡机,必须要从 Ironwood Payments 的合伙人 “Northern Leasing Systems" 租用刷卡机,每月租金是$85。他们一再强调既使加上租金,每月的总费用也会比TD便宜很多!张太最终被他们的“诚心”打动,于是不再与TD续约,与 Ironwood Payments 以及 Northern Leasing Systems 鉴定了信用卡服务合同。

嘿嘿,本来以为捡了个便宜,结果改换门庭后第一个月账单(钱已自动从张太账户拿走)来后一看,乖乖隆地咚。比原来在TD时贵了几乎三倍!义粪填鹰,义粪填鹰呀!

于是张太先打电话找那个病人,这家伙从此不接电话,从此也不来张太诊断看病,泥牛入海,杳无音信。找不到病人,就给 Ironwood Payments 打电话找他们经理。那个接线员总推说经理忙,敷衍了事。后来气得张太没办法,让前台一直打一直打直到把经理打出来接电话。花了无数精力,千呼万唤屎出来!噢不不,是经理出来。这个经理一开始铁嘴钢牙不承认给张太优惠价,等张太把鉴的合同上的优惠价拿给她看时,她说下月会给做调整。

结果等到下月账单来后一看,乖乖隆地咚!与上月没区别,还是那么高。义粪填鹰,义粪填鹰呀!

于是又给这个经理打电话,又是泥牛入海,又是费尽九牛二虎之力才找到她。她推说前段时间特别忙,发誓说从下月起会做调整。

结果等到下月账单来后一看,乖乖隆地咚!与上月没区别,还是那么高。义粪填鹰,义粪填鹰呀!

于是又给这个经理打电话,又是泥牛入海,又是费尽九牛二虎之力才找到她。她发誓说下月一定做调整,退还多收的钱。

结果等到下月账单来后一看,乖乖隆地咚!收费还是那么高。但这个经理总算给了一点点退款,但连违约多收走的钱的1/5都不到!义粪填鹰,义粪填鹰呀!

Enough is enough,这次张太也不打电话找经理了,直接给她发封信退出合约,不再与骗子打交道!与此同时,张太把从 Northern Leasing Systems 租来的刷卡机也寄了回去,就当是花钱买个教训,从此与骗子们一刀两断。

嘿嘿,意想不到的是,骗子还来了劲儿了。Northern Leasing Systems 收到张太退还的刷卡机后,就一直不断打电话,寄信来骚扰。口口声声说张太鉴了合同,想要退出,必须要交$3600罚款!如果不交,会有严重后果blablala……

不怕骗子骗,就怕骗子得便宜卖乖瞎扯蛋。

张太一气之下,把两家骗子公司一起告到 Federal Trade Commission 与纽约总检察官治下 Consumer Frauds Bureau 那里去了!让骗子们尝尝骗人的恶果,嘿嘿!

最后呢,俺把骗子公司欺诈的套路归纳总结如下:提醒自己开业的老中们,千万要小心,别被美国骗子骗进去:

1. 骗子甲用优惠价引诱客户加盟;

2. 骗子甲声称若想拿到优惠价,必须也要与骗子乙鉴约;

3. 鉴约后顾客发现被骗子甲欺骗,不退则已,若想退出,骗子乙则出面声称顾客违约,必须交纳一大笔罚款方能退出。

4. 骗子甲与骗子乙坐地分赃后,继续合伙去欺骗下一个顾客。

请大家都记住这两个骗子公司:

Northern Leasing Systems,Inc.

419 East Main Street,Suite 102,Middletown,NY 10940

Ironwood Payments

2150 South 1300 East,Suite 500,

Salt Lake City, Utah 84106

备注-1. 被义粪填的鹰的抗议:

没招谁没惹谁,莫名其妙就被粪填了九次,神马世道呀!NND,我也要去 Federal Trade Commission 与 Consumer Frauds Bureau 投诉去!

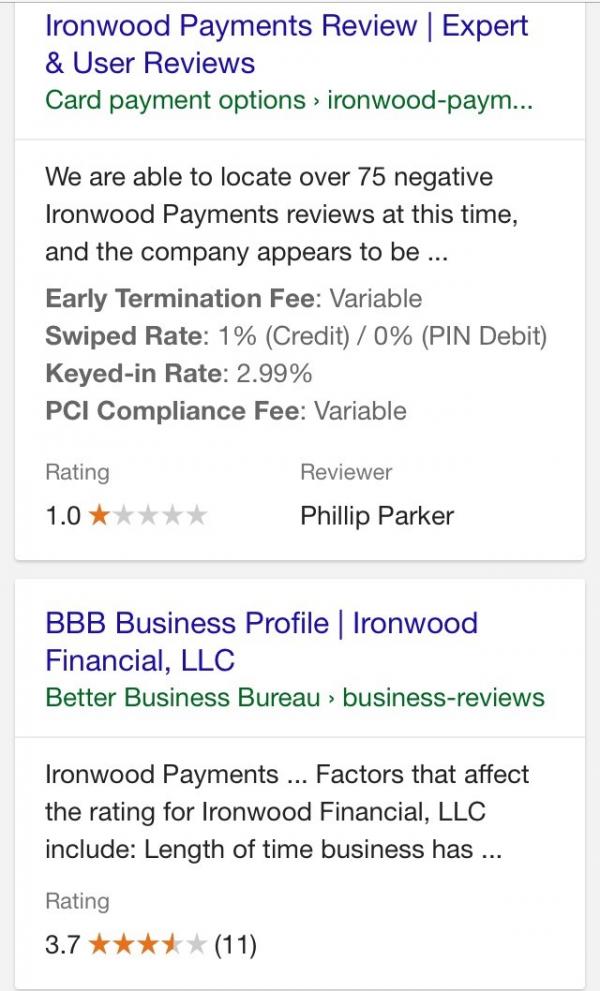

备注-2. 看看Ironwood Payments 是个啥货色!

备注-3. 原来 Northern Leasing Systems 这个骗子公司前科累累呀!

A.G. Schneiderman Sues Northern Leasing Systems, Inc. For Deceptive Business Practices And Abuse Of Judicial Process

Attorney General Schneiderman Sues Northern Leasing Allegedly For Trapping Small Business Owners Through Deceptive Practices In Unconscionable Lease Agreements And Suing Them For Failure To Pay

The Lawsuit Seeks To Vacate Judgments Obtained By Northern Leasing, Provide Additional Relief For Consumers, And Dissolve The Company

Schneiderman: We Will Not Allow Companies To Hold Small Businesses For Ransom By Using Lies And Forgery

NEW YORK – Attorney General Eric T. Schneiderman today announced the filing of a lawsuit against Northern Leasing Systems, Inc., a New York company, and several of its affiliated companies, including Lease Finance Group LLC, MBF Leasing LLC, Pushpin Holdings LLC and others (collectively, “Northern Leasing”), as well as principal, Jay Cohen a/k/a Ari Jay Cohen, law firm Joseph I. Sussman, P.C., and other individuals involved in Northern Leasing’s operations, for their fraudulent and deceptive practices that trap small business owners across the country. The lawsuit alleges that Northern Leasing trapped small businesses into never-ending lease agreements for over-priced credit card processing equipment and abused the judicial process by suing to collect on these leases in the Civil Court of the City of New York, regardless of whether the debt is fraudulent, the claim is timely or legitimate efforts to terminate the lease were ignored. The Attorney General on behalf of the People of the State of New York, and Deputy Chief Administrative Judge Fern A. Fisher are joint petitioners in this proceeding.

The Attorney General’s office secured a temporary restraining order restraining Northern Leasing from selling, assigning or transferring any equipment finance lease for less than fair market value. Northern Leasing and principal Jay Cohen are also restrained from transferring, converting or otherwise disposing of any asset owned, possessed or controlled by them for less than fair market value. Northern Leasing and Cohen also must provide a list of all assets to the Attorney General within five days of service of the order.

“Small business owners – many of whom are immigrants, elderly, or veterans – are the cornerstone of the economy and deserve to be treated honestly and fairly,” Attorney General Schneiderman said. “We allege that Northern Leasing not only deceived consumers, but used the New York court system to perpetrate their harassing, fraudulent, and deceptive debt collection practices. We will not allow companies to hold small businesses for ransom by using lies and forgery.”

The lawsuit seeks to vacate default judgments obtained by Northern Leasing against consumers, many of whom were not even aware that they had been sued by Northern Leasing until they learned of the default judgment when they checked their credit reports. The lawsuit also seeks additional relief, including but not limited to a permanent injunction prohibiting Northern Leasing, its related entities, and its owners and officers from continuing their deceptive business practices, ordering Northern Leasing to pay restitution to consumers, dissolving Northern Leasing Systems, Inc. and directing Northern Leasing to notify all three national credit reporting agencies that the default judgments have been vacated and should be removed from consumers’ credit reports. Attorney General Schneiderman previously reached a multimillion agreement with Northern Leasing in 2013 for similar deceptive practices for siphoning over $3.6 million in unauthorized fees from the bank accounts of nearly 110,000 former customers without warning and up to eleven years after their leases had expired.

The Attorney General conducted its investigation with the assistance of the Deputy Chief Administrative Judge for New York City Courts and Administrative Authority of the Civil Court of the City of New York, Fern A. Fisher.

The Attorney General’s investigation found that Northern Leasing has targeted small business owners across the country through its deceptive practices, which include inducing individuals to sign lease agreements without realizing they are doing so, falsely representing that the lease is “free” or that the individuals will save money, and falsely stating that the consumer can cancel the lease at any time. In hundreds of instances, it is charged that consumers discovered that the signatures on the leases are not theirs or that material terms were added to the lease without their knowledge.

Northern Leasing’s lease terms are onerous and totally one-sided in favor of the company. The credit card equipment leased to consumers by Northern Leasing is valued at only a few hundred dollars (at most) when new, yet over the course of a Northern Leasing lease consumers pay thousands of dollars for the equipment. Further, the lease agreements are printed in miniscule typeface, require any lawsuit under the lease to be brought in New York, regardless of where the consumer lives, and requires the consumer to pay for Northern Leasing’s attorney fees in the event the lawsuit is found meritless (but not the other way around).

It is charged that once a consumer is trapped in a Northern Leasing lease agreement, Northern Leasing refuses to cancel the lease under any circumstances -- even if the equipment never worked or if the consumer’s signature was forged. Also, based on tiny print in the contracts – which many consumers were never given an opportunity to read – Northern Leasing continues to deduct lease payments from consumers’ bank accounts for months or years after the lease’s initial term.

Northern Leasing also includes a personal guaranty in all of its lease agreements, which traps the individual business owner (or whoever else may have signed the lease) into assuming personal responsibility for making payments under the lease agreement.

When a consumer stops making payments on his or her lease, Northern Leasing, through its own employees and the law firm of Joseph I. Sussman P.C., then bombards the consumer with harassing phone calls and letters threatening to sue the consumer in New York. The law firm of Joseph I. Sussman P.C. then commences collection actions in New York Civil Court, knowing that many of the debts are not collectable, and that the cost of travelling to New York and hiring a lawyer to defend such a lawsuit would be prohibitive for many consumers, many of whom live as far away as Texas and California. Northern Leasing and its related entities filed more than 30,000 collection actions between 2010 and 2015 in NYC Civil Court. The company has also obtained more than 19,000 default judgments against individual consumers since 2010 in NYC Civil Court, often because the consumer either was not aware of the lawsuit or could not appear in court to defend him or herself because he or she did not live in the New York area.

Also named in the lawsuit are attorneys Joseph I. Sussman and Eliyahu R. Babad, who are the attorneys of record on the actions filed in New York City Civil Court, and who sign the complaints and other legal documents in those actions. The suit further names Neil Hertzman, who is the Vice-President of Customer Services and Collections for Northern Leasing and Principal Jay Cohen.

Consumers who believe they have been a victim of Northern Leasing’s deceptive practices are urged to file complaints online or call 1-800-771-7755.

For more information about the Attorney General’s lawsuit, please visit http://ag.ny.gov/NLFAQ.

This investigation and proceeding is being handled by Assistant Attorney General Lydia Keaney Reynolds, Volunteer Assistant Attorney General Ross Bratin, Special Counsel Mary Alestra, Deputy Bureau Chief Laura J. Levine and Bureau Chief Jane M. Azia, all of the Consumer Frauds and Protection Bureau, and Chief Deputy Attorney General Janet Sabel. |